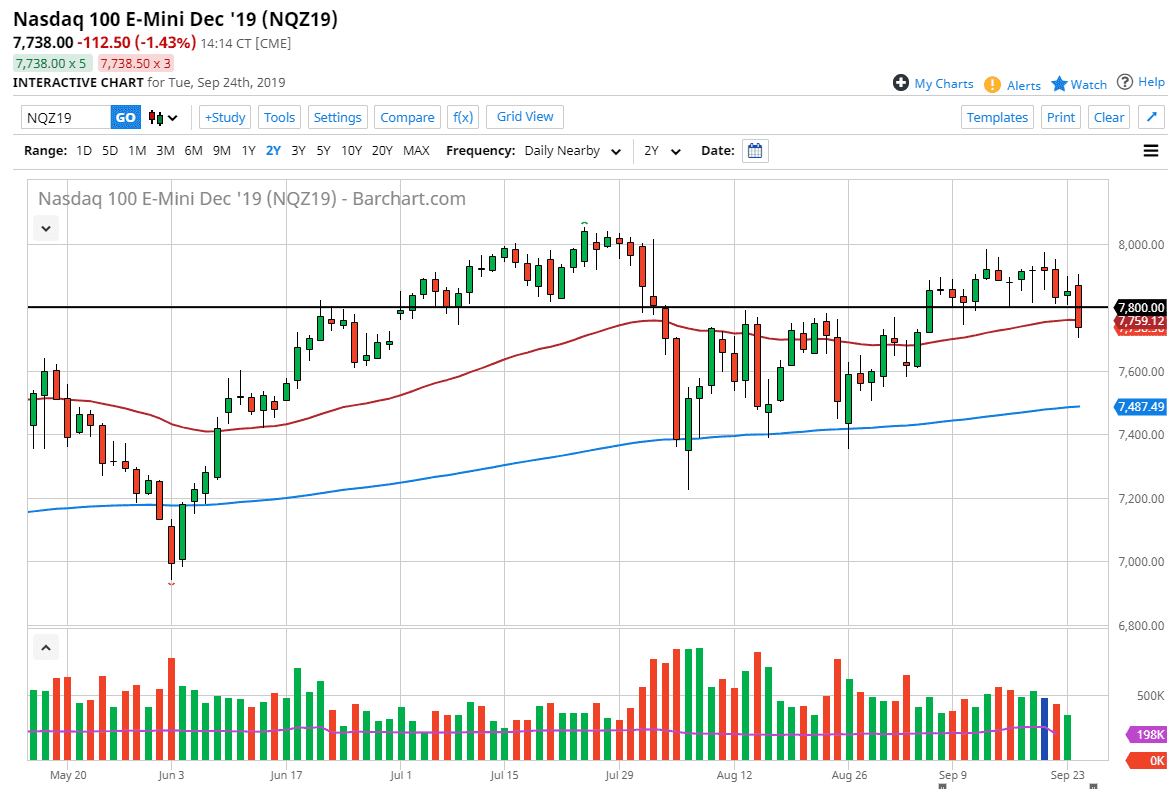

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but then broke down below the 7800 level to reach through the 50 day EMA. At this point in time it’s very likely that the market will continue to go a bit lower from here though, perhaps reaching towards the previous consolidation area to find a certain amount of support. Ultimately, the 200 day EMA below which is painted in blue should be the absolute “floor” in the market, and therefore somewhere between here and there I fully anticipate that the market will turn around and bounce higher. That being said, there is a lot of downward pressure after the Democrats have finally started the impeachment inquiry. That being said, the Republican still hold the Senate and therefore impeachment goes nowhere in the long run.

This will more than likely be looked at as a potential buying opportunity underneath, it’s cooler heads prevail and of course people start to trade instead of the algorithmic knee-jerk reaction that you get off of these types of headlines. That being said, we may have another day or so of negativity, but at the first sign of support it’s very likely that we are looking for an opportunity to pick up value. That being said though, if we were to break below the 200 day EMA finally, then it changes the entire trend and of course there is also the specter of the US/China trade situation which hasn’t necessarily gotten any better, although the Chinese are now starting to buy soybeans again.

The 8000 level above is major resistance and if we can clear that area, then it’s possible that we may continue to go much higher. If that’s the case, then it simply continues the overall uptrend. That being said though, it is clear that there has been a lot of order flow between here and 7400, so I think this is probably going to be more of a pullback than any type of meltdown. Quite frankly, this would be about the 500th time over the last few months that the market look like it was falling out of the sky, and it’s obvious that the Federal Reserve has everybody’s back at this point. If that’s going to be the case, then the buyers will eventually jump in and take control again.