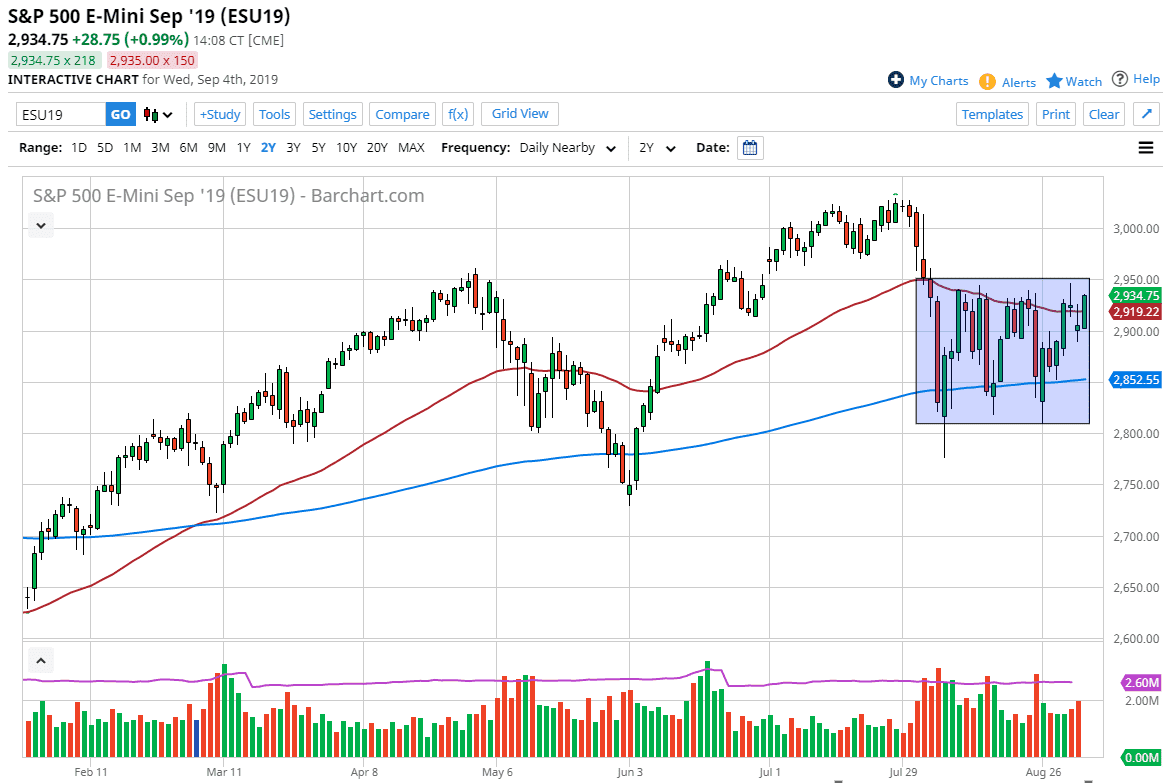

The S&P 500 has rallied again during the trading session on Wednesday to fill the gap that we opened up on Tuesday. Because of this, it looks as if the market is trying to figure out whether or not happy days are here again or whatever. We have been testing the 2950 level for some time and if we can break above there it’s obviously a very bullish sign. I think at that point, the market is likely to go to the 3050 level, but I don’t know if it happens before the jobs number. That would obviously be a bit of a tall order, but it would obviously be telling as well.

Because of this, I think that the market will more than likely continue to find plenty of reasons to chop around between now and the jobs figure with an attempt to break out. That being said, we also have massive support underneath at the 2800 level that holds the market in place. This has been a very difficult market to deal with, and I just don’t see it getting any better. Because of this, I choose to keep my position size small and recognize that we are only one Tweet or headline away from the whole thing falling apart again.

I don’t think that there are many headlines that could send this market higher for a longer period of time though, because we’ve had plenty of “Hopium” tweets about a trade deal, none of which have come to fruition. Having said that, the market will only be fooled so many times. However, that negative headlines still affect the market the way they used too. That’s something worth noting.

It has been a very bullish run during the Wednesday session though, so it’ll be interesting to see whether there is any follow-through. If there is, that would be a very strong sign indeed, and could send buyers into this market hand over fist. What I don’t like about this rally is that it accompanied a bond rally, and one of the markets is clearly wrong. It’s very rare you can get both a bond in a stock market rally, so that’s something to pay quite a bit of attention to as it could be the beginning of something kind of difficult. Regardless though, by the time we are done with the jobs number and into next week, we should start to get some clarity.