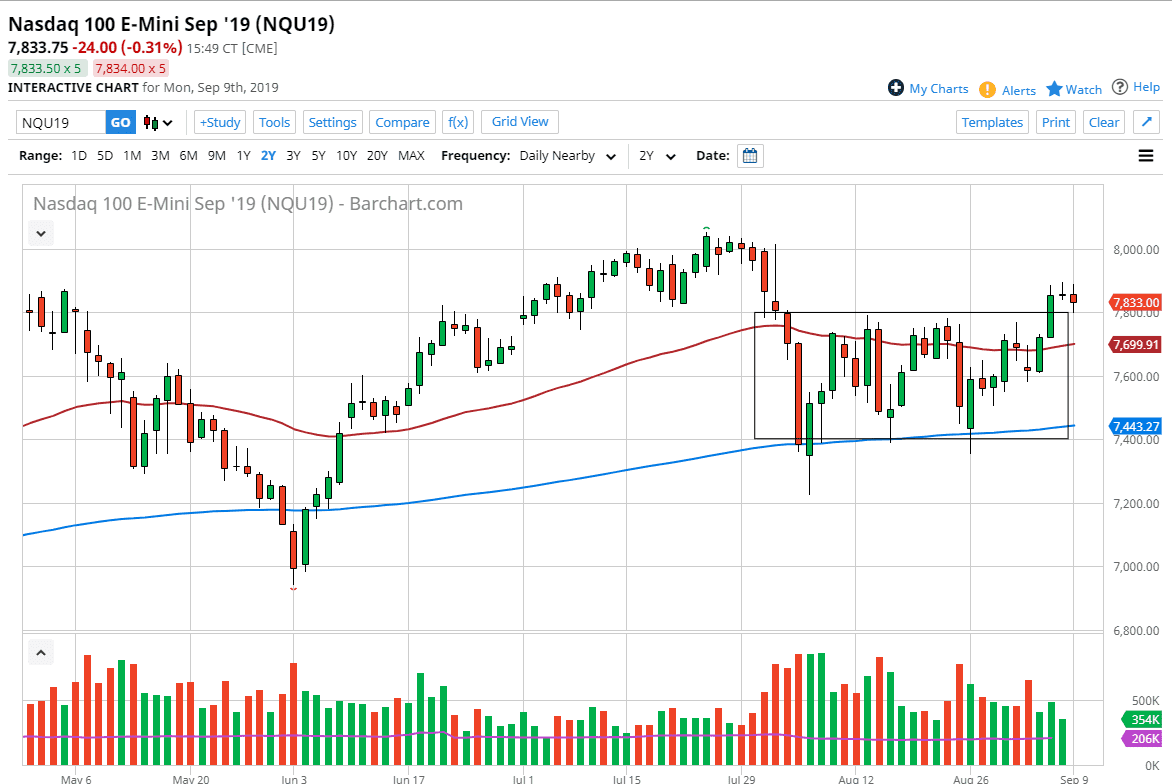

The NASDAQ 100 fell a bit during the trading session on Monday, reaching down towards the important 7800 level. This is an area that has been crucial more than once as it was the top of the recent consolidation area. With that being the case, I think that the fact that we have bounced 33 points above there is a good sign. If we can break above the highs from the Friday session, this market will more than likely go looking towards the 8000 handle. Ultimately, the 8000 handle will offer a lot of resistance, as it is a large, round, psychologically significant figure.

Underneath all of this, we have the red 50 day EMA which I’m using as support, and as long as we can stay above there you can make an argument for buying. Remember, the NASDAQ 100 is highly sensitive to the US/China trade negotiations, and recently things have gone well. This is a short-term situation though, and it’s only a matter time before something bad happens. It is because of this that I am short-term bullish, longer-term bearish. That being said, you must play the market that you are offered, and right now we are offered in market that looks like it is going to continue to be a “by on the dips” situation.

If we were to break above the 8100 level, then it’s likely that we could go even higher, perhaps the 8200 level based upon the 400 point range that we have been in previous to this recent breakout. The 200 day EMA is at the bottom of the consolidation area, and if we were to break down below the 7400 level then it’s obviously a very negative sign, perhaps a major break down just waiting to happen. That of course would open up a 400 point move down towards the 7000 handle. That of course is a large, round, psychologically significant figure, which will attract a lot of attention. The volatility is here to stay, and unfortunately I think is going to get worse, not better. Keep an eye on trade relations and of course Twitter, as it will probably dictate where we go next. One thing that is helping is that the Federal Reserve looks very likely to offer plenty of liquidity and quantitative easing to continue to push stocks higher, including the ones in the NASDAQ 100.