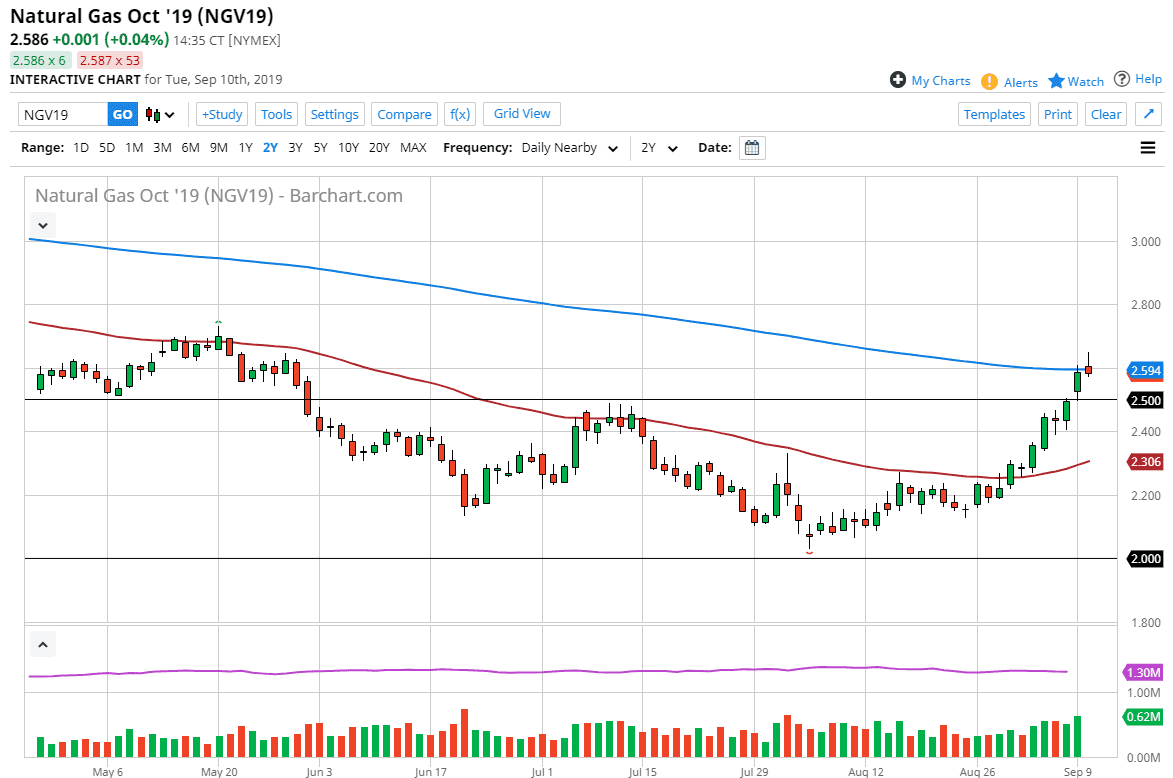

Natural gas markets initially tried to rally during the trading session on Tuesday, breaking towards the $2.65 level before finding selling again. At this point, the 200 day EMA has caused a bit of an issue, as you would expect in general. All things being equal, I would anticipate seeing a bit of a pullback from here as we gotten ahead of ourselves, but it looks to me as if in fact the “Winter bounce” he is in effect and it’s likely that we will continue to see natural gas rise over the longer-term, at least for the meantime. In the short term though, I would anticipate a little bit of a pullback as it would make more sense to see closer to the $2.50 level, possibly even the 50 day EMA underneath there, reaching towards that red indicator on the chart.

The shooting star suggests a bit of negativity, but I don’t necessarily think that this is the end of the uptrend. I think we have just seen the “first shot across the bow” by natural gas for the winter months. Typically, we will get something along the lines of a $2.00 gain, and then they sudden flush in January as soon as we start to focus on spring. Remember, one of the biggest drivers of natural gas Price will be heating demand in the United States, which of course picks up during that time of the year.

The alternate scenario is that we break above the top of the shooting star, which of course would be even more momentum to the upside. If we can break above there, then we go to the $2.80 level, and then possibly the $3.00 level but at this point I figure that it’s much easier to pull back and look for buyers at lower prices than to try to chase this market. This is a market that continues to be very noisy but ultimately I think we are looking at a scenario where we have turned the corner and now buyers will be waiting underneath to pick out and pick up bits of value. I will be especially interested in hammers closer to the 50 day EMA, or even the $2.40 level. There is plenty of reason to be patient and wait for this move, because once we take off for the winter, this will be explosive.