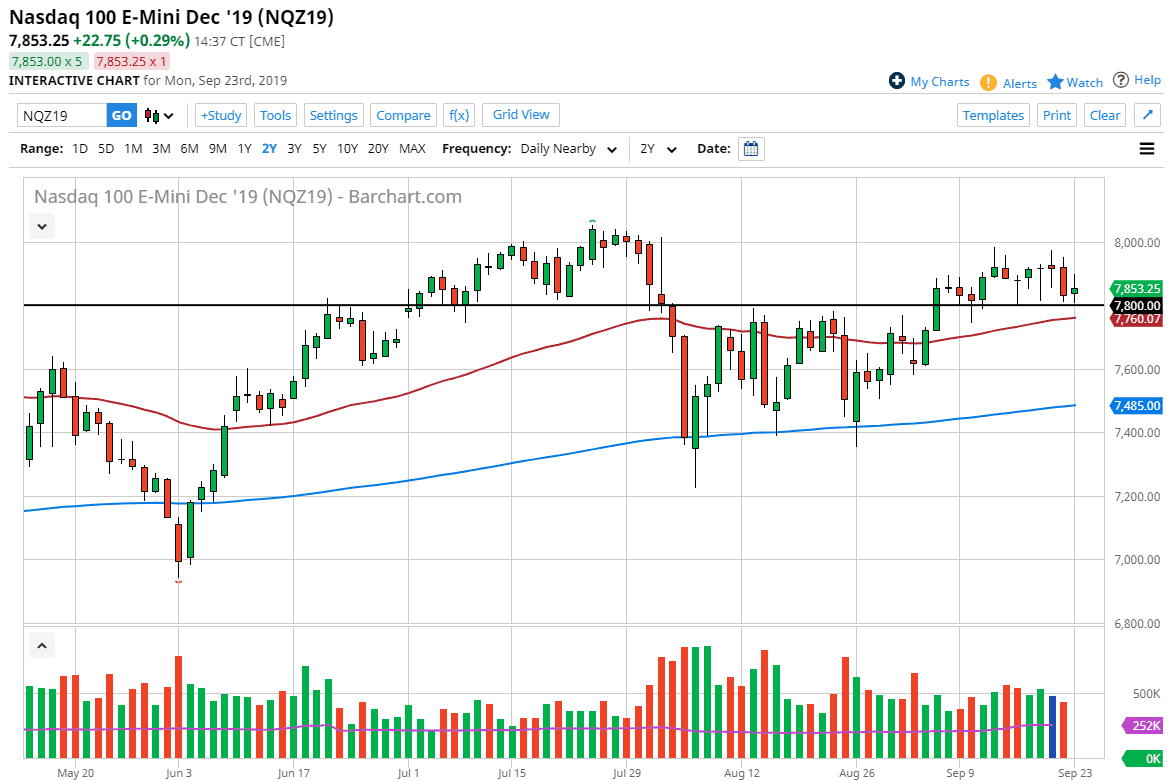

The NASDAQ 100 has gone back and forth during the trading session on Monday, showing signs of volatility yet again. Ultimately, the 7800 level seems to be very important, and as a result it’s likely that the market continues to find buyers underneath, as the large, round, psychologically significant number typically does. Beyond that, we also have the 50 day EMA just below that could offer plenty of support as well.

All things being equal, the market has been rather volatile and sideways until the recent breakout, and measuring the previous consolidation area, it’s likely that the market should in theory go to the 8200 level. Obviously, we need some type of catalyst to make that happen, perhaps in the form of good news coming out of the US/China trade situation. The 50 day EMA has been important previously, not only as support but also as resistance. At this point in time, it’s still a bit of a mixed bag but it’s obvious that the market really wants to take off to the upside on any signs of strength. Every time there is a good headline, the market rallies.

To the downside, if we were to clear the 50 day EMA with selling pressure, the 7600 level would be the next target. Below there, the market could go as low as the 200 day EMA, perhaps even the 7400 level. Below there, then you have a complete trend change and the bearish market. While I don’t expect that to happen, it is a possibility and something that should be paid attention to. All of that being said, if we can break above the top of the candle stick for the trading session for Monday, the market could then go looking towards the 8000 handle. A break above there could send this market towards the 8200 level as previously mentioned, but obviously there needs to be a certain amount of momentum in the market to make that happen.

The Federal Reserve is continuing to look very loose with its monetary policy, so that could be a reason for the market to continue to rally. We are in an uptrend, so it seems as if we get pulled back there should be plenty of buyers to jump in. I prefer to trade with the trend, so I will be looking for buying opportunities on short-term dips but as far as “buying and holding”, it’s probably going to be very difficult.