Since the beginning of this week's trading, the price of gold has been trying hard to keep moving around and above the $ 1500 psychological resistance to confirm the adherence to the uptrend and prepare for stronger gains today. This is most the important day this week, as the US dollar will be strongly influenced by the announcement of the Federal Reserve monetary policy decisions and an the important press conference of Jerome Powell. If, as expected, the bank cut US interest rates by a quarter-point, issued a pessimistic monetary policy statement and a shift in Jerome Powell's view of US economic performance, gold might have a stronger chance of making stronger gains again, taking advantage of the weaker US dollar. In contrast, if the bank remains confident about the US economic performance and gives up what is expected, gold may be affected negatively and retreat.

Tomorrow, the markets will be on another important date as the Bank of England, the Bank of Japan and the Swiss National Bank, will announce their monetary policy, any sudden shift could trigger strong price volatility, hence, the increase interest in buying gold. The recent bearish momentum of the gold price was supported by a cooling of the trade war between the world's two largest economies and weakening fears of a British exit from the EU without agreement.

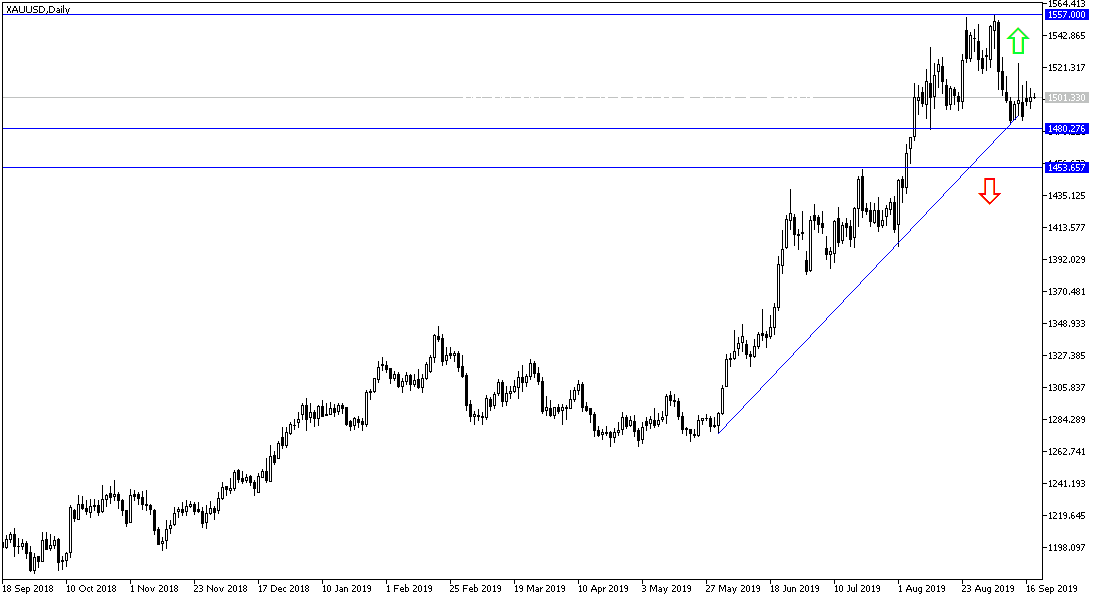

According to the technical analysis of gold: Stability of gold prices around and the above the $1500 psychological resistance is still a strong support for the uptrend, as shown on the daily chart, and will increase the strength of the upward momentum if the price moves towards the resistance areas at 1512, 1527 and 1540 respectively. The resurgence of the US dollar may push the gold price down towards the 1490, 1475 and 1460 support levels respectively. We still prefer to buy gold from every bearish level as global trade and geopolitical tensions remain, and gold is one of the most important safe havens for investors in times of uncertainty.

On the economic data front today: The economic calendar today contains the announcement of inflation figures from Britain and the Eurozone. From the US, we will have the US building permits and oil inventories data, the Fed's monetary policy decisions and then important remarks by Governor Jerome Powell. And don't forget Trump's comments after the bank's announcement.