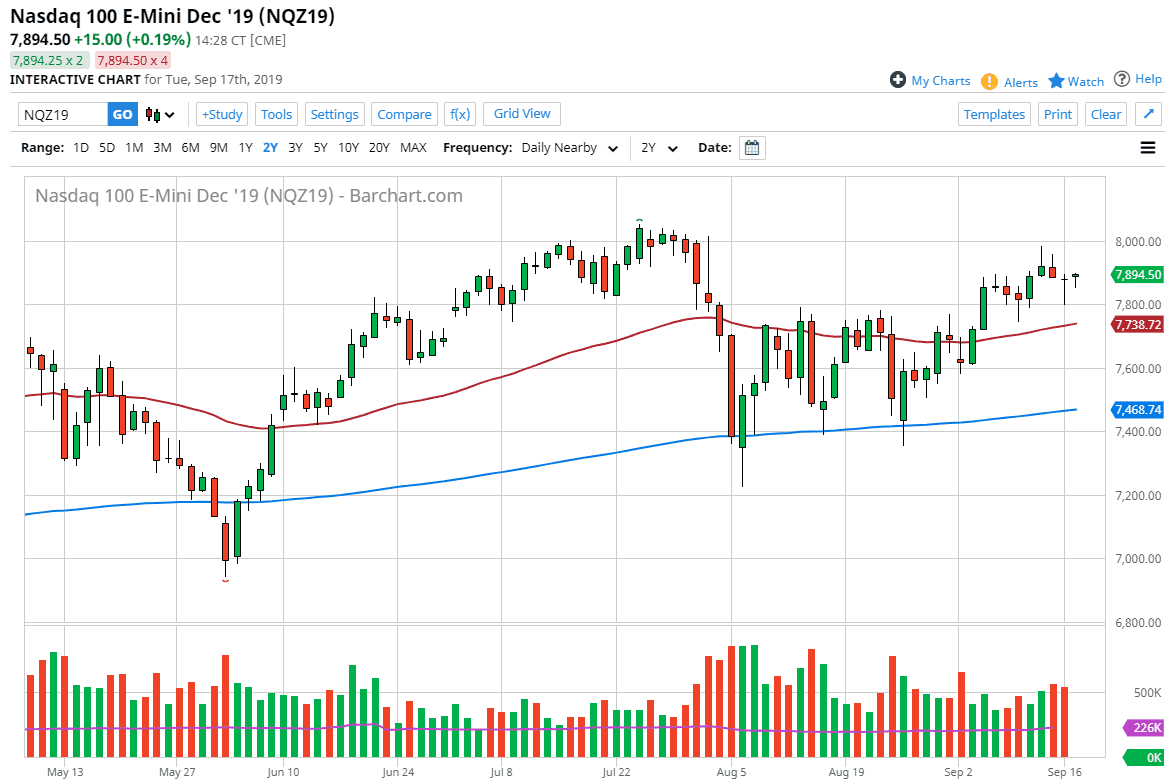

The NASDAQ 100 is likely to be very noisy during the trading session on Wednesday, but it does look like traders are setting up for a buying opportunity based upon the Federal Reserve being ultra-loose with monetary policy. Above we have the 8000 level which should be massive resistance, and if we can break above there it’s likely that we could go higher. We had previously been consolidating with a projected a move to the 8200 level and there’s nothing on this chart that suggests that we are going to do exactly that.

A pullback from here has the 50 day EMA in focus, which is down at the 7740 level. At this point, it’s very likely that the market continues to grind higher, and I think overall the 200 day EMA underneath which is painted in blue will be the bottom of the entire trend. It doesn’t matter, any pullback at this point will be a nice buying opportunity. I would anticipate that the market will continue to find plenty of reasons to rally, if nothing else based upon stimulus.

All things being equal, the 7800 level underneath is going to be supportive as well, and this is a scenario where I can see where the NASDAQ 100 should rally based upon stimulus and perhaps even if Donald Trump comes out and says something nice about China, which ironically enough could very well happen during the day to boost the markets. Breaking the 8000 level is of course a significant scenario, and therefore should be looked at with intense focus. Longer-term, this is a market that has been very bullish for a long time, and therefore I think that the pullbacks will continue to offer a nice buying opportunity and that means that this market will probably continue as it had before but perhaps with a little bit more velocity after this Federal Reserve meeting.

Remember, the more dovish the Federal Reserve is, the more likely this market is to continue to rally, as we have plenty of money flowing into the markets to avoid low rates which of course will continue to be a major problem. All things being equal, I’m a buyer but I would love to find some type of value, perhaps ahead of the announcement if I can get a nice enough bounce from the levels underneath.