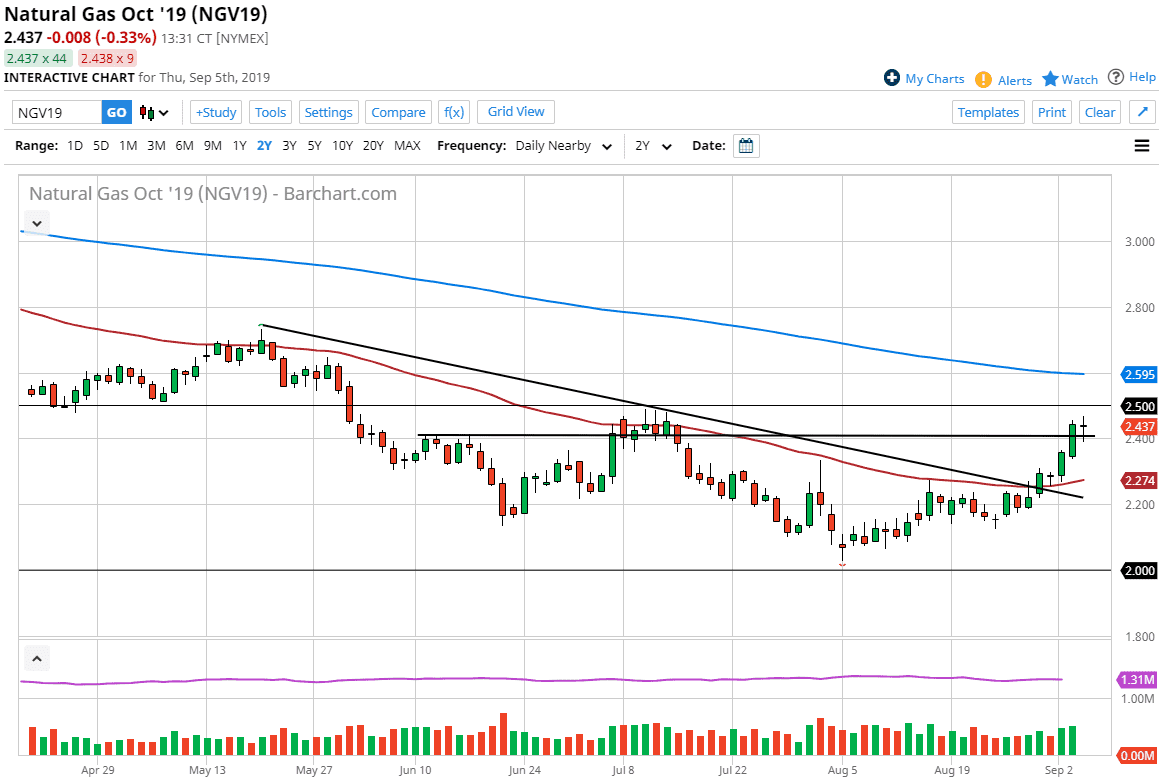

Natural gas markets have gone back and forth during the session on Thursday as we are starting to reach highs again. The $2.50 level will of course attract a lot of attention, as it is a large, round, psychologically significant figure. Beyond that fact, we have seen a lot of resistance just above, so keep in mind that it might be a little bit difficult to handle this market during the day on Friday, because we have the jobs number. That being the case, the close of course is going to be crucial, and at this point I think it’s only a matter time before we either break out or break back down.

To the downside, if we were to break below the bottom of the candle stick for the trading session on Thursday, it’s likely that we drop down towards the 50 day EMA on the chart which is maroon. To the upside, we need to clear that vital $2.50 level. If we get a daily close above there, we then will go towards the 200 day EMA above which is pictured in blue and at roughly $2.60. One thing is for sure, we are about to get a move so it’ll be interesting to see how the Friday session closes.

Ultimately, this is a market that is trying to change the overall trend, mainly because we are getting close towards the season that we see a lot more demand due to colder temperatures. We are currently trading the October contact, and as a result we aren’t quite there yet. However, we did see some bullish pressure due to the fact that hotter temperatures are expected in the United States in the short term.

There may have also been a little bit of a knock on effect due to the fact that the hurricane was heading towards the Gulf of Mexico but has since turned towards the Carolinas. With that being the case, now I think this was the beginning of the attempt to break out but there is a long bottoming pattern that we typically do every year. With that, I suspect we will probably pull back but there should be a longer-term buying opportunity closer to about $2.25 or perhaps even $2.20 underneath. It’s going to be choppy and messy, but that’s typical when you start to see the trend change overall. Once we start trading the November bath, then things will start to heat up again, at least for the short term.