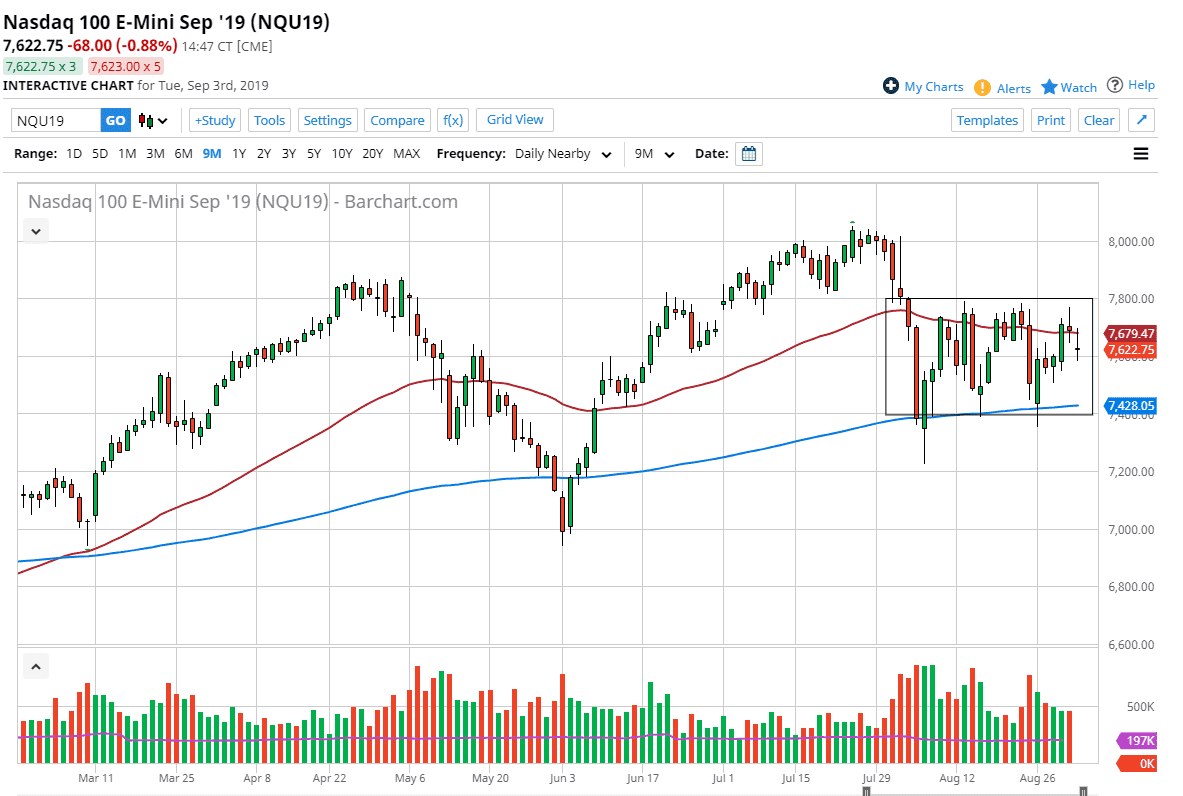

The NASDAQ 100 gapped lower to kick off the trading day on Tuesday, but then rallied significantly to fill that gap. That makes quite a bit of sense considering that the US and the Chinese have levied tariffs on each other, increasing the tension in the trade war. At this point, it looks as if we are ready to continue more of the same action that we have seen for some time, as we have been consolidating between the 7800 level and the 7400 level. The fact that the candlestick is forming a bit of a shooting star suggests that we could pull back from here but right now were essentially in the “fair value area” that the market has been paying quite a bit of attention.

We are currently between the 200 day EMA on the bottom and the 50 day EMA just above. I think the market is going to continue to show signs of confusion and choppiness between now and Friday, which is the day that we get the jobs number coming out. Between now and then I think it’s just simply going to be a short-term traders type of back-and-forth situation.

That being said, if we broke above the 7800 level, it opens up the door to the 8000 handle, but would probably need some type of good news in order to make that happen but given enough time I think the market would not only reach the 8000 level in that environment, but could break out to a fresh, new highs.

To the downside, if we were to break down below the 7400 level, it’s likely that the market would unravel and it’s likely that we could continue to go much lower. The 7000 handle could be targeted then, and then perhaps even lower. This would probably be part of some type of general market selloff and therefore you would see not only the NASDAQ 100 falling apart, but the Dow Jones Industrial Average, and the S&P 500. With all that being said, we are most certainly at an area that we are going to have to see some type of decision made, and I think that will be made after Friday’s crucial number. After all, large amounts of volume is about to reenter the market as the summer season is all but over in the next few days.