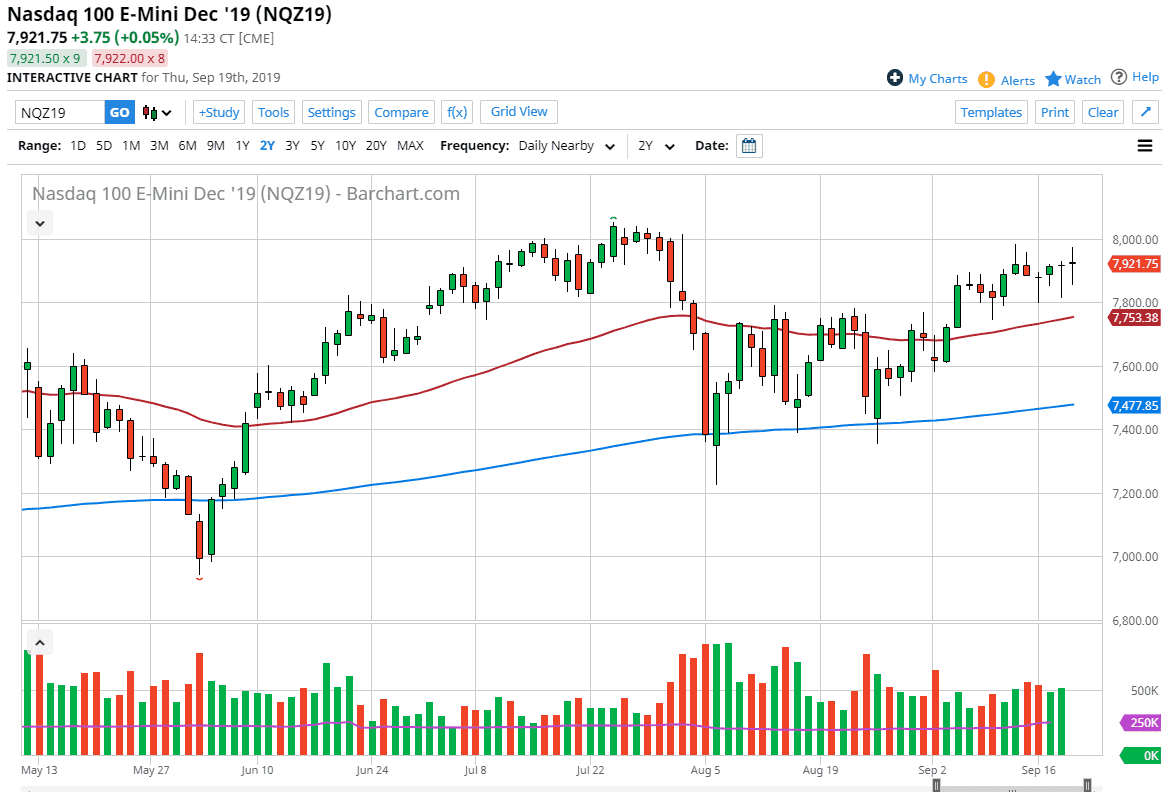

The NASDAQ 100 continues to go back and forth during the trading session on Thursday and there’s no relief in sight. We are far too close to the overall highs to think that the market is suddenly going to take off to the upside, at least not without some type of major push. With Friday being “quadruple witching”, it’s going to be very dangerous and difficult market to trade. Options will be expiring and futures, stocks, indices, and so on. In other words, there’s going to be a lot of manipulation of the market during the day so what’s very likely is that the market will end up where it is. We may have moves of pressure in one direction or the other only to be reversed in the middle of the day.

The best trade for a “quadruple witching day” is to simply stay out of the market. That being said, I know many of you will want to press buttons during the day so keep in mind that the 7800 level should in theory be supported. To the upside, the 8000 level will offer quite a bit of resistance. So if we break out of these areas it’s possible that we may get a bit of a move, but the reality is that the threat of even a false breakout is very high.

The week has been very flat, and in and of itself could be thought of as a small victory for the trend, but not impressively so considering that the Federal Reserve has just cut interest rates and even suggested that they could again, while equities did very little. In other words, it seems as if the market is just as confused as it was last week, and it needs to figure out whether or not it has the momentum to break out. Based upon the consolidation underneath, the target was to be the 8200 level but obviously the 8000 level needs to be put in the rearview mirror for the market to be able to do so. If we were to break down, I would expect plenty of areas, roughly every 100 points or so, to offer support that could be taken advantage of. Again though, the smart money is staying out of the market during the trading session as flows to defend options strike prices will continue to drive the market back and forth.