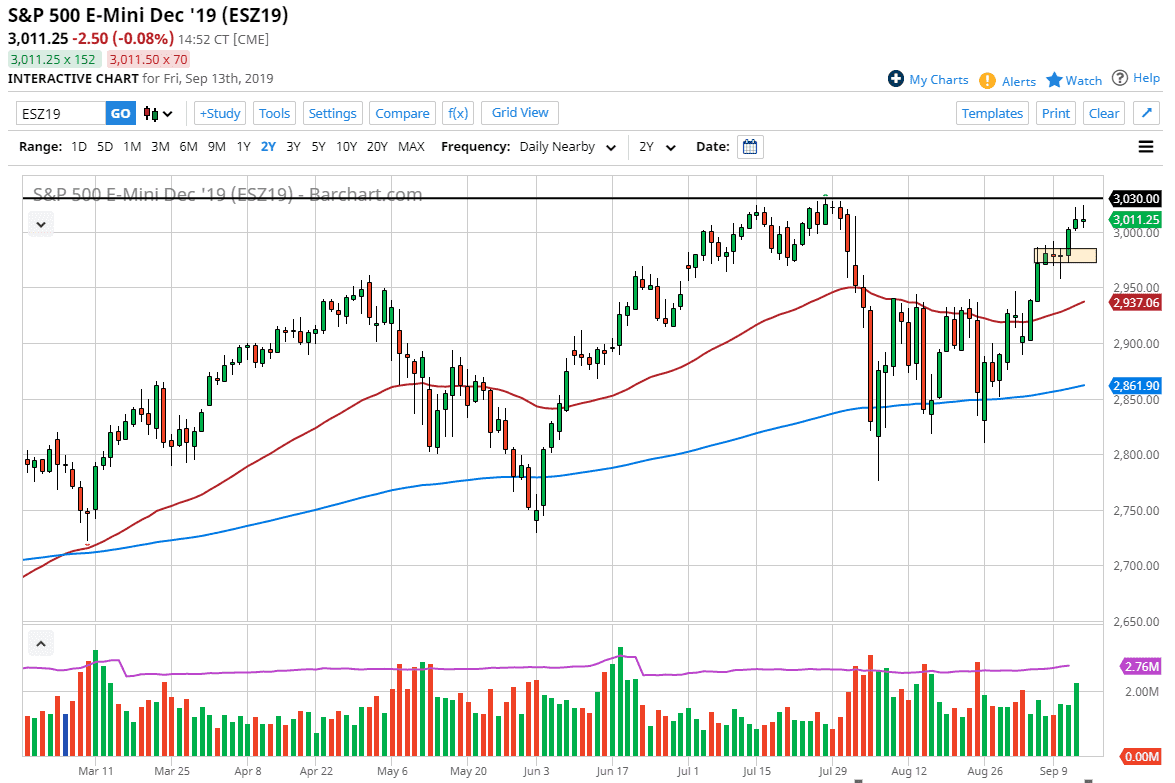

The S&P 500 initially tried to rally during the trading session on Friday but found enough resistance at the all-time highs to turn around and form a bit of a shooting star. This is obviously a very negative sign, so if we can break back below the 3000 handle I think we will probably go looking towards the 2980 level which was the next cluster underneath, and then possibly even the 2950 level. That being said, I think a short-term buying opportunity could present itself given enough time.

The alternate scenario is that the markets break to a fresh, new high which would show an impulsive leg to the upside, sending this market much higher. This could be based upon the US/China trade relations getting better, which they do appear to be. Beyond that we also have the Federal Reserve this week coming out with an interest rate statement and of course that could have a massive effect as to where we go next. This is a market that will continue to look at volatility as a hindrance, but eventually we will get that explosive move that we been looking for. While we have formed an exhaustive candle stick, the reality is that we are still very bullish as far as a trend is concerned, and to think that we would just simply slice through the highs without any resistance was probably asking far too much.

The measured move from the consolidation area underneath suggested that we could go as high as 3100, so I think that given enough time that’s exactly where we go, but not necessarily right away. I would anticipate that there is a lot of volatility ahead, but if you can take advantage of the dips, you could work out quite well in this market. With that, I remain bullish but I also recognize that we are not to jump in with both feet, so looking for a bit of value is probably the only way to go forward.

If we were to break down below the 50 day EMA, then the market probably drops towards the 200 day EMA where we would completely “reset.” That would be a very bearish move, but at this point I give that about a 10% chance as it seems like everybody’s willing to pick this market up based upon the latest headlines.