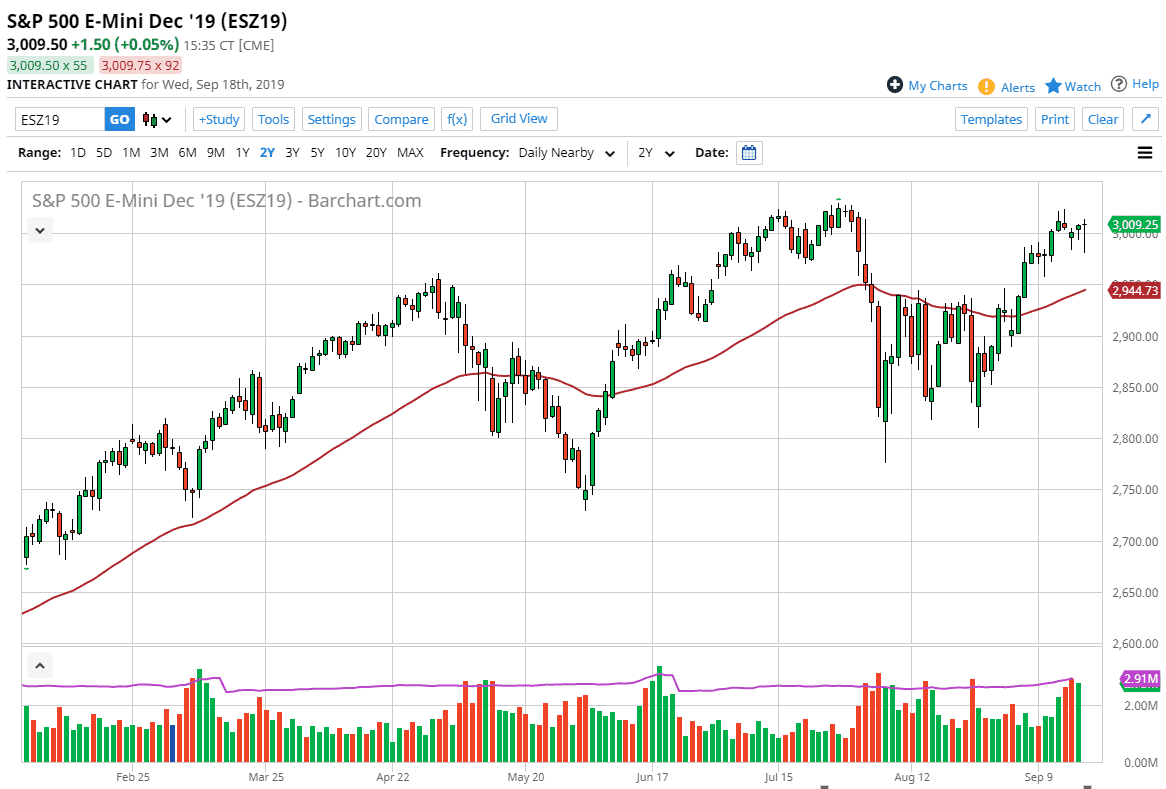

The S&P 500 fell during the trading session on Wednesday as the Federal Reserve had cut interest rates. By doing so, it looks as if the market is ready to go higher again, despite all the volatility. The candle stick for the day is a hammer, and that does suggest that we still have a lot of upward pressure ahead. With that being the case, if we can break above the highs, it’s likely that we could go much higher. To the downside, the bottom of the candle stick for the trading session is massive support. The 2980 handle underneath is essentially where that sits.

By forming the hammer like candle stick that sets up a potential trade, either to the upside or to the downside as a break below the bottom of it could’ve essentially formed a “hanging man.” If we can break above the 3030 level, then it extends to the overall bullish run that we had seen for quite some time. I believe at this point stock markets are going to continue to go higher based upon the way they closed, which of course is rather impressive.

The 50 day EMA underneath is starting to turn higher as well, reaching towards the 2950 level. At this, the 3000 level is also important to pay attention to as it will attract a certain amount of attention as well. Ultimately, I think it’s only a matter time before we find a reason to buy the market, and therefore I don’t necessarily want to short this market, but I do recognize that if we break down below the hammer, it’s likely that we would probably find quite a bit of support at that 50 day EMA. There is a lot of noise underneath though, that extends all the way down towards the 2800 level, and I think that the massive amount of noise underneath will continue to attract enough order flow to keep this market higher. In fact, if you squint you could make out a bit of a “W pattern”, so therefore it’s likely that most traders will be looking for the bullish pressure and of value on pullbacks. Ultimately, this is a market that seems to be attracting more money, and the fact that it reacted so well after the announcement tells me that we are going to go much higher.