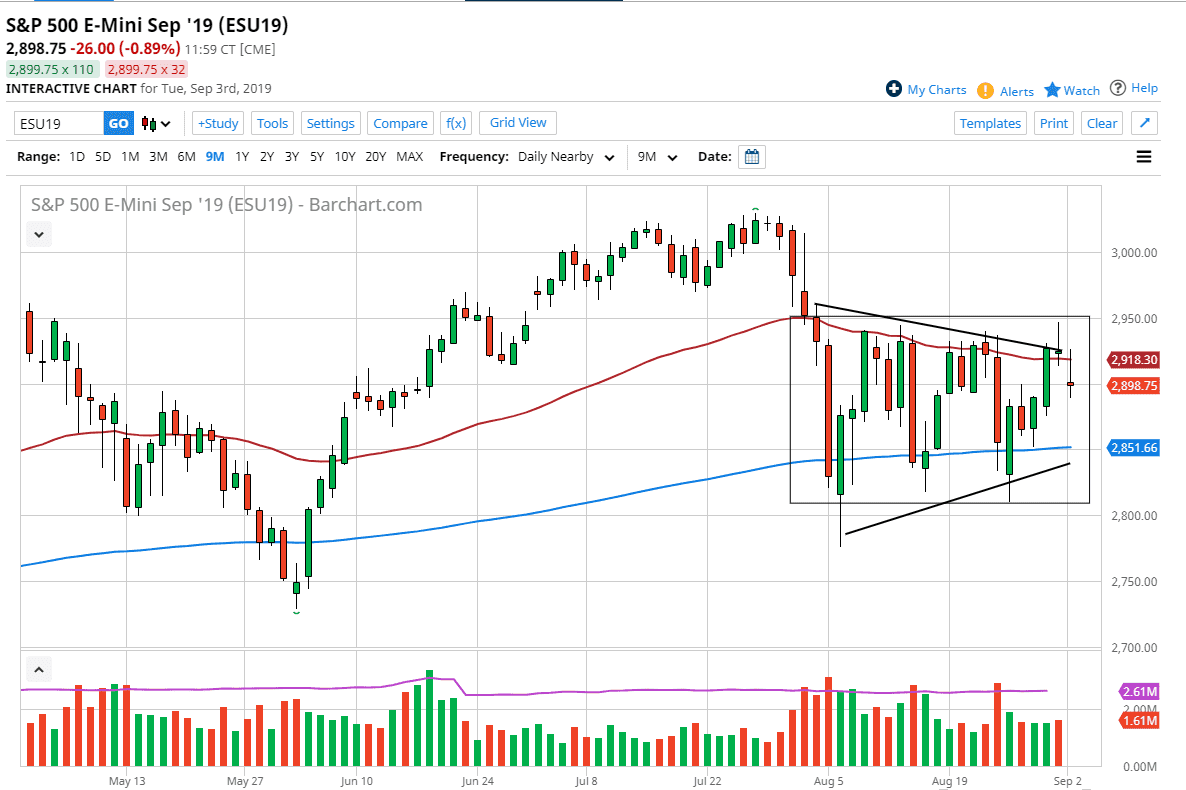

The S&P 500 gapped lower during the trading session on Monday, as we had thin electronic trading of the futures contract due to the fact that it was Labor Day in the United States. That being said though, as we gapped lower due to the US and China slapping tariffs on each other, we also turned around to fill that gap. Beyond that, we also have the 50 day EMA pressing that area, and as a result we fell right back down to form a bit of a shooting star like candle stick.

We have been trading back and forth between the 50 day EMA and the 200 day EMA. All things being equal, it’s likely that we continue to see a lot of back-and-forth. I think that as the jobs number continues to rear its head at the end of the week, it’s very likely that the market will be hesitant to go “all in” between now and then. Ultimately, I think at this point it’s very likely that the market will be very choppy and erratic, but at this point if we continue the downward pressure I think we go to the 2850 level. Beyond all of that, we also have a couple of trendlines that are starting to converge. Ultimately, this is a market that is going to be typing, but again I think it makes quite a bit of sense that we grind sideways between now and the Nonfarm Payroll announcement.

I believe that we also will eventually see some type of resolution to the situation, but we need to wait until the jobs number comes out to see the “true reaction” by most of Wall Street. However, I would say that it’s much easier to fall here then it is to rally just due to the fact that there are so many potential landmines out there waiting to go off. Having said all of that, if we did somehow get an agreement between the Americans and the Chinese, that could be the one thing that would send this market straight back up in the air, at least for the short term. Ultimately, this is a market that should continue to be erratic and noisy, and unfortunately based upon the latest headlines either coming out of Twitter, or Chinese media. In other words, although things have been quite difficult to deal with for some time, they're only about to get worse.