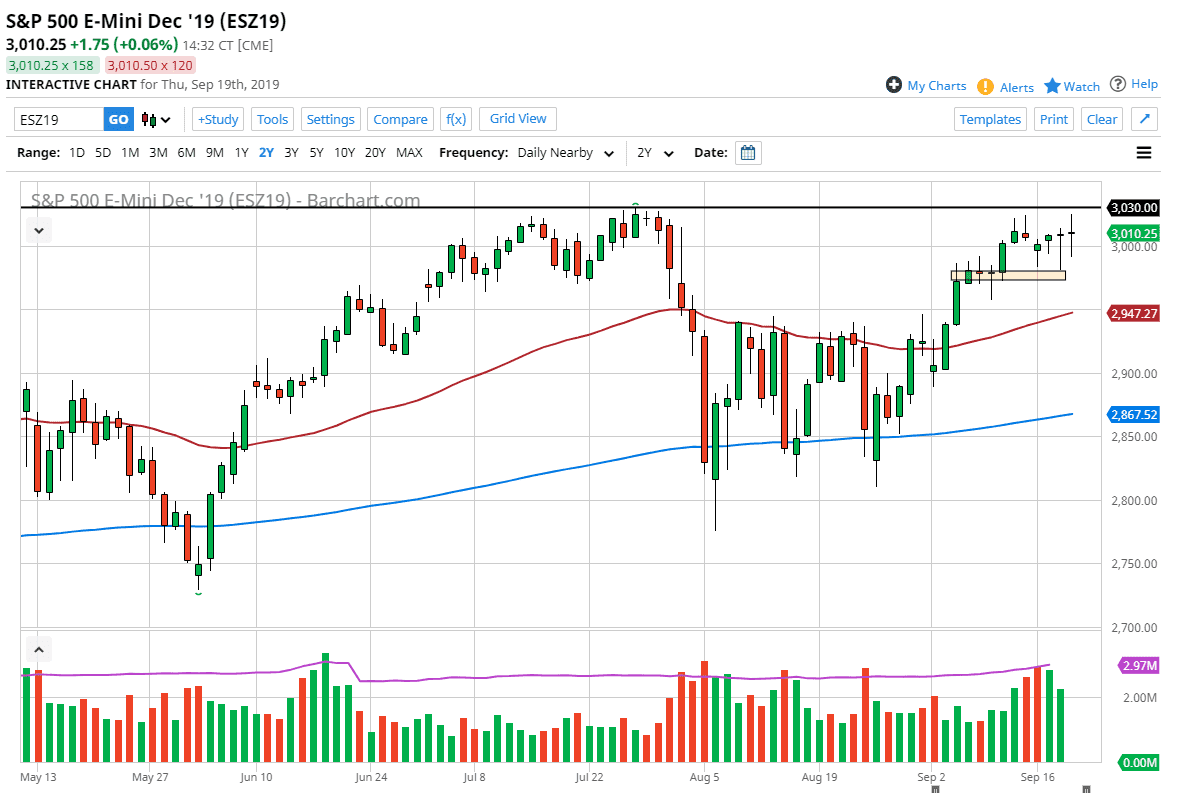

The S&P 500 is likely to flop around during the trading session on Friday, as it is what is known as a “quadruple witching day”, meaning that for different assets have options that are expiring. If that’s going to be the case, then you will have a lot of crosscurrents during the trading session and therefore price action won’t be able to be trusted. In fact, it would not be surprising at all to see the market try to break above the all-time highs, only to slam right back down in the range that we have been in all week.

The Federal Reserve cut interest rates the other day, and the Federal Reserve even suggested that they were willing to accommodate the market. Having said that, the market is still where it was and that tells me that there is a lot of conviction right now. To the downside, the 2950 level should offer support but the all-time high above the 3030 handle should offer resistance. I fully suspect that there is a good chance the markets will probably end up in this range by the end of the day, so the most likely outcome for trading the S&P 500 on Friday is going to be getting chopped up and losing your trading capital in the process.

Most prop shops that I have dealt with do very little on these sessions, and certainly longer-term traders look at them as a headache. There will be a lot of volume, but that shouldn’t be thought of as conviction. It simply people trying to defend strike prices on options which of course as some of the options are single stocks, it’s going to be interesting to see how that affects the indices such as the S&P 500. Remember, the S&P 500 is not an equal weighted index, so some stock option prices and even more importantly the defense of those prices are going to have much more significant weight on what happens during the day. As far as the stock indices in the United States are concerned, you may be better off starting in early weekend and waiting until it all fleshes out to see how things open up on Monday. That being said, we have been in a range for some time and it looks like we are going to stay here going into the weekend.