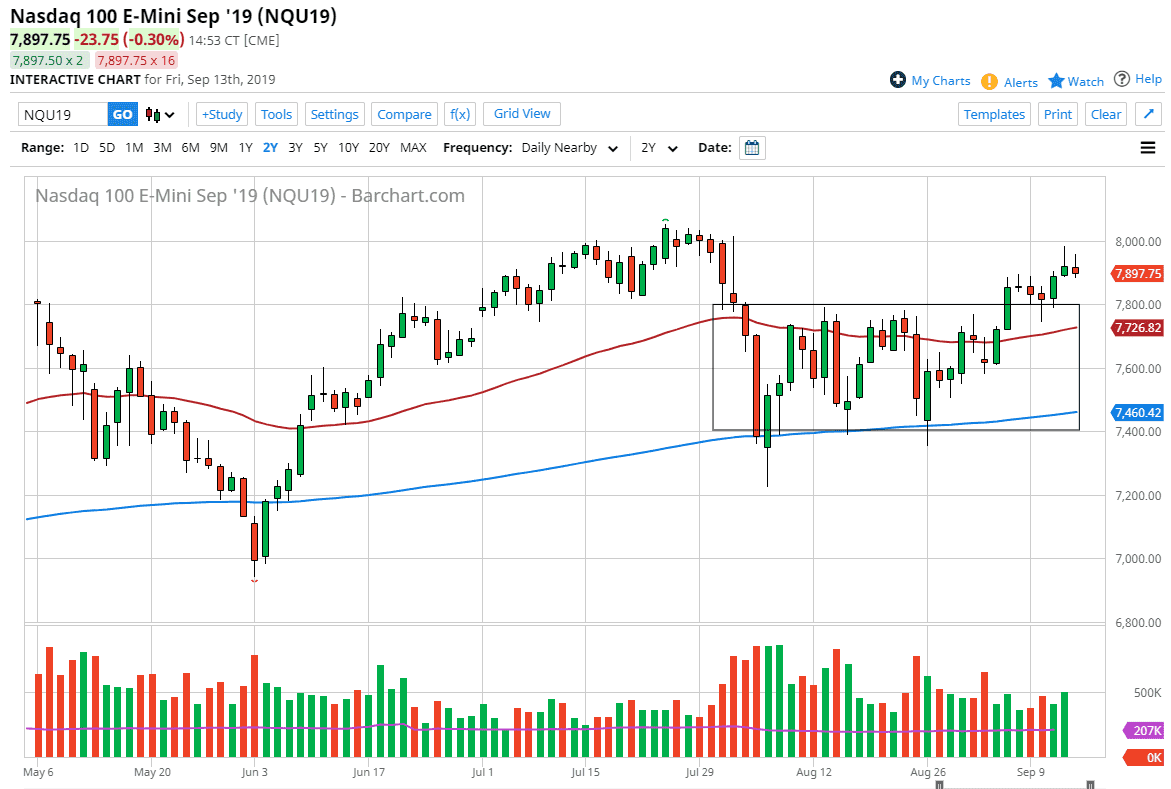

The NASDAQ 100 initially tried to rally during the trading session on Friday but gave back quite a bit of the gains end up forming a massive shooting star. That being the case, it mirrors what we had seen on Thursday and that tells me that there is a lot of overhead resistance. This makes quite a bit of sense if you look at the chart though, because the 8000 handle is a large, round, psychologically significant figure, and of course an area where we had recently ran into quite a bit of resistance. Ultimately, the 7800 level underneath should offer a significant amount of support. Underneath, the 50 day EMA comes into play so there are plenty of reasons to think that any pullback should be short-lived at best.

As the United States and China calm trading tensions a bit, that should also help this market as it is highly sensitive to technological stocks that obviously are sensitive to the growth of Asia and cross Pacific transactions. Ultimately, the market is in an uptrend but we also have a significant amount of resistance above.

Looking at this noise, it’s likely that we will continue to see a little bit of a pullback but obviously buyers underneath. In other words I think that what we are about to see is a sideways grind with an upward tilt. The 50 day EMA will be an interesting area to watch, but at this point it’s very likely that we will see plenty of volatility so I think that short-term dips will be bought. I don’t have any interest in shorting this market, at least not until we break down below the 50 day EMA on an extensive red candle from the daily time frame.

Otherwise, if we were to break above the 8000 handle, then the market goes much higher, perhaps reaching towards the 8200 level based upon the measured move of the consolidation box that I have drawn on the chart. This is the most basic of technical analysis, but at this point I think it’s only a matter of time before we get there based upon perhaps the Federal Reserve, the ability of Donald Trump to work out a deal, or perhaps even just simple momentum. Pay attention to bond yields they are falling so that’s probably a good sign as well. Expect short-term pullbacks offer short-term buying opportunities.