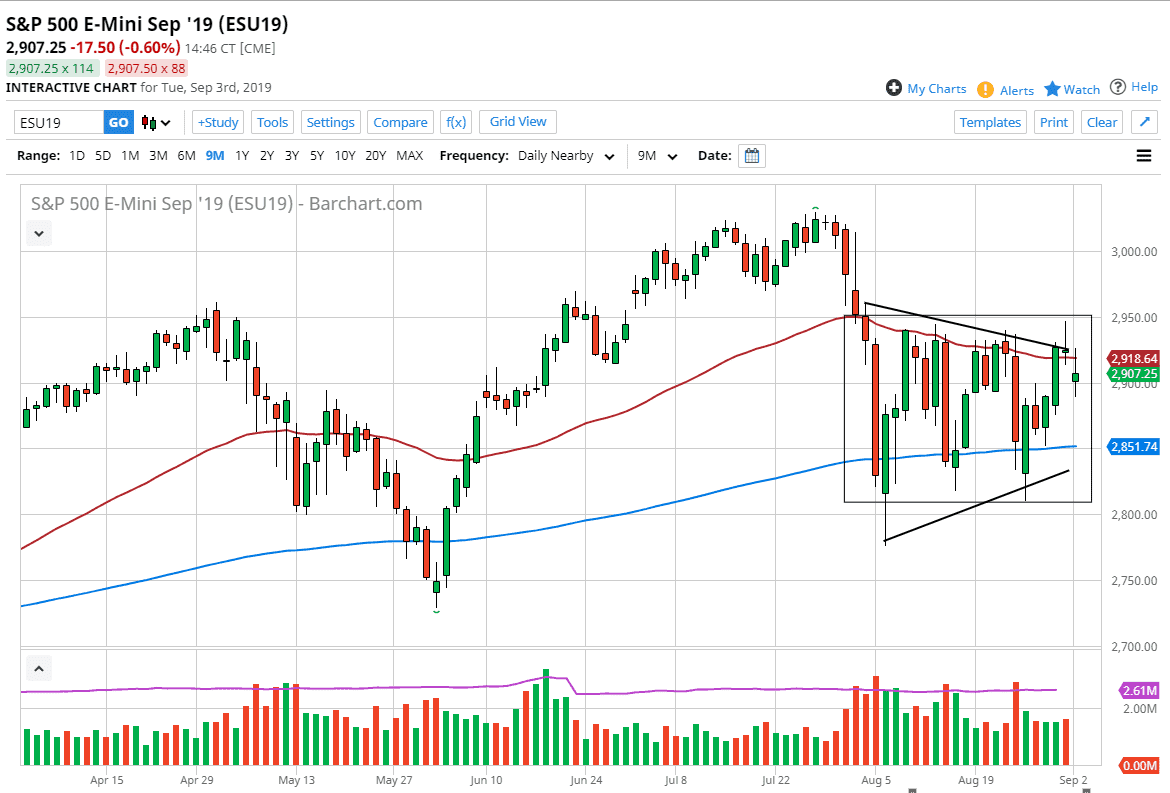

The S&P 500 gapped lower to kick off the trading session on Tuesday but then turned around to fill the gap rather quickly, only before we turn around and broke down. The 50 day EMA is slicing through this gap, and it shows that the market continues to consolidate in general. At this point, we are looking at the massive resistance hanging about the 2950 level, with the massive support underneath at the 2800 level. The 200 day EMA is currently sitting at the 2850 level, so there is a whole mess of reasons to think that the market could continue to go back and forth.

This is especially true considering all of the issues between the United States and China, and the global growth situation looking worse by the day. PMI numbers were a bit soft in the United States, and we still have no idea what the actual result of the terrible war will be. The market is likely to continue to see a lot of volatility in this area, but I think we’re going to tighten up in general. I think we continue to bounce around between the two EMA indicators on the chart, and as a result I think that the market goes sideways between now and Friday. By the time we get the close of the Friday session, then it’s very likely we could see some type of continuation in one direction or another.

At this point, there certainly are a lot of negative headlines out there just waiting to happen, so I do believe that it’s probably going to be easier to short this market than to buy it, but if we can break above the 2950 level, you simply can’t argue with that type of move. It would probably send this market towards the 3100 level, with of course the 3000 level causing major issues. To the downside, the 2800 level being broken could send this market much lower. Again though, between now and then it’s very likely that a range bound trading opportunity will present itself more than once and give us the opportunity to take advantage of both support and resistance at the EMAs on the chart. I would keep my position rather small, as the market will remain massively volatile. Unfortunately, it’s only going to take one Tweet to move this market rapidly as well.