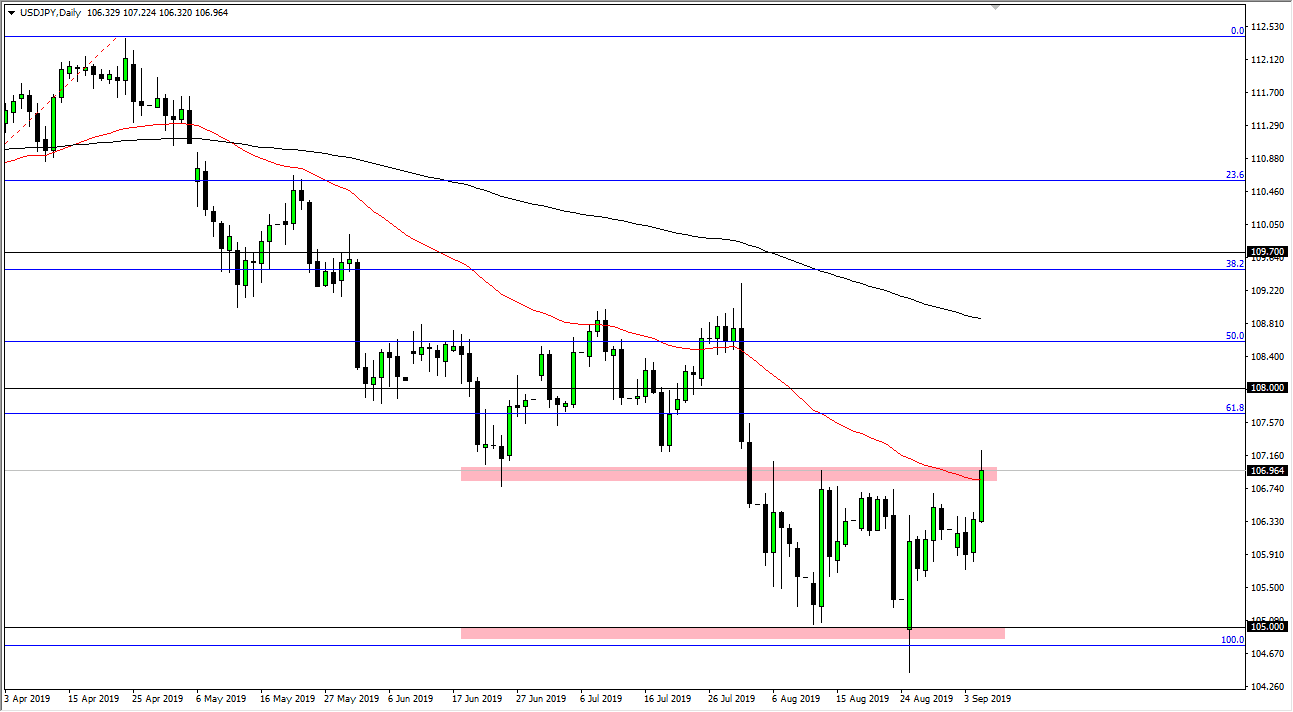

The US dollar has rallied significantly during the trading session on Thursday, reaching above the 50 day EMA before pulling back a bit at the end of the New York session. At this point, the 50 day EMA is starting to offer a bit of resistance, but perhaps more importantly we are seeing the ¥107 level offer resistance. The reason this is important is because it has been the top of the range that we had been stuck in.

To the downside, we have the ¥105 level which causes quite a bit of support. We have been in this 200 point range for some time, but I’m the first person to suggest that perhaps we are trying to see a “W pattern” formed. If that’s going to be the case, then we could break towards the top of the day that the market break down, perhaps reaching towards the ¥109 level. Remember, this pair is extraordinarily sensitive to the jobs number so I believe that by the time the day is all said and done we should figure out whether this was a “W pattern” or just the top of more consolidation. We should find this out rather quickly, and then we can act upon it.

At this point in time the 50 day EMA does suggest that perhaps sellers will come in but obviously if we get a huge “risk on” move after the jobs figure, and it’s likely that the market will rally as it tends to do. Obviously, if we have a major shock or disappointment, we could see a massive “risk off” move in that could send this market back towards the ¥105 level. Ultimately, I think this pair is trying to find a bottom but remember it has a lot to do with risk appetite. The market likely will continue to see a lot of volatility as the world is moving at lightspeed these days. I anticipate that small positions are probably necessary, and perhaps an eye on the short-term chart is probably where you should be trading from. Longer-term, it is worth noting that as long as there is more of a “risk off” attitude of the world, there is always going to be the opportunity to break lower, which could be very sharp and sudden due to headlines or God forbid some type of Tweet.