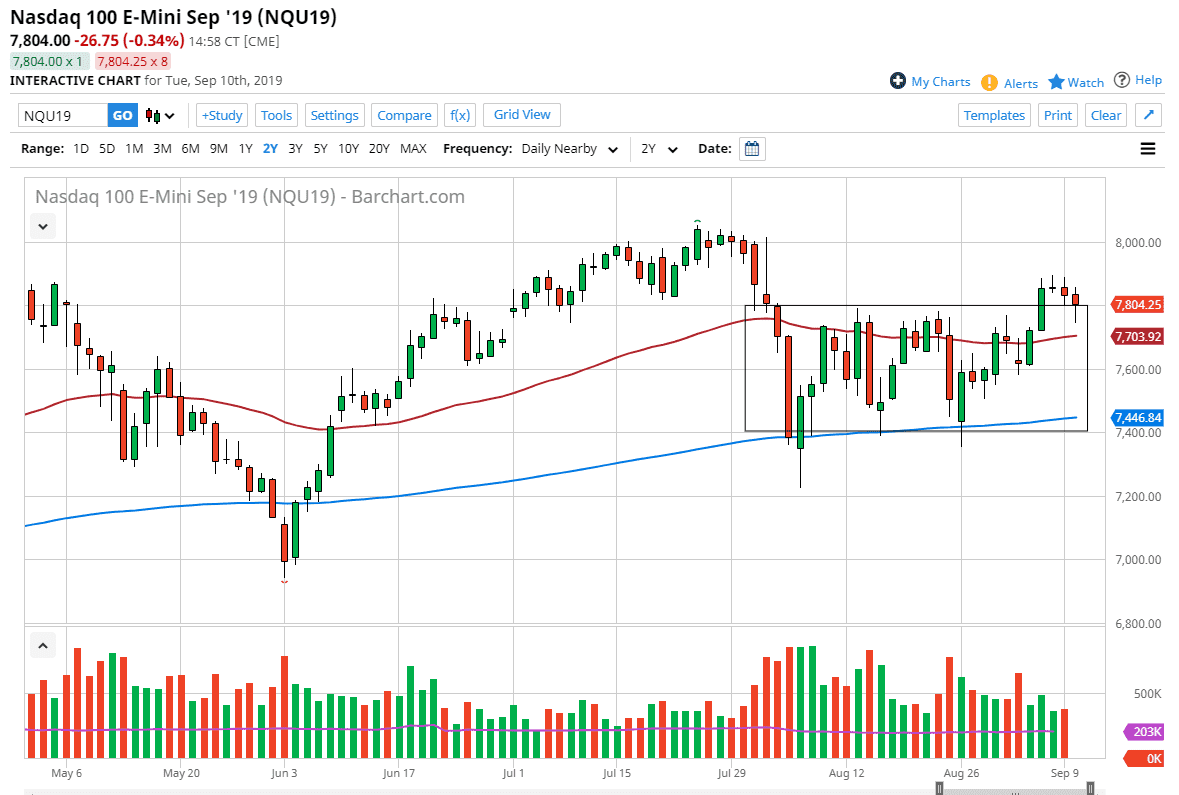

The NASDAQ 100 has fallen during the trading session on Tuesday, reaching towards the 50 day EMA before turning around completely. By doing so we ended up forming a massive hammer which is sitting right on top of the consolidation area from the previous range. Ultimately, the 50 day EMA is underneath and turning higher as well, and with that being the case it’s likely that we continue to see buyers come into this marketplace and try to push it towards the 8000 handle. The NASDAQ 100 has found buyers underneath and I do think that we will continue to find some as quantitative easing becomes the most important thing in the world when it comes to stocks. Ignore fundamental reasoning, because it doesn’t have anything to do with what happens next. This is especially true when it comes to indices so unless you are trading an individual company, you should look at this as a “cut or not to cut” barometer for the Federal Reserve.

The 8000 level above will cause quite a bit of resistance but I think it’s only a matter of time before the breakthrough there as well, especially if central banks around the world become even more dovish. This will be a short-term “sugar high”, which could lead to a bit more trouble. Based upon technical analysis, the break above the top of the consolidation area should in theory send this market to the 8200 level, so that would be a longer-term target.

The alternate scenario is that we break down through the 50 day EMA and go looking towards the 7600 level underneath, followed by the 200 day EMA which is close to the bottom of the consolidation area that we just broke out of. This would also be a breaking of a hammer shaped candle, which would turn the session on Tuesday into a “hanging man”, which is a very negative signal. All things being equal I think it’s only a matter time before we find trouble and then start selling. That being said, it doesn’t look to be anytime soon so keep that in mind. Fundamentals don’t matter, it’s price at the end of the day. It certainly looks as if price will be higher, so that tells you the direction you should be trading, regardless of what’s going on around the world.