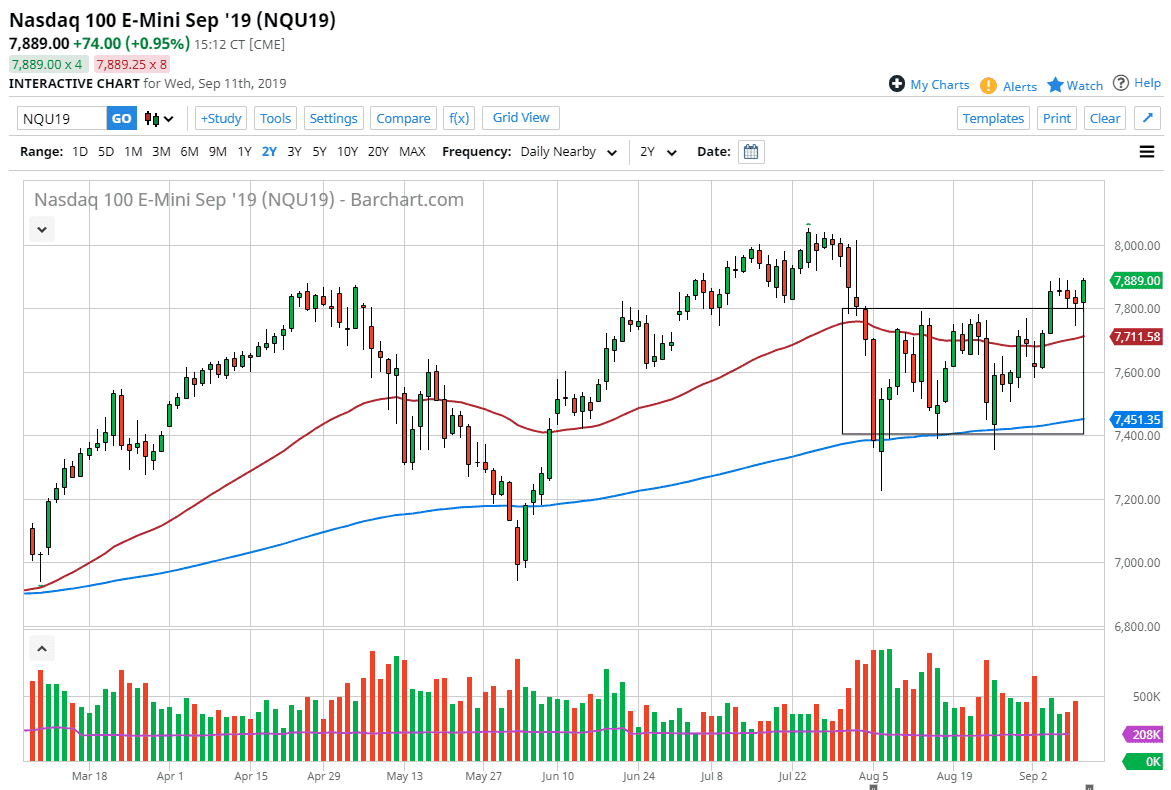

The NASDAQ 100 rallied a bit during the trading session on Wednesday, testing the 7800 level before shooting higher in the air. What the daily chart doesn’t show you is that a lot of the momentum was at the end of the day and that’s an extraordinarily positive sign. This is because a lot of institutional orders such as retirement funds jump into the market in the last hour. With that in mind, it should continue to push this market to the upside.

We did end up forming a perfect little hammer during the trading session on Tuesday, and now that we have reached towards the highs of the last couple of days again late in the day on Wednesday, I feel rather positive about this market and I think we are going to go looking towards the 8000 handle. Beyond that, we had recently broken out of a consolidation area, which measured 400 points. That means that we could be looking at a move towards the 8200 level given enough time, but it doesn’t necessarily mean that we see it immediately.

If you have the ability to trade the NASDAQ 100 in small increments, then by all means this is a nice trend just waiting to happen. Short-term traders will have to be a little bit more selective on pullbacks or breakouts to show signs of strength, but ultimately I do think it’s only a matter of time before we go to the upside. The 8000 handle will of course cause a lot of issues but ultimately I think the trend is stronger and of course with more monetary stimulus coming from central banks around the world, money is being thrown into the stock markets. Beyond all of that, you also have the US/China trade talks at least going a little bit better over the last week or so and here we are.

Having said that, it’s very likely that we continue to see upward momentum until somebody somewhere says something stupid. The question is whether or not it comes from Beijing or Washington DC, not so much whether or not it happens. That at least has been the pattern recently. I do think that we probably look for that 8200 level, and then perhaps rollback. Expect a lot of choppiness to the upside but I still believe that the overall attitude is to go to the upside more than anything else.