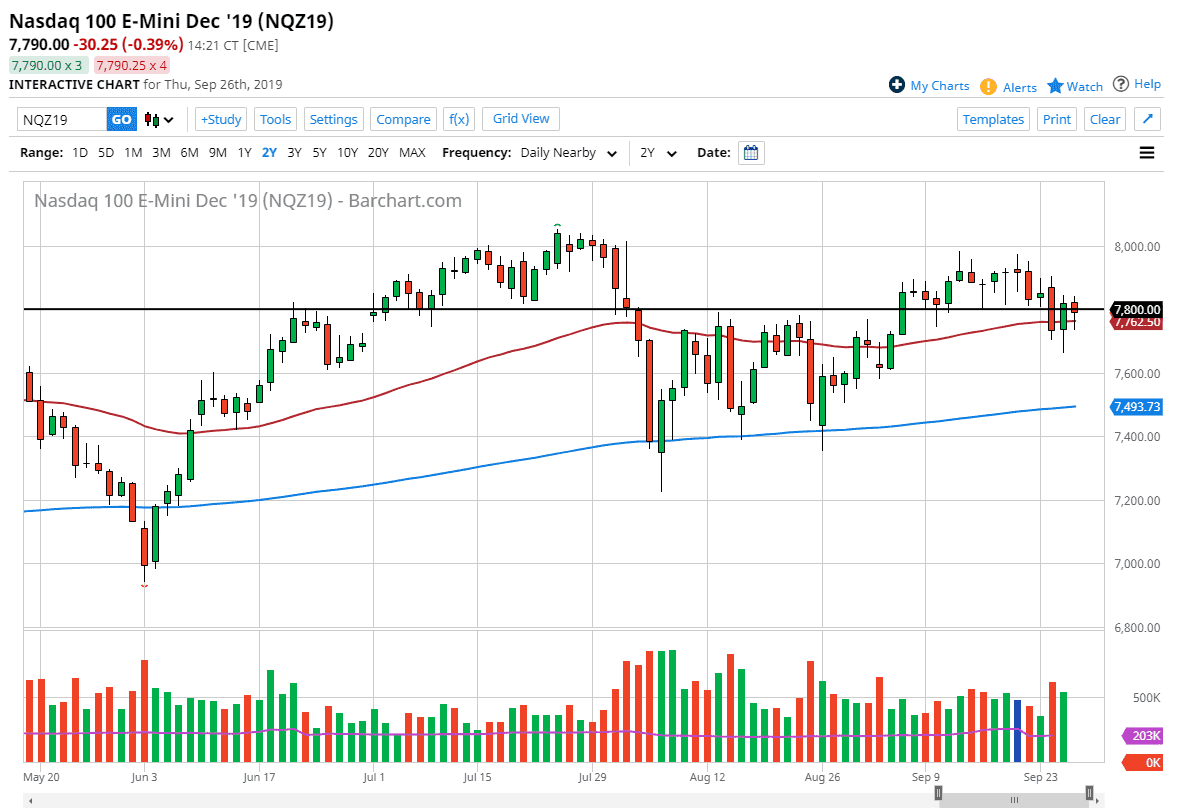

The NASDAQ 100 initially fell during trading on Thursday but found enough support underneath the 50 day EMA to turn around of form a nice-looking hammer. This of course is a very bullish sign and therefore the fact that the 50 day EMA is holding tells me also that there are plenty of buyers underneath to pick up bits and pieces of value.

Even with the nonsense going on in Washington at the moment, markets are starting to look past that already. After all, political noise continues to be just that, noise. At the end of the day, the markets will be worrying about global growth more than anything else, which seems to be slowing down so that’s likely to continue to be a problem. However, one thing that’s worth paying attention to is the fact that the United States is one of the few places where we are still growing, or at least with any type of strength. That of course means that money will continue to flow to the stock markets in the United States, the NASDAQ 100 included. Ultimately, it looks as if every time the market sell off, people look at it as a potential value proposition.

Looking at the candlesticks over the last couple of days it’s easy to see that buyers continue to come in and pick up the market levels underneath, and I suspect that will probably continue to be the case. Ultimately, this is a market that will continue to find plenty of reasons to be volatile, but in the end I think that the resiliency is something that simply cannot be ignored. To the downside, we would need to wipeout the candle stick from the Wednesday session to be very suddenly, and even then it would be a bit difficult to sell for a longer-term move, simply because there’s so much noise between here and the 200 day EMA. With all that in mind, I remain bullish and I am impressed by the fact that the buyers continue to stick to their guns in this marketplace. Selling is all but impossible, at least not until we break down below the 200 day EMA which would be a longer-term signal for algorithmic traders. It appears that the market wants to go back towards the 8000 handle given enough time, and I do believe that happens probably sooner rather than later.