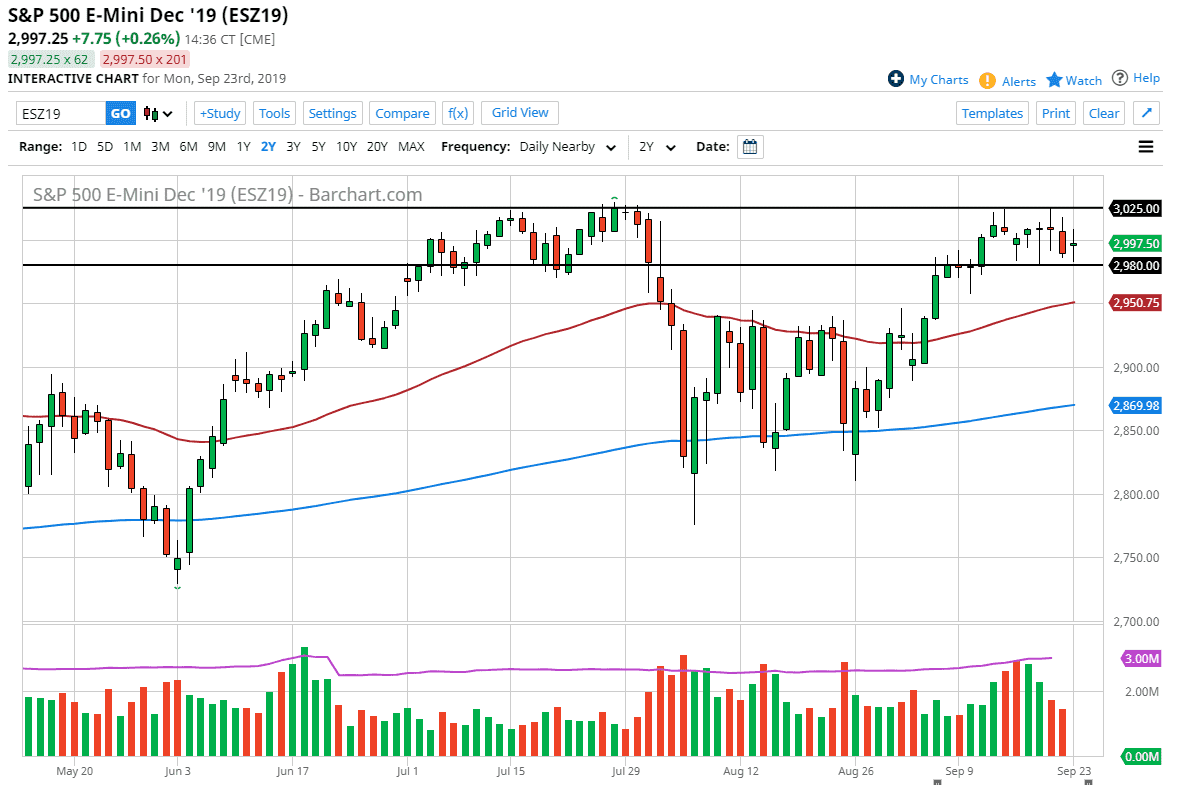

The S&P 500 went back and forth during the trading session on Monday to kick off the week as there still seems to be a lot of confusion around this market. Keep in mind that it is highly sensitive to the US/China trade situation, which is still a bit of a fluid matter. The market has been trading in a well-defined range of the last couple of weeks, so therefore I continue to use them as guidelines to navigate the market.

The 2980 level underneath is massive support, as it was previous resistance. That support level should continue to be important, and as long as we can stay above there you would have to lean to the side of buying more than anything else. To the upside though, the 3025 handle continues offer plenty of resistance. We are currently trading in that range and it has been relatively well-defined so shorter-term range bound system should continue to be the best way to navigate this marketplace. That being said though, if we can break above the 3025 handle, then the market is free to go to the roughly 3100 level, based upon the consolidation area underneath it we had broken out of a couple of weeks ago, and a potential top of an uptrend channel. In other words, there are plenty of reasons to think that although we could break out to the upside, it’s very likely that will take yet another catalyst to.

If we break out to the upside, then it’s just a simple continuation of the overall uptrend. However, if we were to break down through the 2980 handle, then the market could go looking towards the red 50 day EMA which is currently at the 2950 handle. Breaking down below there also opens up the door to the 200 day EMA, but it’s going to be very difficult to get down there. Expect a lot of choppiness, and I think it’s probably easier to simply trade short-term day trade type of set ups more than anything else but have more of an upward bias. All things being equal, this is a market that is at least trying to break out above the water line but doesn’t have enough momentum to quite do so at this point. Looking at this choppy chart, the question now is whether or not we are running out of momentum, because that will be the true tell.