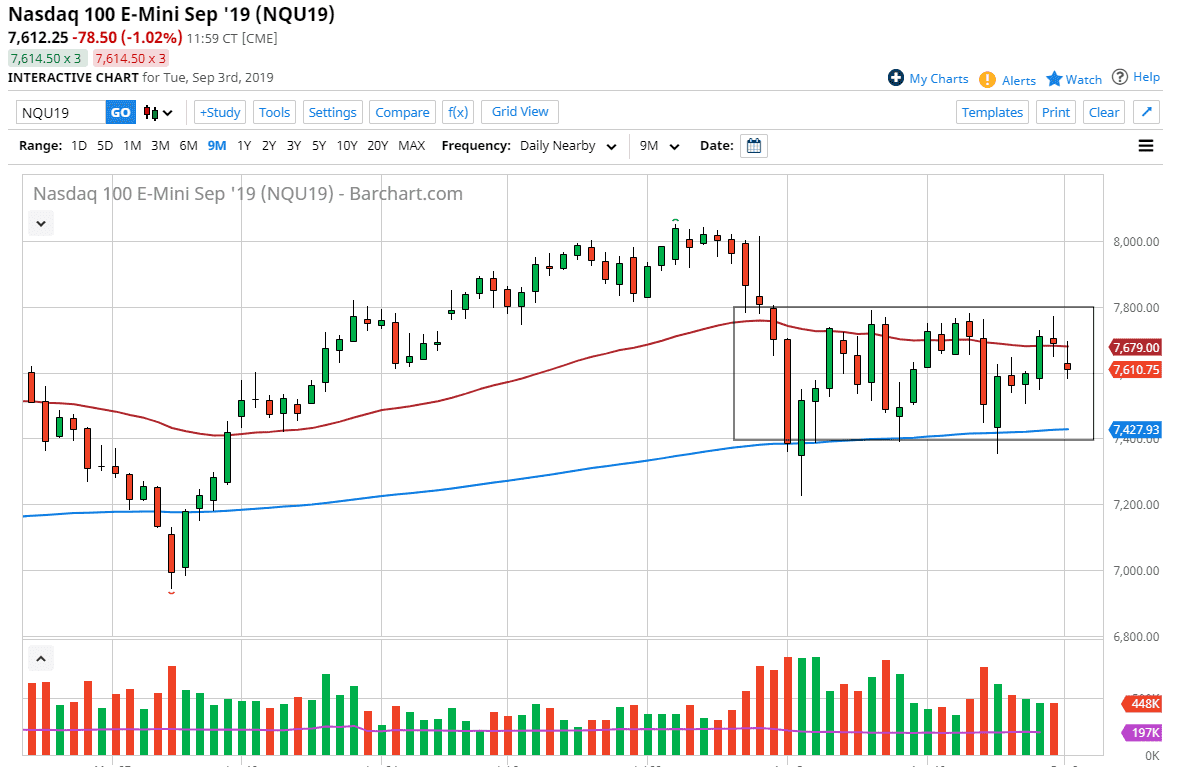

The NASDAQ 100 traded in very thin electronic trading on Labor Day, gapping lower in reaction to the US and China slapping tariffs on each other. We gapped quite significantly, spent the entire day trying to fill that gap, and then fell again once we got to the top of it. Beyond that, the 50 day EMA has offered resistance, and now we ended up falling from there. I think at this point it’s very likely that the United States and China attacking each other will still continue to put a lot of pressure on technology stocks. That of course makes it very likely to push the NASDAQ 100 lower.

Beyond that, as you can see we have been consolidating between the 7800 level on the top and the 7400 level on the bottom. We are currently sitting on top of the 7600 level, which is essentially “fair value”, but the candlestick formation looks very ominous to say the least. At this point, I think we are simply ready to make a return trip towards the 7400 level, which also coincides quite nicely with the 200 day EMA. Ultimately, this is a market that has been going back and forth, and I think that will continue to be the same going forward as we have a lot of concerns globally and have probably the most important monthly announcement on Friday in the form of the jobs figure in the United States.

That almost always causes a lot of noise in the markets, as people are not willing to put on a lot of money and take on a lot of risk in that situation. With all of that, it makes quite a bit of sense that we just won’t have the momentum to break out or break down. Having said that, we will start to see a lot of volume jump back into the marketplace next week, and that of course will have a major influence on where we go.

If we break out to the upside, then I think we probably go looking towards the 8000 handle. To the downside, if we break down below the 7400 level, then it’s very likely that we go down to the 7200 level. Until we make the breakout though, I think simply bouncing around in the rectangle drawn on the chart makes the most sense in the short term.