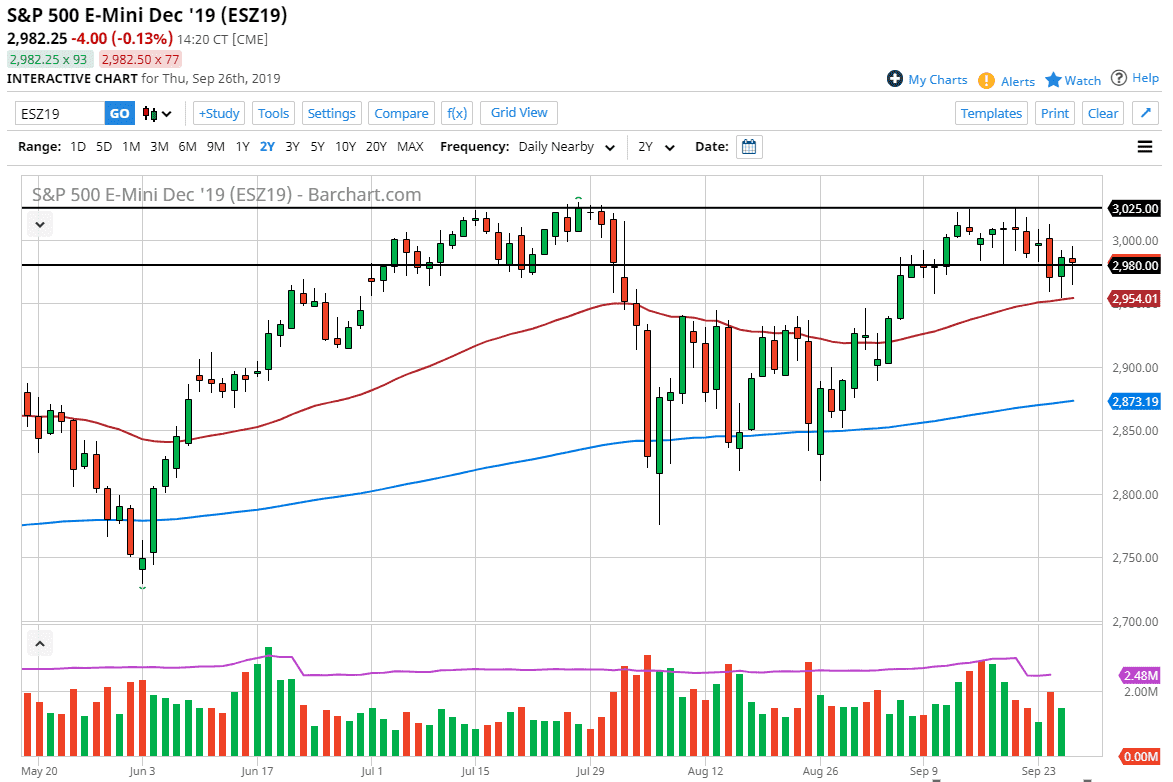

The S&P 500 is likely to bounce from here, suggesting that there is plenty of resiliency left in the marketplace. That being said, there is also the 50 day EMA underneath that should offer quite a bit of support as well. Overall, this is a market that continues to show signs of resiliency and likelihood of going higher. The market breaking above the top of the day, or roughly the 3000 handle, should send the S&P 500 looking towards the all-time highs yet again.

To the downside, the 50 day EMA continues to offer support, and if we were to break down below there it’s likely that we would face a whole mess of noise all the way down to the 200 day EMA. The intraday volatility is only going to get worse from this point, as we continue to see a lot of political drama unfold in the United States. The market has a lot to worry about, not the least of which will be the nonsense coming out of Congress and the president, along with global slowdowns, a stronger US dollar, and of course whole host of other sideline issues. All things been equal though, the market continues to show a lot of resiliency do so at this point one has to believe that the buyers are going to continue to be aggressive. Now that we have formed a shooting star again, it’s likely that we continue to go higher. To the downside, if we were to break below the 50 day EMA then I will simply wait for the market to “reset” so that I can pick up value.

To the upside, if we can break above the 3025 level it’s likely that we continue to go higher, perhaps reaching towards the 3050 handle, and then eventually the 3100 level based upon the consolidation that we had seen previously and the measured move. That being said though, the 50 day EMA is obviously being paid attention to, and that’s probably the most important thing to pay attention to. I’m looking for short-term pullbacks to take advantage of, but I would not hang onto trades for very long. This continues to be back and forth with an upward slant. Do expect a big move is probably asking a lot, and at this point ultimately short-term trading is all this is good for.