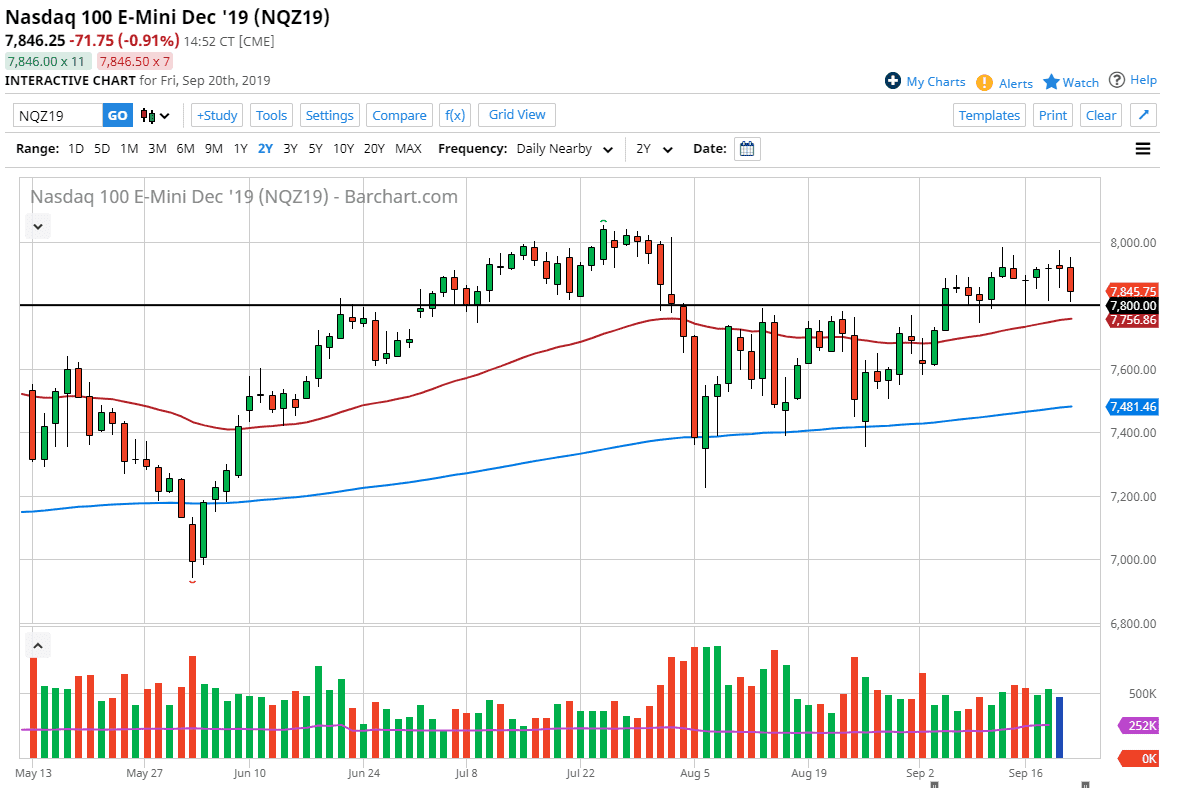

The NASDAQ 100 initially tried to rally during the day on Friday during “quadruple witching” which is the conclusion of four different types of options, throwing chaos into the markets. By the time all things were closed though, the market reached down towards the 7800 level before bouncing slightly. This is an area that was previous resistance, so it makes sense that the buyers should be hanging about. Beyond that, the 50 day EMA is just below, so it’s likely that traders will be looking to start buying from there. Remember, we are in an overall uptrend and have recently broken out of a major consolidation area. That being said though, it doesn’t mean that it will be easier for this market to break out to the upside.

Looking at this chart, the 7800 level was the top of a consolidation area that extends all the way down to the 7400 level, so that suggests that the market is going to go looking towards the 8200 level given enough time. That doesn’t mean that we will get there right away, and quite frankly it’s likely that we will see a lot of noise based upon headlines, and of course the occasional blips on news sites. Traders continue to focus on the US/China trade situation which although has made a bit of progress lately in the sense that low-level talks have continued, there’s nothing to suggest that much has changed. As long as that’s the case, there is still a bit of an overhang when it comes to the markets, this one included.

Looking at the chart you can see clearly that we had formed a bit of a “W pattern” but haven’t broken out to the upside. When we do, that would be a very bullish sign but it will be difficult to see that happening without some type of good news. The one good thing that has helped the markets lately is that the Federal Reserve looks likely to continue offering cheap money, which is essentially what Wall Street looks for, not necessarily economic news. With that, traders will continue to pump money into the market given enough time but now the question is whether or not it will happen now, or if we need to pull back a bit before trying again? Short-term pullbacks should offer buying opportunities but you should be looking long only positions at this point.