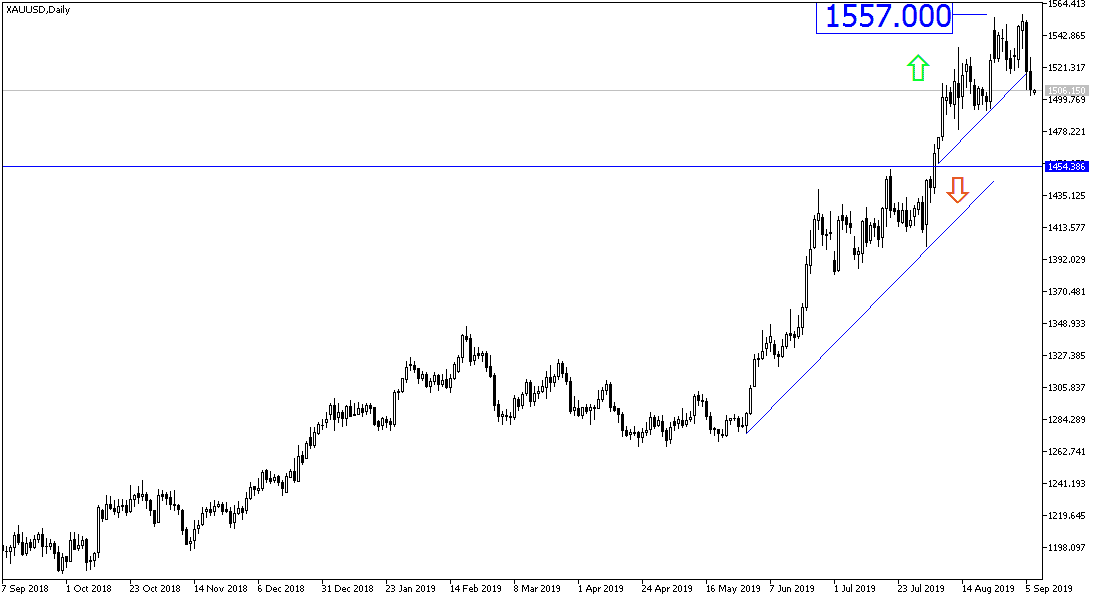

The gold price today and now is one of the most searched words and monitored items by investors over the past two weeks, with the price of gold reaching the $ 1557 level, the highest in six years. What stunned gold watchers was the collapse in the last two trading sessions of last week, as the price collapsed from $ 1557 resistance to $ 1502, as risk appetite increased, supported by positive comments on the US economy from Federal Reserve Chairman Jerome Powell. Speaking at a forum in Zurich, Switzerland, Powell said the central bank has helped keep the US economy firmly on solid ground amid the uncertainty caused by Trump's trade war with China.

Powell said that despite the uncertainty caused by the trade war, the US central bank currently does not expect a recession, noting that the labor market and consumer spending are still strong. The outlook is likely to remain moderate economic growth, the labor market remains strong and inflation continues to rise. ” He also reiterated that the Fed will "act as necessary" to maintain US economic growth.

Prior to his remarks, we saw mixed results in the US jobs report as the number of new jobs in the non-farm sector fell less than expected, and from the previous result, but we witnessed an increase in the average hourly wages and steady unemployment rate in the country.

According to the technical analysis of gold: Stability above the $1500 psychological level will continue to support the upward trend of gold. If gold prices move to the 1493, 1485 and 1472 support levels, there will be a real break of the general uptrend, and at the same time, these will be levels with at which investors are thinking to return to buy gold from, where the factors of its gains are still the list of global trade and geopolitical tensions, which have not been resolved. Gold's return to the 1515, 1525 and 1537 resistance levels will support the continuation of the bullish trend.

There is no significant US economic data expected today, and the gold price will be influenced by the released US jobs figures and remarks by US Federal Reserve Governor Jerome Powell, as well as any new developments regarding world trade war and Brexit.