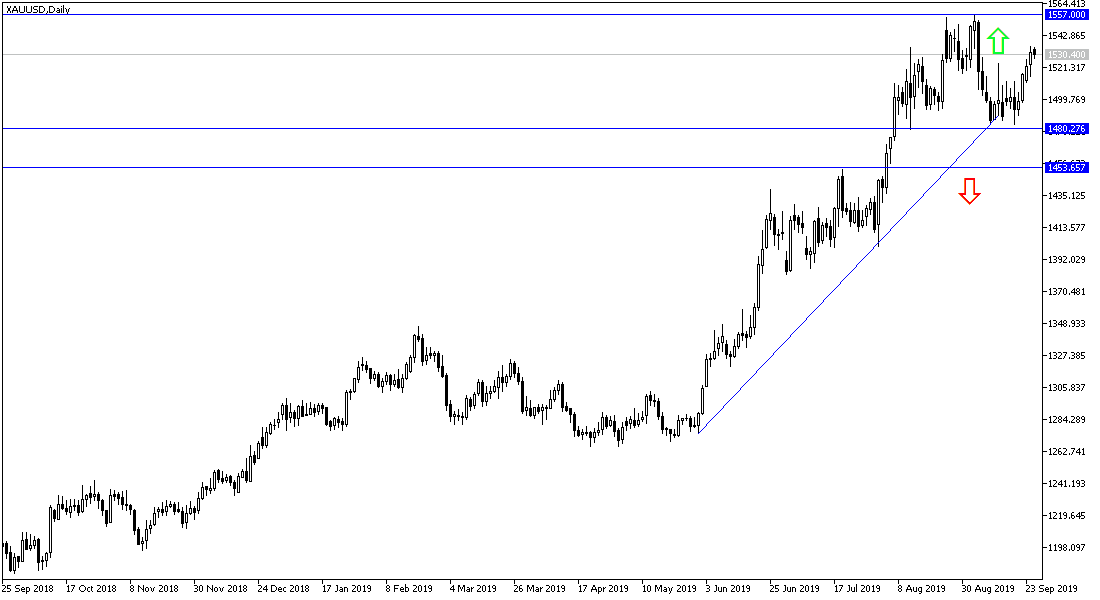

Concern over the failure of the current round of trade talks between the United States and China and the future of the Brexit, which remains uncertain. This is along with the tensions in the Middle East and the slowing global economic growth, and the beginning of slowing in the Eurozone, prompted investors to return to buying gold again, pushing the price to test the $ 1527 level, its highest level in two weeks. During last week's trading, the price of gold fell to the $1483 support per ounce. We then went back to buy with a target up to $ 1535 resistance. After the recent bounce, investors are wondering when to go back to sell gold?

The resurgence of the yellow metal could increase as investor sentiment improves, confidence in the global trade war, and Brexit solutions are found to avoid getting out without a deal. Investors may start thinking about profit-taking when the price moves towards 1533 and 1542, respectively. A low volume deal can be made from the level of 1526. The performance of the US dollar should be taken into consideration. The dollar's strength is a loss for gold and vice versa.

The easing of monetary policy by global central banks underlines the risks facing the global economy and thus motivates investors to buy gold. This week, we will be a date with several important remarks by monetary policy makers from the Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan, as investors try to find strong indications on the future of their policies.

According to the technical analysis of gold: Stability around and on top of the $1500 psychological resistance will continue motivating investors to buy gold. The closest resistance levels for gold are currently at 1532, 1540 and 1555 respectively. As for the downtrend, there will be no reversal of the bullish performance without moving below the $1,500 resistance level. Overall, the current global situation continues to support the buying strategy from every bearish level.

On the economic data front today: The economic calendar today includes the announcement of the German IFO business climate index and mortgage approvals from Britain. From the US, there is the consumer confidence and the Richmond Industrial Index data.