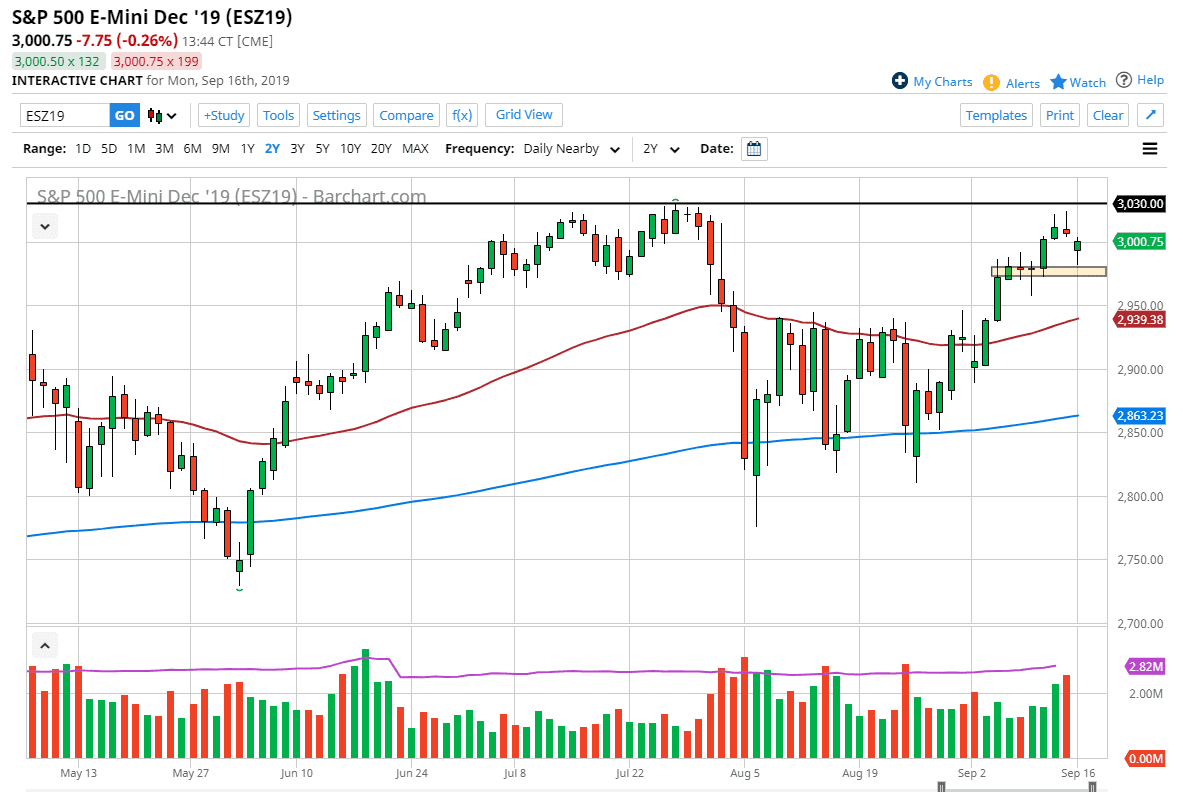

The S&P 500 gapped lower to kick off the trading week on Monday after the Saudi drone attack. That being the case, we fell all the way down to the closest support level at the 2980 handle before bouncing again towards the 3000 handle. We ended up forming a nice hammer though, and it looks as if we are ready to bounce from here and perhaps try to test the highs yet again. The nice thing about this scenario is that we have a couple of clear levels that we should be watching.

Looking at the 2980 handle, if we were to break down through there it would be a very negative sign and probably have the market looking towards the 2950 level, perhaps even the 50 day EMA after that. It wouldn’t be too hard to imagine a scenario where that could happen, because the situation between the Iranians and the Americans are only going to get negative headlines out there at this point, and that could cause people to be a bit concerned. However, we also have the Federal Reserve this week and if they are easy enough it’s possible that the market may rally again and try to go towards the 3030 level.

If we can break above the 3003 level, then it’s very likely that the market could go much higher, and continue the longer-term uptrend that we had been in. The market continues to be very volatile, as there are moving pieces all over the board. We have the concerns in the Middle East, we have the trade tensions between the United States and China, we have various geopolitical situations, and as a result there is a lot of noise out there to chew through. Beyond that, economic numbers aren’t necessarily the greatest at this point, so it’s possible that we continue to see just a lot of noisy sloppy trading in this general vicinity. It is because of this that we need to find some type of smaller position that we can take advantage of or simply day trade. I am still bullish and I do think that the market continues to go higher eventually but obviously we have some work to do to finally break out. The alternate scenario is that we break down below the 50 day EMA and then start going towards the 200 day EMA, probably on even more bad news.