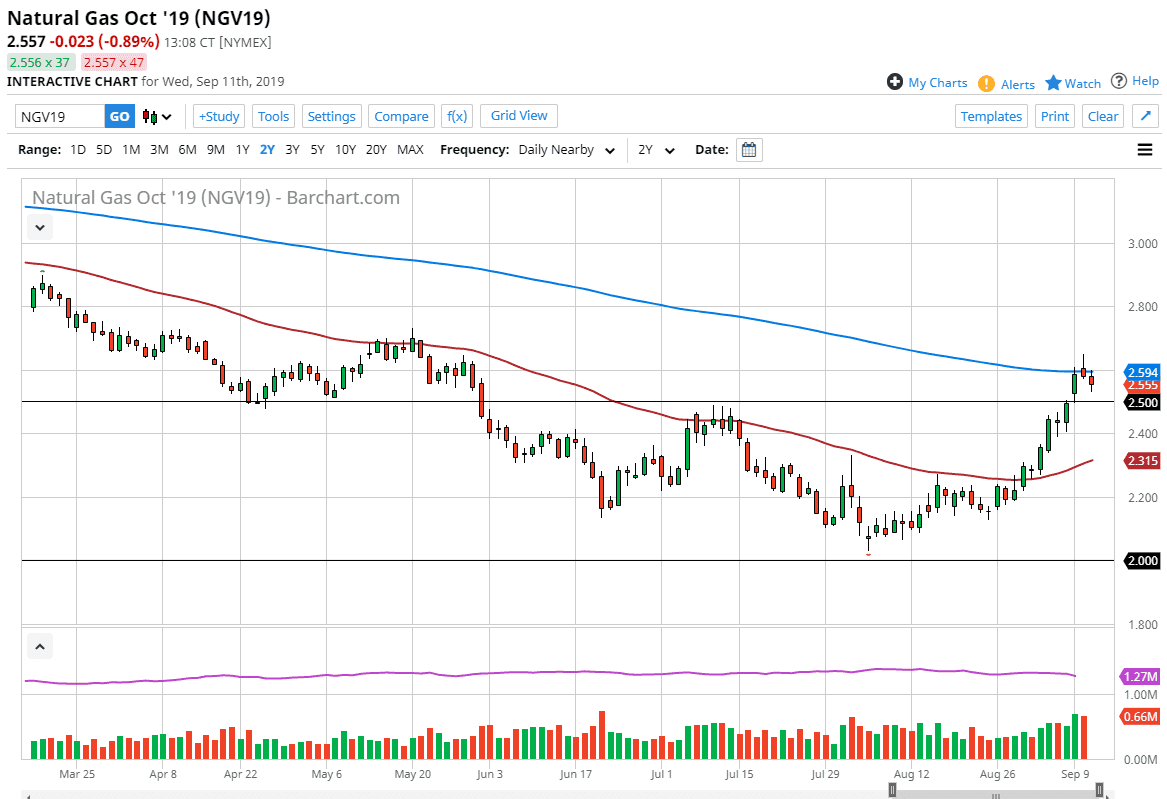

Natural gas markets pulled back a bit during the trading session on Wednesday, as the 200 day EMA has offered significant resistance during the day on Tuesday, forming a shooting star. However, we have the $2.50 level underneath offering support, so I think it is going to be a bit difficult to break down drastically. Nonetheless, we also have an inventory number coming out during the day so that of course can have a major influence on where this goes next.

All things been equal though it appears that we have broken through pretty significant resistance and it’s likely that we are going to see buyers come in and try to pick up bits of value on a pullback. I think the trend has change, at least between now and the early part of next year, as the natural gas markets do tend to do better in the colder months. It’s a bit early to get excited about the cold months in the United States or Europe, but at this point it seems to be that the market is simply looking for value after breakup. I would be cautious about trying to short this market, because even though I understand that the market is overextended, I think the easiest trade is going to be looking at lower levels for signs of a bounce or strength that we can take advantage of.

The 50 day EMA underneath is painted in red, and that should be massive support. If that support continues to hold, then it’s likely that we will see buyers jump in and try to take advantage of which should be thought of as value. Keep in mind that the move higher during the cold months the natural gas markets can go absolutely parabolic, but I think this movie is a little bit early for that seasonality. If we were to break down below the 50 day EMA, that would of course make this even more sloppy but right now I think the buyers are definitely starting to step in. The fact that it’s a bit hotter than usual during the last couple of weeks in the United States also helps with natural gas demand due to air conditioning. All things been equal though, I think simply waiting for dips and signs of support underneath will be the best trade going forward.