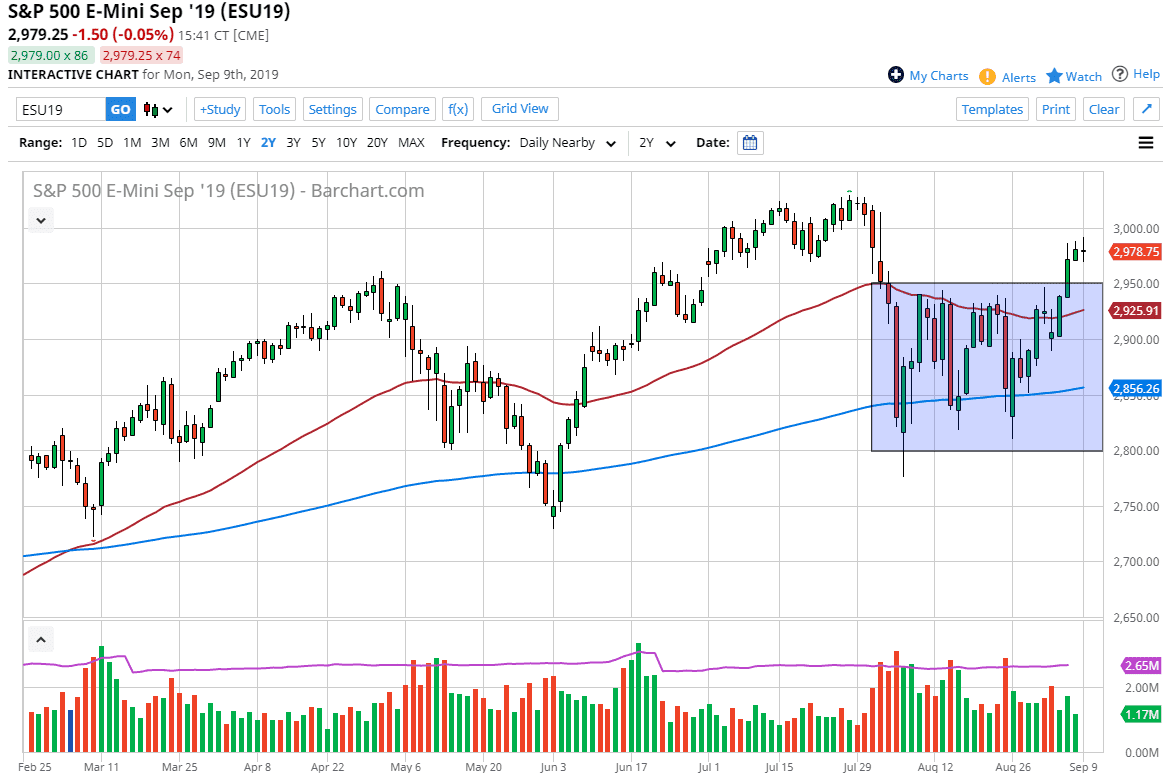

The S&P 500 went back and forth during the trading session on Monday, as traders came back from the weekend. At this point, we had recently broken above a major resistance barrier in the consolidative box that I have drawn on the chart. The 2950 level was major resistance, and now that we are above there it should be a major support. That being said though, the Monday session didn’t exactly bring in a lot of confidence at this point. The 3000 handle above continues to offer a lot of psychological resistance as well, so I think we may see a little bit of a pullback in order to find value underneath. At this point, the 2950 level should be an area where buyers may be interested in this market.

Below there, we have the 50 day EMA painted in red that is starting to turn higher. Ultimately, this is an area that if it gets broken to the downside would be very bearish. This market is still a very erratic situation, and I think at this point it’s likely that the overall volatility continues. there are a whole litany of problems out there that will work against the stock market, and I think most of what we will see could be based upon central bank intervention and liquidity. Because of this, I believe that we continue to see the Federal Reserve dictate what happens in the stock market. As long as they are willing to keep the taps open, Wall Street will continue to buy stocks. If they look a bit hawkish, then we will see the S&P 500 break down drastically.

Remember, the S&P 500 has absolutely nothing to do with the economy, and more to do with liquidity. This has been the case since 2008, as it’s all been a “race to the bottom” when it comes to quantitative easing. When you get free or cheap money to buy back stocks as a corporation, then it makes quite a bit of sense to come into the marketplace and start buying. This is a pretty scary proposition, but it is the market we find ourselves in. Ultimately, I look at short-term pullbacks as a potential buying opportunity but I have an eye on the 50 day EMA underneath as being crucial to keep above.