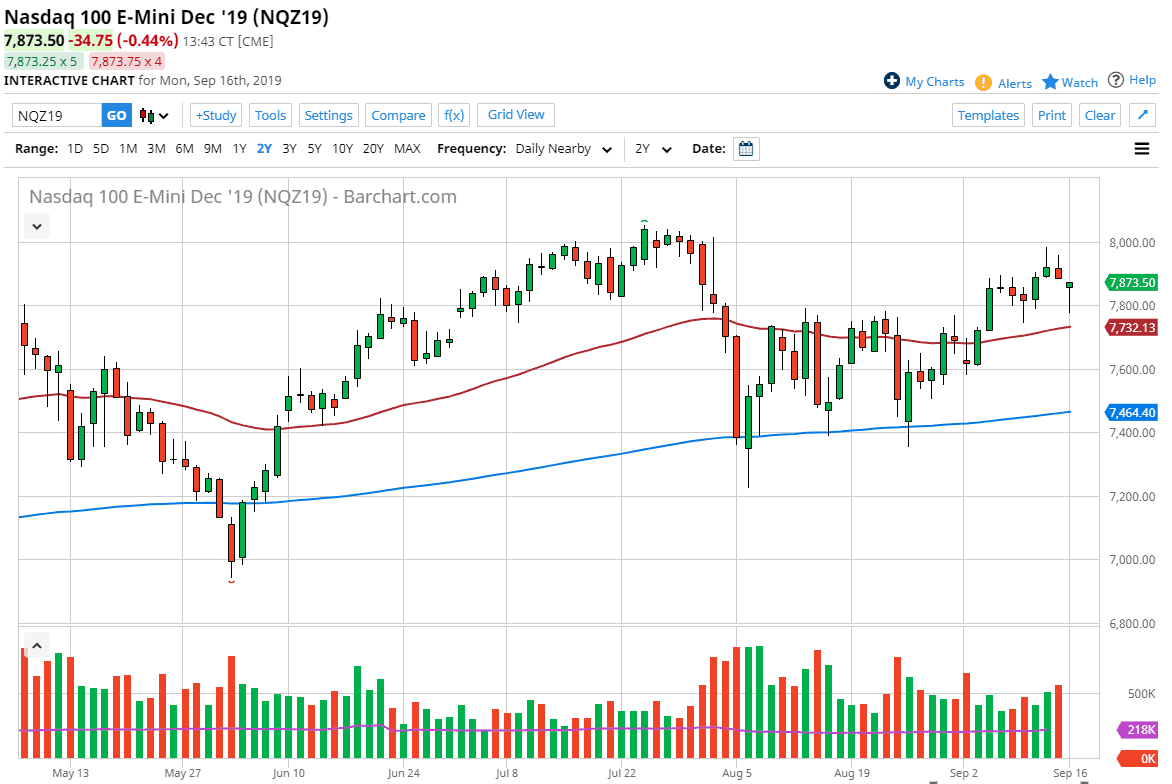

The NASDAQ 100 gapped lower at the beginning of the week as pretty much everything else with any risk appetite attached to it did due to the drone strike in Saudi Arabia. Because of this, it makes quite a bit of sense that we were very negative during the Asian session, but it’s clear now that the Americans were willing to step in and pick this market up, as they are starting to focus on other things such as the Federal Reserve cutting interest rates. Economic numbers recently haven’t been as bad as once previously thought, and that could of course drive the NASDAQ 100 higher as well. Remember, these are technology stocks and therefore very sensitive to growth.

To the upside, we have formed a couple of shooting stars right at the 8000 handle so it shows just how resistant that level is going to be. The 7800 level has offered support and held, so it makes sense that buyers would be back in and looking to pick up value when it occurs. I like the idea of buying dips which of course offer value, and what has already been a big uptrend. If we can clear the 8000 level, then we can continue the overall move to the upside.

We had recently been consolidating in a roughly 400 point zone, and we have tested the top of it again only to find buyers. Based upon that measured move we could be looking at a move to 8200 given enough time. We need to see some type of good news or liquidity measures to push the market higher, because the world of course is holding its collective breath about this whole Iranian situation with the Americans. The drone strike is supposedly originating from Iran, and it makes sense that we could be looking at a lot of fear out there when it comes to a military move. With all that being said, I recognize that keeping your position size somewhat small might be crucial, as you can keep yourself out of the lot of trouble in what is almost certainly going to be a very volatile market. All things being equal though, we are still in an uptrend and that’s probably the most important thing to pay attention to here as although we did gapped lower, the candle stick for the day does look rather supportive and bullish.