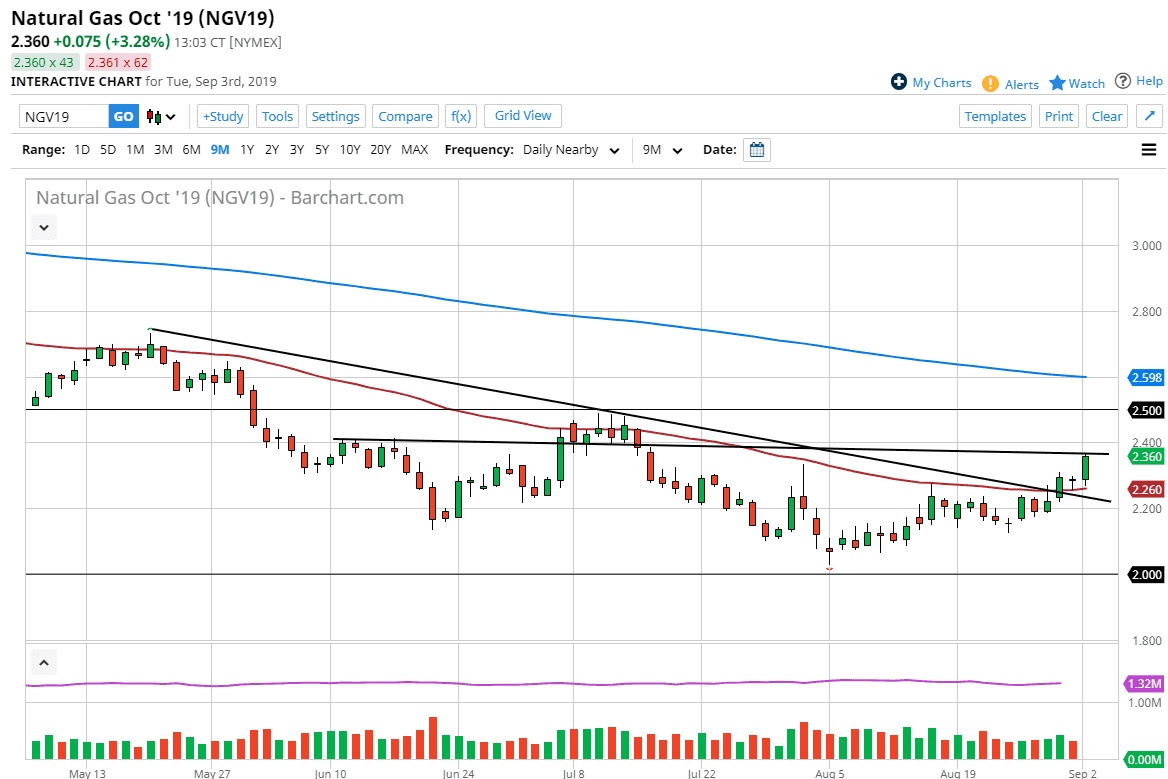

Natural gas markets have rallied quite significantly during the trading session on Tuesday, after initially pulling back to the 50 day EMA before bouncing towards the $2.35 level. This is an area that has been both support and resistance in the past but would not surprise me at all to see this market rally a bit from here. It’s significantly resisted all the way to the $2.50 level so don’t be surprised at all to see some type of exhaustion between here and there.

I think at this point we are more than likely going to see an exhaustive candle that leads to a pull back. It looks as if we are trying to build up some type of basing pattern in order to change the overall trend which would make sense considering that quite often we will do this heading into the cold months. As winter makes itself known in the United States and Europe, we will see demand for natural gas increased. This is a cyclical trade, as traders jump in and try to go much higher with the market. Having said that, the futures market is currently trading the October month, so while it is a little bit more bullish than September, the reality is we aren't quite to the cold months yet. What we see here is an attempt to build up that base for the surge a few weeks down the road.

Beyond that, part of the strength in the natural gas market probably was due to the hurricane hitting the southeastern part of the United States, which could have an effect on natural gas distribution and therefore drive down supply, albeit temporarily. At this point, the market is looking for a reason to go higher, but I think we will more than likely find exhaustion between here and the $2.50 level that can be sold for a quick profit, and then perhaps offer another buying opportunity closer to the 50 day EMA. If we break down through there, then we could go looking towards the $2.20 level, possibly even the $2.10 level after that. All things being equal, it’s difficult to imagine this market being easy to deal with but as we get closer to the cold weather, you start to have a viable reason to start buying. We aren’t quite there yet, but we certainly are starting to see the first vestiges of this.