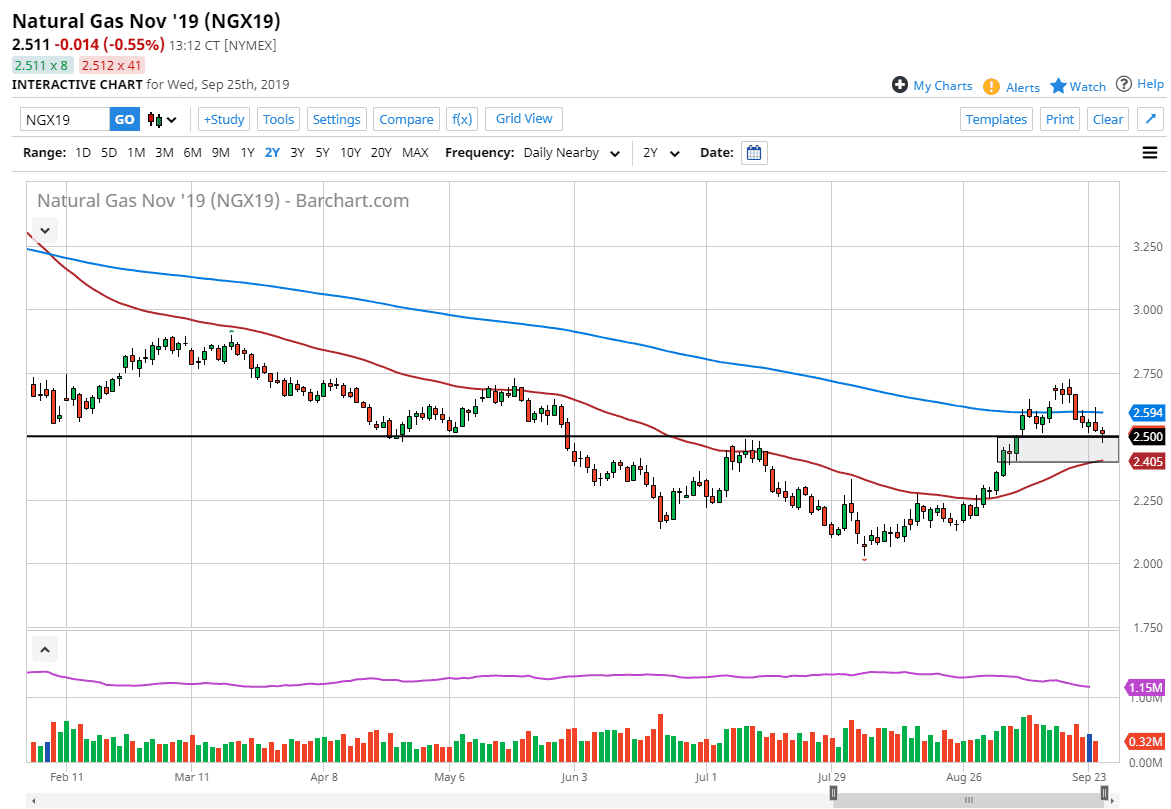

Natural gas markets initially pulled back during the trading session on Wednesday, breaking below the $2.50 level. That of course is an area that has a lot of interest attached to it as it is a large, round, psychologically significant figure. The area has offered both support and resistance over the past, so it makes quite a bit of sense that we dipped below it but then again found buyers underneath the turn things around and form a bit of a hammer like candle stick.

Just above, there is the 200 day EMA which is painted in blue at the $2.60 level, which offers quite a bit of resistance. That being broken to the upside probably sends this market going towards the $2.75 level, but ultimately this is a market that is starting to look towards the wintertime, which of course is the high demand season for natural gas to warm homes in the United States and Europe. Beyond that, the area below the $2.50 level could extend all the way down to the $2.40 level where the 50 day EMA currently sits.

There was also a bullish flag that broke to the upside, although it’s a bit of an ugly mess at the moment. That being said, if we can break above the 200 day EMA, then it’s likely that we can break above the inverted hammer that formed during the trading session on Tuesday, which would be another sign of breaking through resistance. Ultimately, I do think that we go towards the upside and start looking towards the next major round figure in the form of the $3.00 level. A break above there, then we are starting to look towards the $3.50 level given enough time.

To the downside, if we were to break down below the 50 day EMA it’s likely that the market goes down to the $2.25 level where there is a significant amount of support there as well. Even if that were to happen though, I would be looking for buying opportunities because quite frankly the seasonality should continue to come into play. Breaking above the $2.50 level was in fact a pretty big sign of bullish pressure, so I think it’s only a matter time before buyers come in to pick up this market and probably run it higher until the beginning of January when we start to look towards the spring.