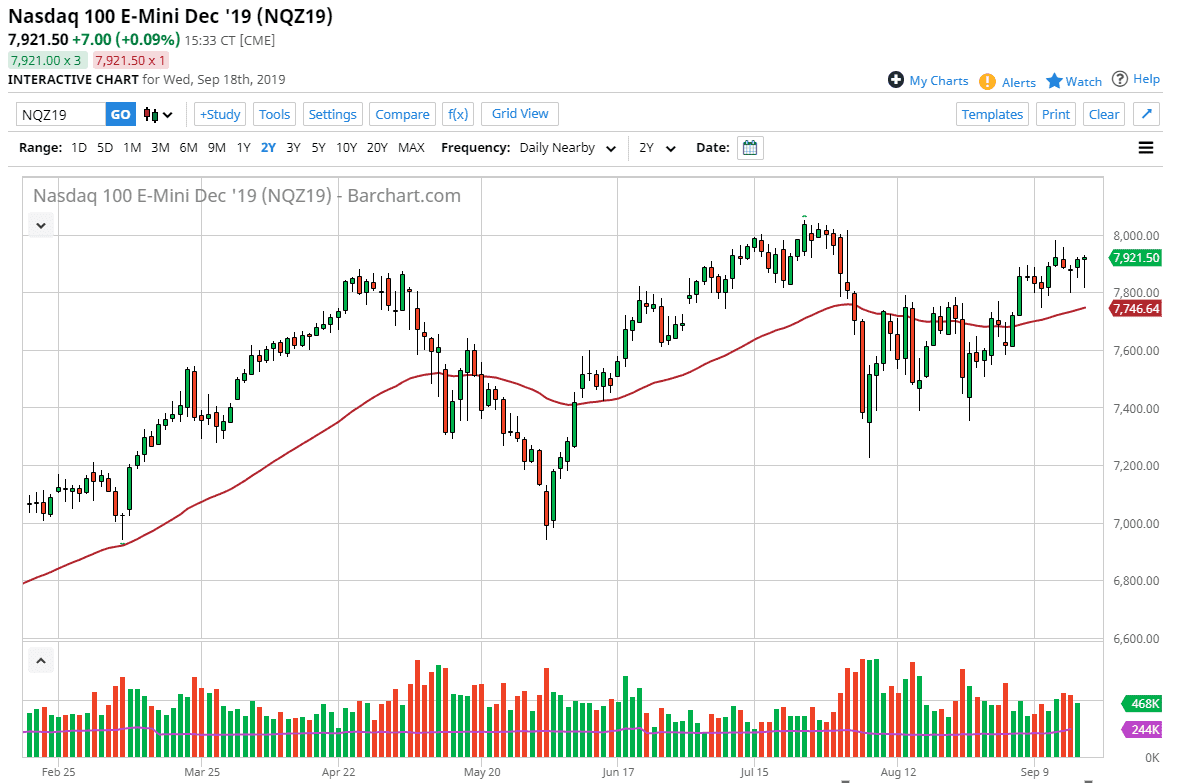

The NASDAQ 100 fell hard during the trading session on Wednesday, reaching towards the 7800 level. However, we turned around to bounce significantly and form a massive hammer. That hammer of course is a very bullish sign and it’s likely that short-term dips will continue to attract a lot of buyers. The 7800 level was the top of the recent consolidation, and the fact that it has held as support suggest that the longer-term uptrend should continue.

The 50 day EMA is sitting right in that area as well and tilting higher. That of course is a very bullish sign and I think it’s only a matter time before buyers will continue to try to reach towards the 8000 handle. If we can break above there, then the market goes much higher. The NASDAQ 100 is very sensitive to overall global growth, and therefore it’s likely that we will continue to be very noisy but it appears that the Federal Reserve is willing to step in and try to pick up the market. With that, the market should continue to go much higher.

To the downside, if we were to break down below the 7800 level, and of course the 50 day EMA, then we could drop towards the 7400 level. Ultimately, this is a market that does look as if it wants to go higher, so having said that we could send the market towards the upside and perhaps go towards the 8200 level. All things been equal this is likely a market that should continue to find buyers on dips, especially after the action that we had seen during the trading session on Wednesday. If Wednesday wasn’t going to knock down the markets, it’s hard to imagine when they were going to get back down, at least until the US/China situation gets worse. In the meantime though, there does seem to be a bit of optimism out there, so with that it’s likely that we will continue to find a “buy on the dips” attitude going forward. The fact that the market rallied late in the day suggests that institutional traders are starting to step in and pick this market up. However, I think the one thing you can probably count on is a lot of volatility when it comes to this market as well as any other stock market at this point.