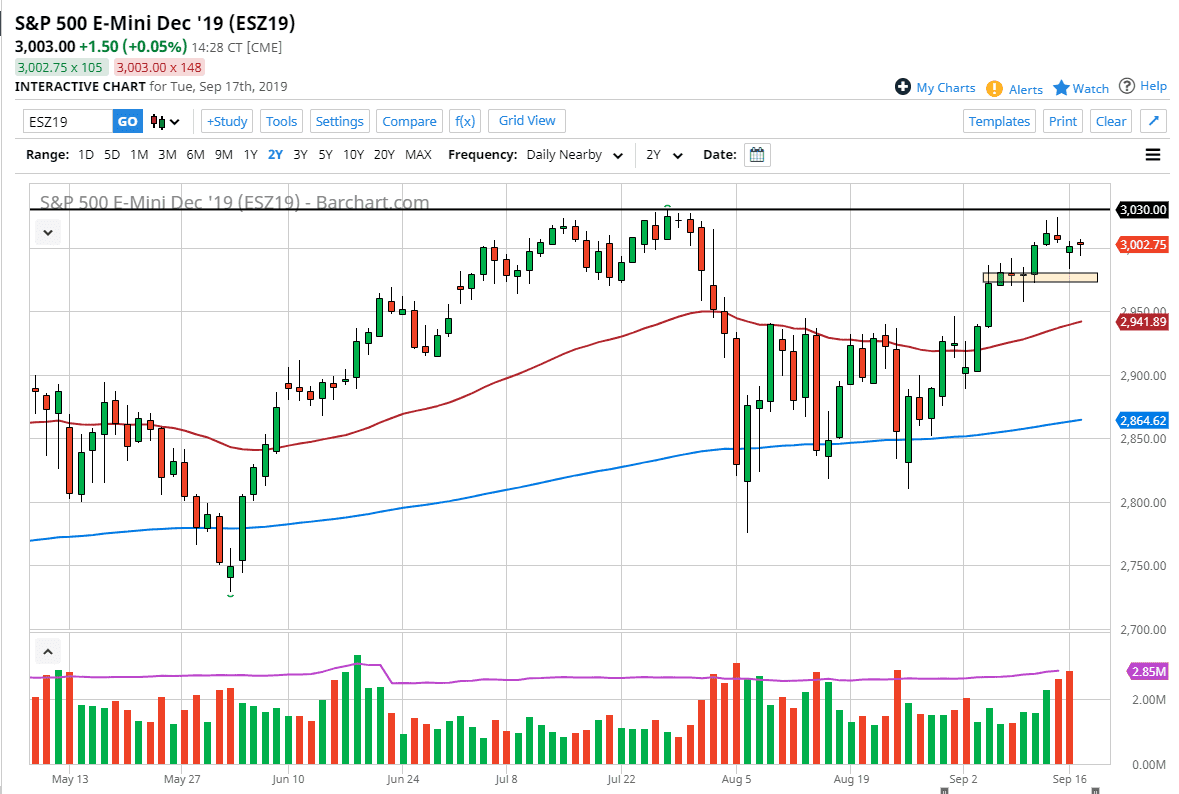

The S&P 500 is likely to bounce around during the Federal Reserve interest rate announcement on Wedsday, which will determine where we go next. Currently, we are bouncing between the 3030 level on the top and the 2980 level underneath. The candle stick for the Tuesday session is a bit of a hammer, and that of course shows signs of bullish pressure. At this point, it’s very likely that the market will start to edge its way higher, as market participants expect more monetary sugar coming out of the Federal Reserve.

Looking at the chart, if we were to break down below the 2980 handle, then the market could drop down to the 2950 level. The 50 day EMA underneath should offer plenty of support, so unless the Federal Reserve really messes everything up, it’s likely that we will see buyers on dips. Heading into the announcement and more importantly the press conference, it’s very likely that the markets will be very quiet, so I would not expect a lot of noise early in the day.

If we can break out to the upside, most likely due to massive quantitative easing, the 3030 level will be left behind and then should end up being support going forward. I have no interest in shorting this market, because there is a lot of order flow underneath and Jerome Powell has been taught by Wall Street to give them what they want. Every time he has been a little less dovish than needed, stock markets tanked. He certainly has learned this by now so it’s really difficult to imagine that the Federal Reserve will sound even remotely hawkish. However, we do have to include all scenarios, which could mean that this market sells off. I anticipate that the 200 day EMA which is painted in blue on the chart will end up being the bottom and the longer-term support going forward even if we do break down. With that in mind I’m looking for value, or a breakout and therefore am essentially “long only” at this point. That doesn’t mean that I would jump in right now, just that it’s the direction that I am looking at going forward. This is a market that is being held underneath a massive barrier, but there should be a massive amount of inertia thrown into the market during the announcement which could propel the S&P 500 much higher.