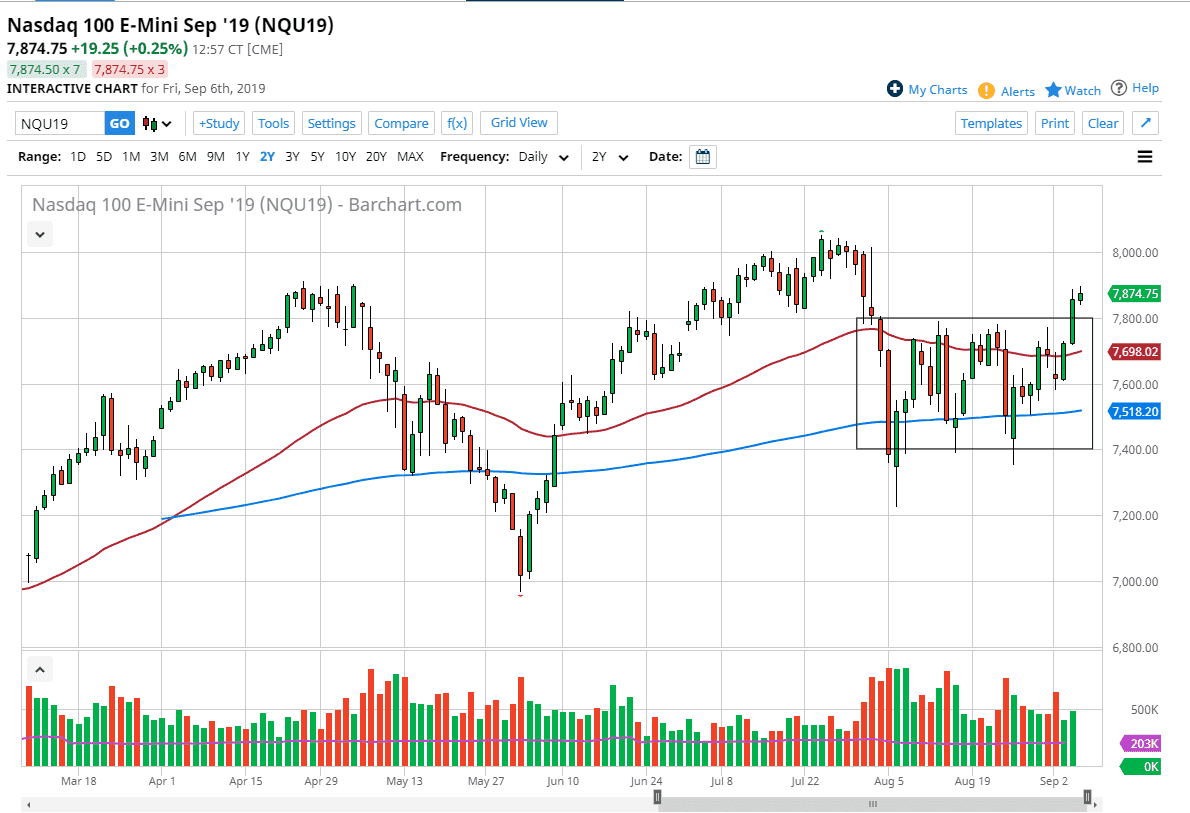

The NASDAQ 100 rallied again during the trading session on Friday in somewhat of a subdued manner, but at this point it’s obvious that we have broken out of a major consolidation phase and that should continue to attract people to the market.

When you think about the reason that we have seen bullish pressure in this market, namely the fact that the United States and China are ready to sit down and start talking again, it makes quite a bit of sense that we have seen this breakout. At this point, the NASDAQ 100 is very sensitive to the US/China situation, because of the cross-border transactions that a lot of these companies will do. With that being the case, it’s very likely that it will continue to move right along with the risk appetite due to the negotiation. Ultimately though, it’s very likely that we will see failure and disappointment, but in the short term it looks as if we are ready to rally.

Based upon the consolidation area underneath we should get a move of 400 points, meaning that we could go as high as 8200 to the upside. Ultimately, short-term pullbacks will be looked at as value, and although we have broken out it’s very likely that we are going to chop around. The 50 day EMA underneath should offer quite a bit of support, and therefore it’s likely that we would find buyers at this point, so look for some type of bounce from that area as an opportunity to pick up a bit of value. As far as negativity is concerned, I wouldn’t be a seller until we break down below the 200 day EMA which is closer to the 7500 level, which is painted in blue.

Ultimately, this is a market that looks destined to go higher so simply look for short-term pullbacks to take advantage of as the trend is still most certainly your friend. Whether or not we can break above the 8200 level is a completely different question, but right now it certainly makes a technically significant target. The more good news we get out of the US/China situation, the better off that this market will be. The “easy money” has already been made, so at this point you are likely to see a lot of erratic back-and-forth trading but then again that’s been the case for months anyway.