In the United States, there is a long running joke when the stock market suddenly rally based upon liquidity that “everything is awesome”, which is a reference to the song out of the Lego movie. We have essentially seen that during the trading session on Tuesday, as money flew into the marketplace late in the day due to the expectation of low interest rates. That puts a decidedly “risk on” attitude into the marketplace in that typically will have money running away from the Japanese yen. All things being equal though, the question then becomes whether or not the central banks around the world are cutting rates for a good reason or not, which I suspect the answer is that the latter of the two.

After all, if you have a strong economy in the United States, then why would you need to cut interest rates? That of course is the kicker here, as the economy is “fine”, and growing at a roughly normal situation, but there are significant concerns out there and that has me concerned. After all, with the employment market stronger than it’s been since the 1960s, it’s difficult to imagine a scenario where cutting rates makes a lot of sense for the longer-term. After all, what happens if something bad comes about? The Federal Reserve will have that much less in the way of ability to fight it.

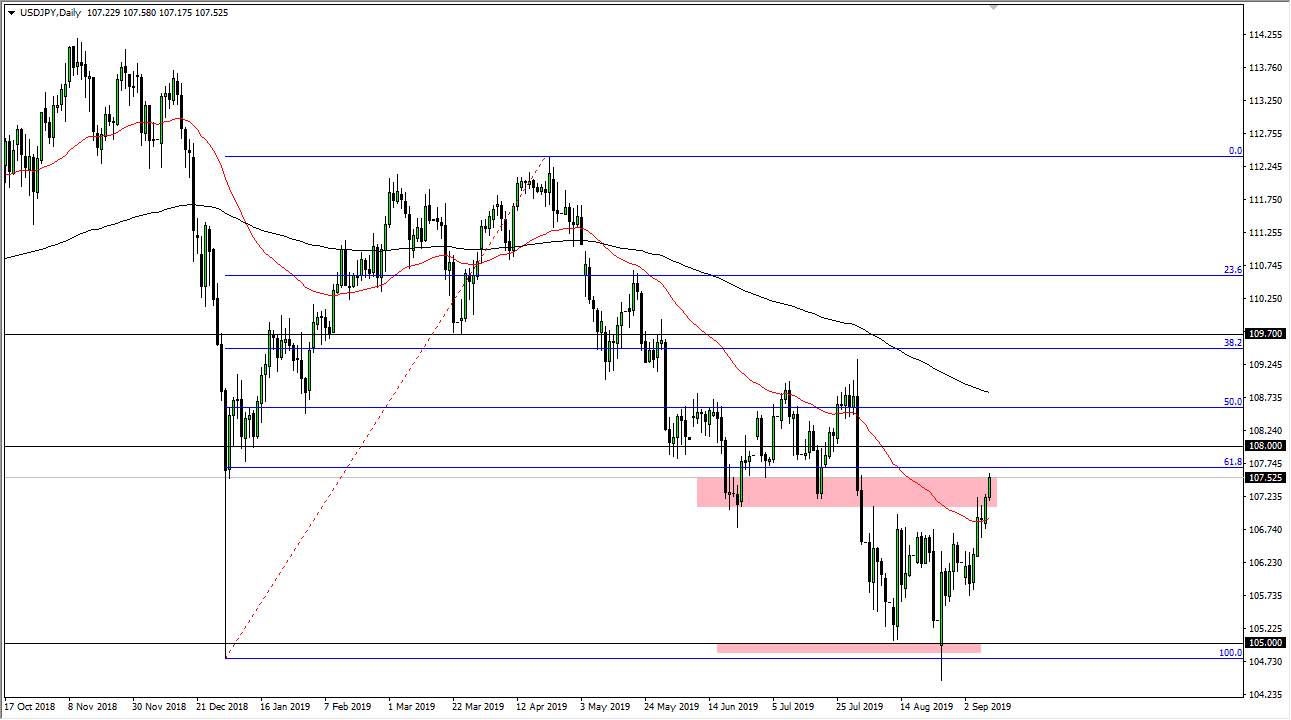

It wasn’t that long ago we were talking about several interest rate hikes over the year, and now all the sudden things have completely turned around. It’s only a matter of time before the Japanese yen gets back in vogue, and I think the first barrier could be the ¥108 level, if not the 200 day EMA above there. At this point, I think it’s a bit of a short-term rally and therefore short-term buying can be done but I would not get married to the position anytime soon as trouble is probably just around the corner.

After saying all of that, it probably comes down to a Tweet or some type of headline out of Beijing that will slap this thing straight back down. After all, most traders these days have to follow Twitter, as the machines do and place trading decisions based upon that. All things being equal, it looks like short-term we are bullish, only to run into trouble above.