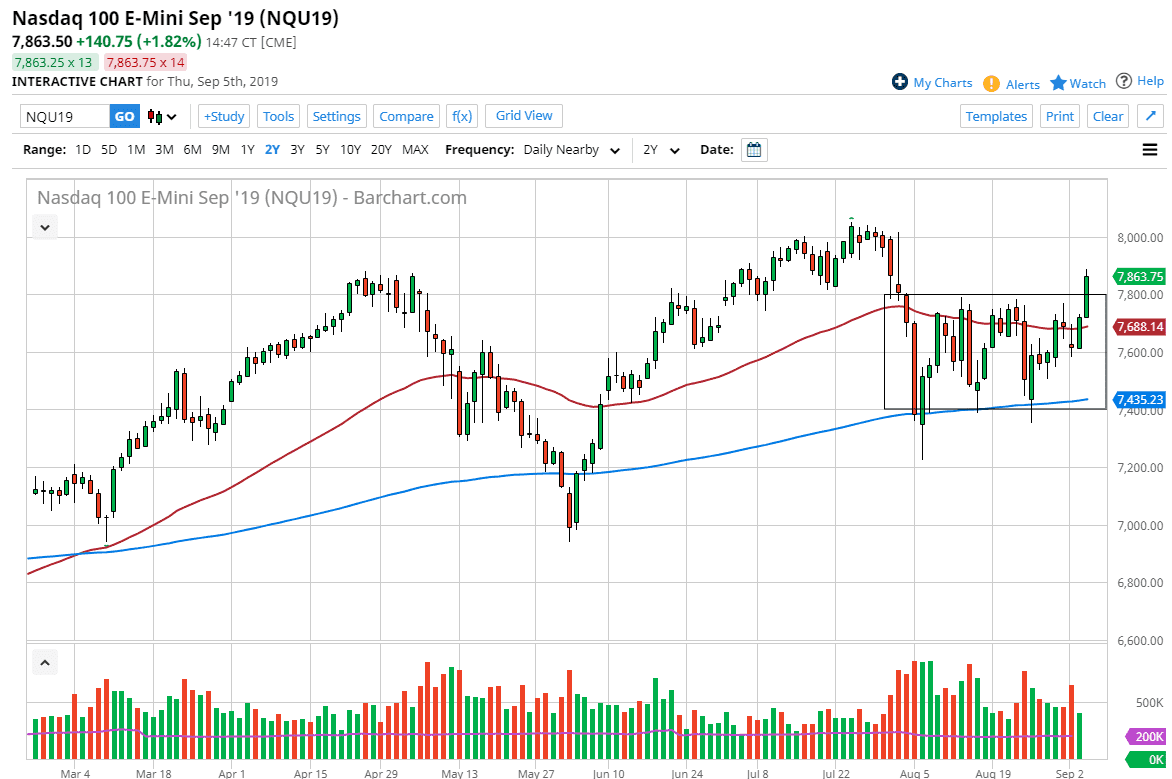

The NASDAQ 100 rallied rather significantly during the trading session on Thursday, with reactions to the Americans and the Chinese meeting again. Now that we have clear the top of the consolidation area, it’s very likely that the market will continue to go higher. With that being the case I think that short-term pullbacks will probably offer value, as traders will be a bit cautious ahead of the jobs figure.

Speaking of the jobs figure, this is going to be one of those scenarios where good news is good, but bad news is good as well, because traders are hoping that the Federal Reserve will continue to cut interest rates in a big way. Worse the jobs numbers are, the more likely they are to go big with those cuts. You can also make out a bit of a rising wedge or ascending triangle that we just broke out of so it’s very likely the NASDAQ 100 will be one of the leaders for the day.

If we do fall from here, the 50 day EMA should be massive support, so if we were to break down below it that would of course be very ugly and negative. I think at this point it seems to be very unlikely but you never know due to the fact that the jobs number can always throw monkey wrench into the equation. Regardless, it looks as if we are going to try to go higher given enough time and I believe at this point it’s likely that value hunters will come out on any pullback as this market has made a significant statement during the trading session on Thursday.

Beyond all of that, we have closed towards the top of the candle stick and that of course is bullish as well. With all of that being said, I do think that we have a real shot at breaking towards the highs as the trend seems to be reasserting itself. After all of this volatility, it looks like we baby finally starting to get a bit of continuation or at least clarity. By the time we close for the weekend, hopefully things will be much more clear, and we will be able to put money to work again as we are finally leaving the holiday season as well, so therefore volume should start to pick up as well which could also help.