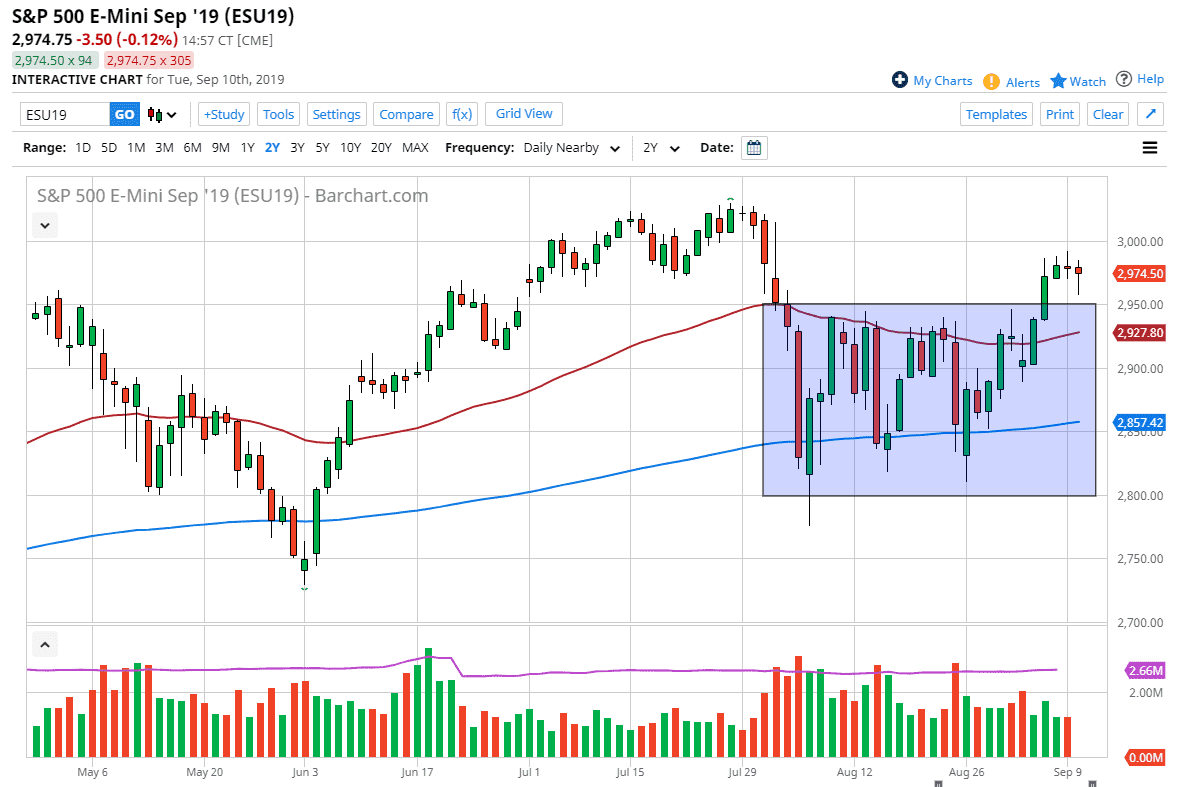

The S&P 500 fell immediately during the trading session on Wednesday, only to find buyers below at the top of the recent consolidation that we have just broken out of. By doing so we ended up forming a hammer and therefore it looks as if the buyers are back. This is based upon central bank liquidity and not necessarily anything fundamental. It was essentially an unchanged day, but it could have been very negative so it looks as if the sellers don’t have the wherewithal to hang onto short positions which means by its very nature we need to go higher.

The ECB will be easing monetary policy this week, and of course the Federal Reserve will be doing so shortly as well. That’s all stocks care about at this point, so that gives you an idea as to which direction we are going. Based upon the consolidation area that we have just broken out of, we should be looking for a move towards the 3100 level, which is the longer-term target. I don’t think it happens overnight, and I certainly think that it will be very choppy and difficult between here and there but certainly that’s the direction we are going.

The 50 day EMA underneath is starting to turn a bit higher, so keep in mind that should come into play as well, so I think at this point it’s very likely that we are going to see buyers step into this market on dips to take advantage of momentum. This is a pure momentum play, and not necessarily one that is based upon anything other than that. Looking at this chart, I think that we see a lot of volatility above just waiting to happen, so keep that in mind. I would keep my position size very small, but one thing that I have noticed during the day is that the volatility is getting worse, as the volumes are getting thinner. Computers are trading against each other so therefore it does behoove you to stay in a position either longer-term or scalp the market. I don’t think there’s any in between at this point, so if you can put on a small enough position to take out a 100 point stop loss, you might be able to buy this market is simply ride out all of the choppiness. If not, you are relegated to buying short-term pullbacks for short-term gains.