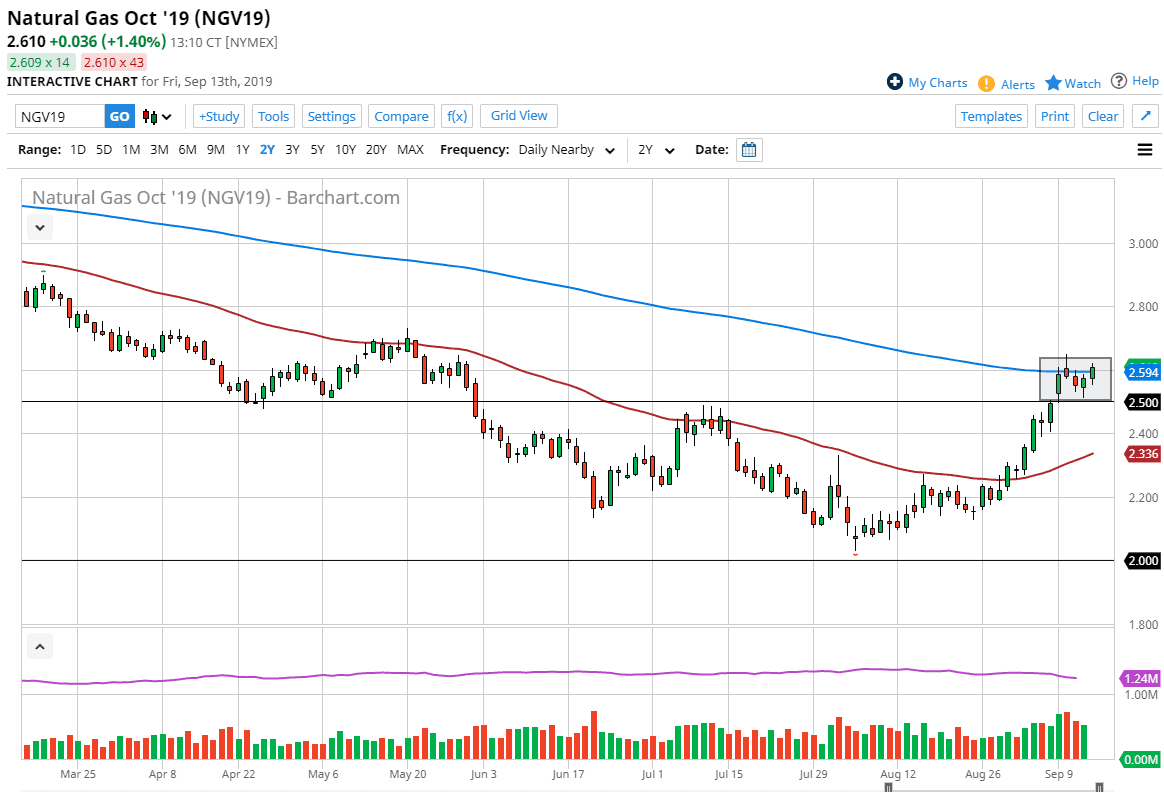

The natural gas markets initially pulled back a bit during the trading session on Friday but then turned around to reach towards the 200 day EMA yet again. At this point in time we are trying to figure out where were going to go next, and as we roll into the November contract, then we should start to see buyers jump in and take advantage of the winter demand that you normally get with natural gas. After all, the United States and Europe both will have a huge amount of demand for heating rather soon.

To the downside the $2.50 level looks to be supportive but I also recognize that the 50 day EMA underneath is probably going to be even more so. Short-term pullbacks should make good buying opportunities as we have clearly change the overall attitude of the market, as the demand will spike rather drastically. All things being equal,, the market could turn around and break above the shooting star as well, and if we break above that it’s likely that the momentum could push this market much higher as it would be the beginning of a significant break out.

In the short term, I think that the market simply bounces around in this area, trying to either digest the gains from the last couple of weeks, or perhaps starts to pull back before you can find support underneath and pick up a bit of value in what should have been a longer-term change in the overall attitude, and therefore it looks likely that we are just done finishing a huge bottoming pattern, which of course is the first sign of recovery. Longer-term, natural gas markets still have major problems with oversupply, but in the next couple of months we will start to see that supply burnt rather rapidly and storage emptied. However, there’s so much fracking going on in the United States that it won’t take long at all to replenish those supplies.

I would expect quite a bit of volatility and choppiness, but at the end of the day I am more of a buyer that seller. It comes down to whether or not we break above the top of the shooting star, or we look for pullbacks closer to the 50 day EMA that give us an opportunity to go long. This season of selling is already over.