The US dollar gapped lower to kick off the week as traders have the ability to react to the Saturday drone strike in Saudi Arabia. Obviously, the pair was reacting to the overall risk appetite, which makes quite a bit of sense as the Japanese yen is considered to be the “safest currency” available. This pair does tend to move right along with the risk appetite around the world, which sometimes coincides quite nicely with the S&P 500. In fact, I quite often use the S&P 500 as a secondary indicator

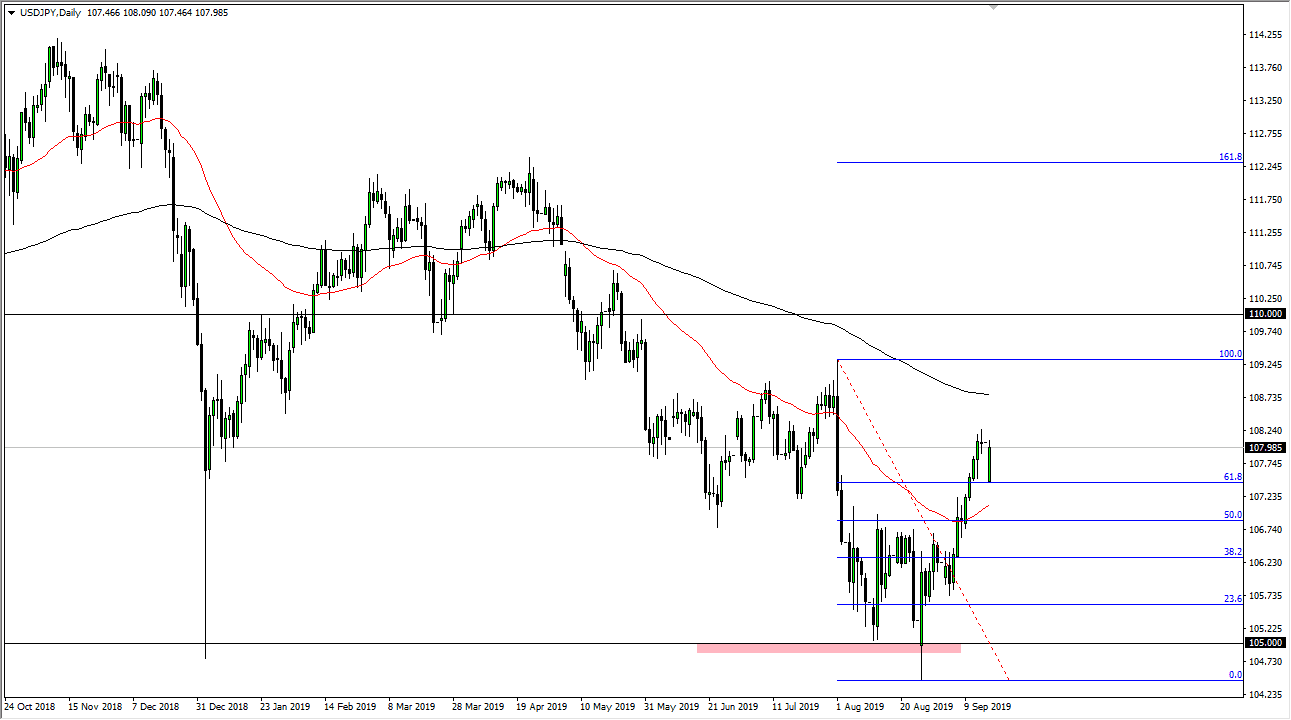

We have bounced significantly to fill that gap, so the question now is whether or not we can continue to go higher? If we do, and break above the ¥108.25 level, it’s likely that we will go looking towards the 200 day EMA after that. Alternately, if we were to roll over and show signs of weakness, perhaps losing the ¥108 handle significantly, then the market is set to drop down towards the ¥107 level. All things being equal, this is a very fluid situation in the Middle East, so it’s difficult to imagine it being very easy to trade in the short term. That being said, we have been in a longer-term downtrend so as long as we stay below the 200 day EMA one would have to assume that the sellers would eventually take over again.

There’s also saber rattling coming out of the United States blaming the attack on coming from the Iranian desert, and that of course could cause quite a bit of trouble. Ultimately, the market breaking above the 200 day EMA would in fact send this market towards the ¥110 level, possibly even higher than that. Remember though, this is going to be based upon the overall risk appetite around the world so obviously the headlines will continue to be a major driver in this pair, probably nothing to do with the actual economies in the United States or Japan.

As we close out the Monday session I do have to admit that things have calmed down quite a bit, so that of course is a good sign for the possibility of continuing higher move in this market. However, we are simply one Tweet or headline away from rolling right back over and shooting straight down. The most important thing you can do is keep your position size relatively small and your stop loss orders intact.