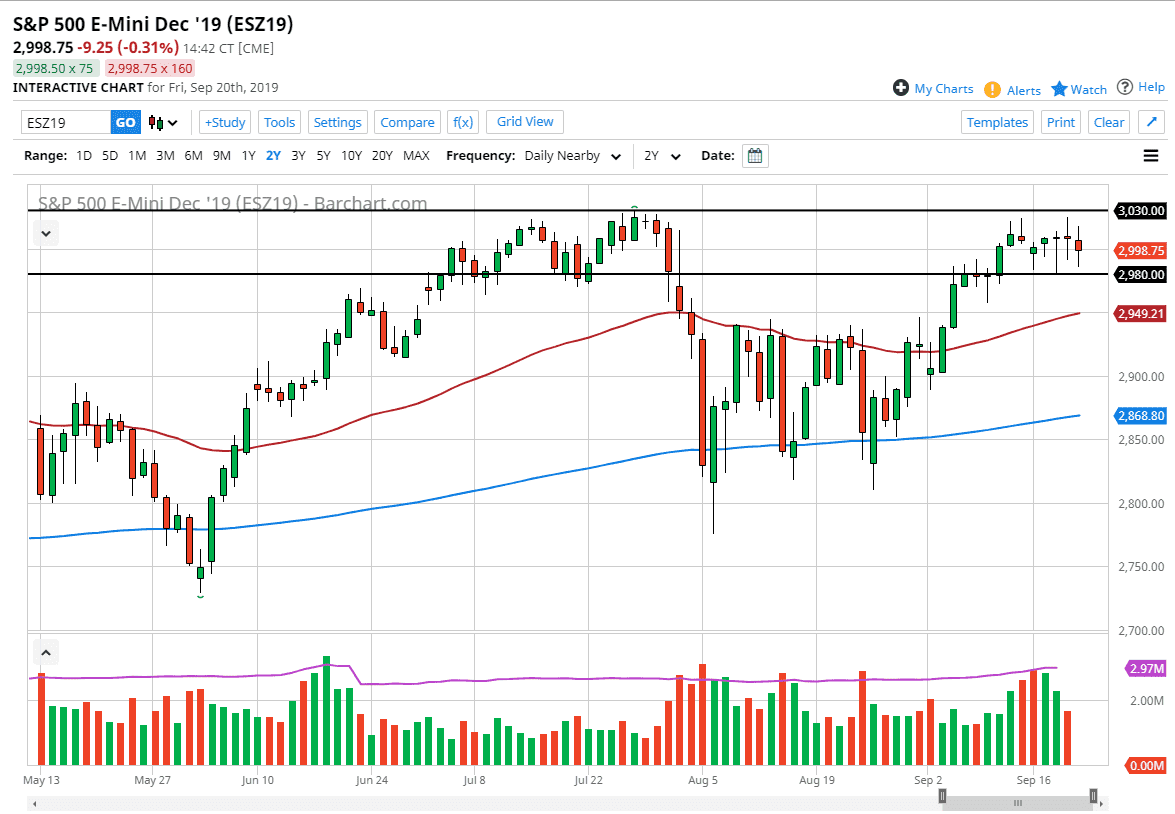

The S&P 500 has gone back and forth during what is known as “quadruple witching” on Friday, which is the expiration of four different types of options. This causes a lot of issues, so therefore it’s not a huge surprise to see the market unable to go anywhere. When you look at the overall week, there wasn’t much going on. This is a market that is currently stuck at this point, so it’s likely that the markets need some type of catalyst to go in one direction or the other. However, there is a couple of well-defined levels that we can pay attention to in order to take advantage of a particular move.

Looking at the 3030 level, it’s very likely that we will see a lot of resistance at that area as it was the recent high, so if we can break above there it’s likely that we could go higher. If we can break above that level, then it’s likely that the market can continue the overall uptrend, but one should pay attention to the fact that we previously had a massive rectangle underneath that measure for a move to the 3100 level, so that might be as far as this market goes, Lisa in the short term. Either way, it would be a bullish turn of events.

However, when you look at the support at the 2980 handle, it’s very likely that there should be a significant amount of support giving a chance for the market to bounce. If we break down below there then it opens up the market for a move down to the 50 day EMA, painted in red on the chart. A breakdown below that level should then be even more significant to the downside. We could open up a move to the 200 day EMA which is painted in blue. That being said though, this level of consolidation that we are in right now has held for a while so it’s likely that we will continue to bang around based upon the market waiting for some type of clarity, something that we just simply don’t have right now. Choppy and noisy intraday trading will probably continue to be a main feature here as the S&P 500 worries about the US/China trade relations, and of course central bank interventions along with geopolitical concerns. Quite frankly, there is plenty of noise for either direction.