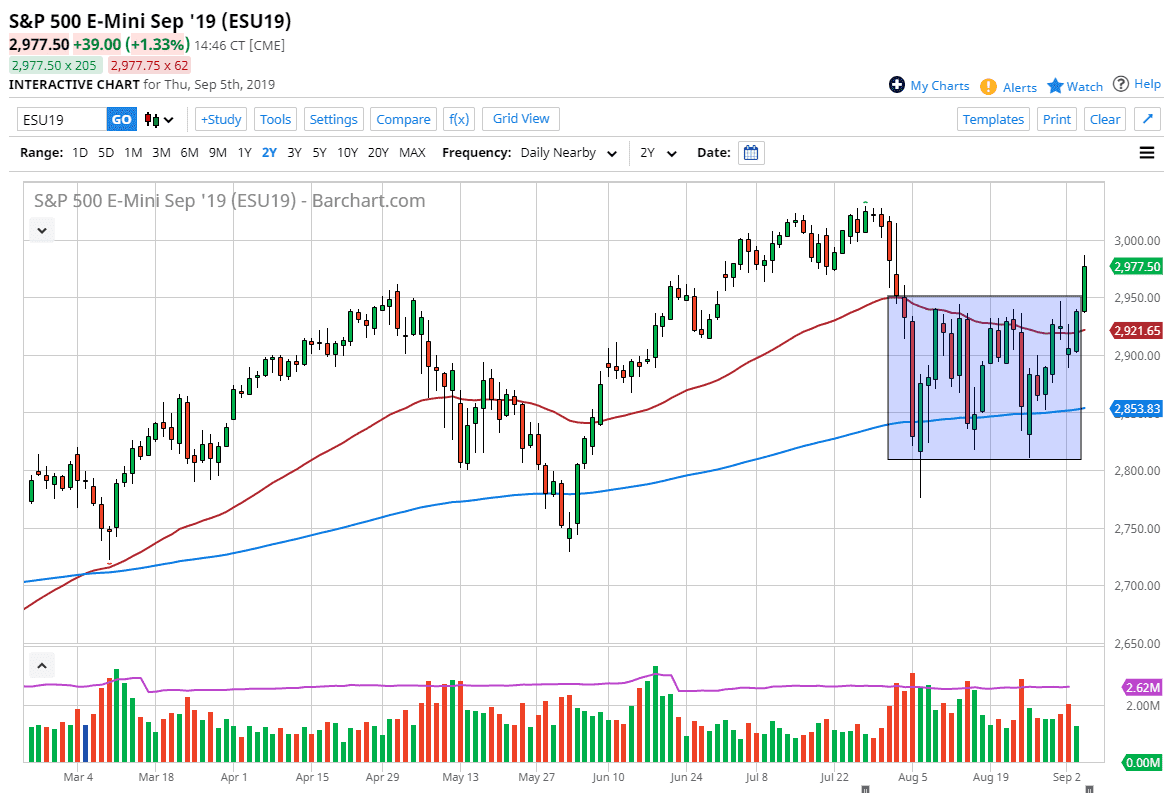

The S&P 500 has broken out during the trading session on Thursday, clearing the 2950 level. This was the top of the overall consolidation area that we been in, and the last couple of days have shown quite a bit of bullish pressure that we need to pay attention to. With that being the case it makes sense that we will which is starting to curl higher. That pullback should be a nice buying opportunity, and therefore I think that given enough time we should find some value, assuming that the market pulls back.

Looking at the chart, we had been in consolidation for quite some time, tightening up the range. It for the longest time, it look like we were ready to break down but at this point it’s very likely that we are ready to continue going higher because the market has been so tight. The 150 point range is finally broken, so it’s likely that the market could match that move. The measured move of course being 150 point suggests that we are going to go to the 3100 level.

If we were to pull back from here, the 50 day EMA is the first area where we could see some buyers, but even if we break down below there it’s likely that the 200 day EMA gets picked up down at the 2850 level. Ultimately, the market is likely to continue to favor the upside due to the fact that the United States and China talking again, but that’s a short-term boost higher. The next question of course is whether or not the Federal Reserve will continue to cut rates. We already pretty much count a 25 basis point rate, but the traders on Wall Street are hoping to see much more. I think at this point it’s going to be interesting to see how that plays out, because the central bank is essentially painted into a corner. If for some reason the Federal Reserve disappoints, you could have major problems in this market, as the stock market no longer has anything to do with the economy, but everything to do with monetary policy and monetary stimulus. This is been the case since 2008, and until things change it’s very likely that will continue to be the catalyst every time we move in one direction or the other for a bigger move.