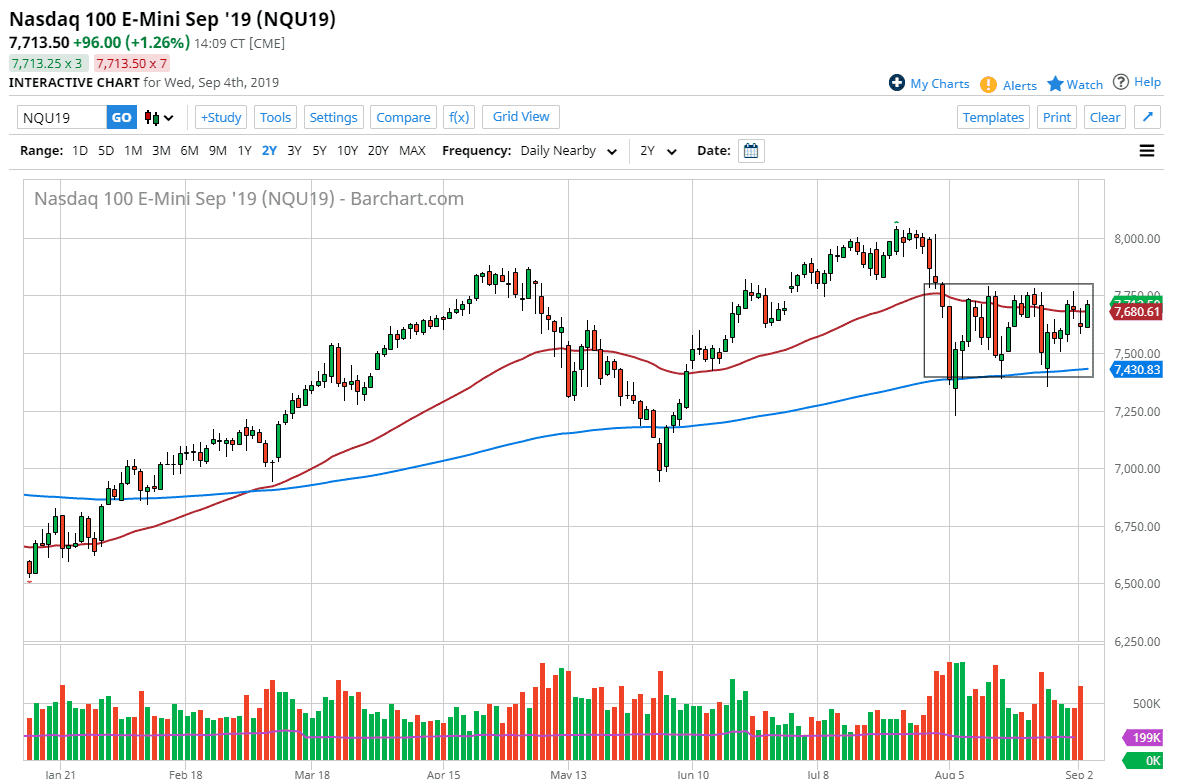

The NASDAQ 100 rallied during the trading session on Wednesday to fill the gap that was formed at the open on Tuesday. With that being the case we are getting close to the top of the range again, and I think it’s going to be a lot to ask out of the market to have it break out of this consolidation ahead of the jobs figure. With that, I fully anticipate seeing this market pull back a bit, waiting for that vital announcement to tell us where we are going next.

If we can break above the 7800 level, then the NASDAQ 100 is free to go to the 8000 level. On the other hand, if we were to roll over and break down through the 7400 level, then the NASDAQ 100 is likely to go to the 7250 level, followed by the 7000 level. Currently, it does look as if the buyers have the upper hand but let’s not forget that Twitter could change everything. With that being the case, it’ll be interesting to see how this market behaves but right now it’s simply killing time between now and the jobs figure to decide which way to go for a bigger move.

Keep in mind that the largest traders have been away on holiday for some time, so it’s very likely they won’t place any big positions until next week. If and when they do, it should give us an idea as to where we are going to go for the fall season. Right now, I think it is a bit too early to get overly excited about anything and put a lot of money to work.

All of that being said we do have some obvious ranges to pay attention to, so I think what we are going to see is more back and forth trading overall, sending this market much lower and testing support. In the meantime, you will want to keep your position size relatively small as the damage has been brutal for both buyers and sellers who have gone “all in” over the last several weeks. The market simply doesn’t know where to go and that’s apparent every day that I sit down at my desk. For example, Wednesday featured bonds, stocks, risk on currencies, and risk off currencies all going higher. Certainly something needs to give and it needs to give soon.