The S&P 500 rallied again during the day on Friday as we continue to see strength in the market after the jobs number has been released. While it wasn’t necessarily a perfect announcement, it was close enough to the consensus number to make people happy, but just underneath that same consensus number, so it lends itself to more central bank easing, and that makes people much happier.

Remember, the S&P 500 has very little to do with the underlying economy, as the S&P 500 and stock markets in general have been trading right along with monetary policy in the United States and of course as a bit of a safety play for foreigners trying to avoid negative yield. The trend is higher, and the fact that we have broken to the upside it’s likely that there should be more people willing to come in and push this market higher and a bit of a “fear of missing out” type of trade.

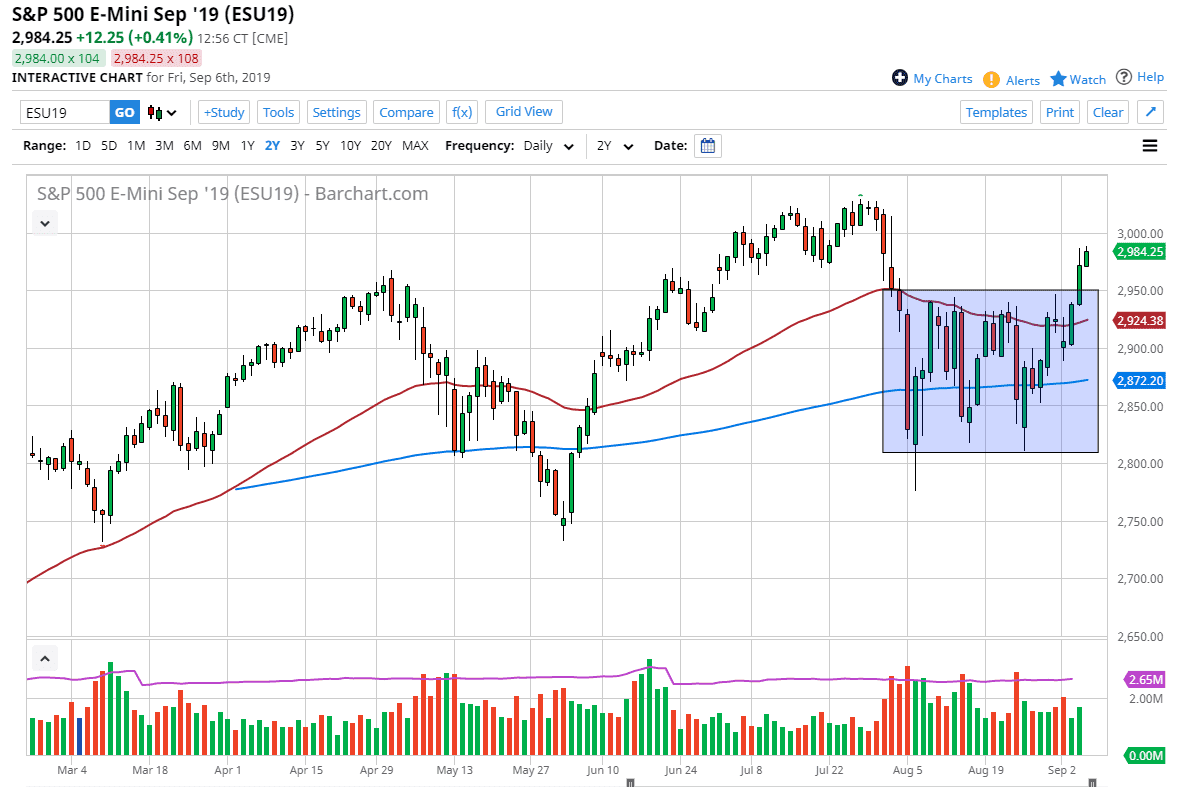

To the downside, I think that the 50 day EMA is going to continue to offer plenty of support, and at this point I don’t think it’s until we break down below the 2900 level that you begin to worry about the overall uptrend. The 200 day EMA is underneath as well, closer to the 2875 level, which would attract a lot of attention as well. All things being equal I think that the market will continue to attract buyers on dips simply because interest rates don’t offer much in the way of yield in the bond market, so money is being forced into the stock market. Granted, this is a huge distortion in the marketplace, but the reality is that the market has been distorted for well over a decade. Because of this, do not worry about economic conditions, but simply pay attention to the momentum. The market is going higher and even though I can give you 100 reasons why we shouldn’t, the reality is the Federal Reserve is willing to step in and help the market every time it dips. A lower interest rate will continue to be one of the main drivers of this market.

Looking at the consolidation area that we have just broken out of, it should be good for a 150 point move. At this point, it should send the market looking towards the 3100 level above, which obviously will have a certain amount of psychological importance as well.