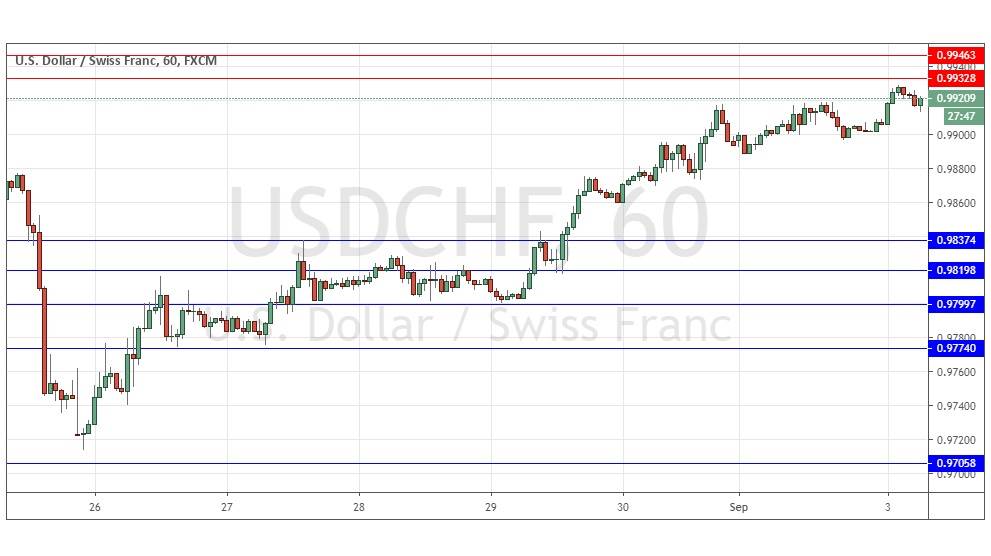

USDCHF Analysis: Short-term bullish trend topping out?

Yesterday’s signals were not triggered, as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.50%.

Trades may only be entered between 8am and 5pm London time today.

Short Trade Ideas

Short entry following a bearish price action reversal upon the next touch of 0.9933 or 0.9946.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following a bullish price action reversal upon the next touch of 0.9837.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that although the short-term was showing some bullish momentum, it looked unreliable, so I wanted to stand aside from trading this pair.

The price actually rose over the course of yesterday but appears to be topping out near the resistance levels which is close by, so there may be a chance for a short trade today if we get a solid bearish reversal there after London opens.

The CHF is acting as a European currency today and not as a safe haven, i.e. it is falling as the Brexit endgame gets underway, along with the Pound and the Euro. This means there could be knock-on volatile movement later in this pair.

I have no directional bias, but I see a short trade from the nearby resistance levels as a potentially good trade entry opportunity. There is nothing of high importance due today concerning the CHF. Regarding the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.

There is nothing of high importance due today concerning the CHF. Regarding the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.