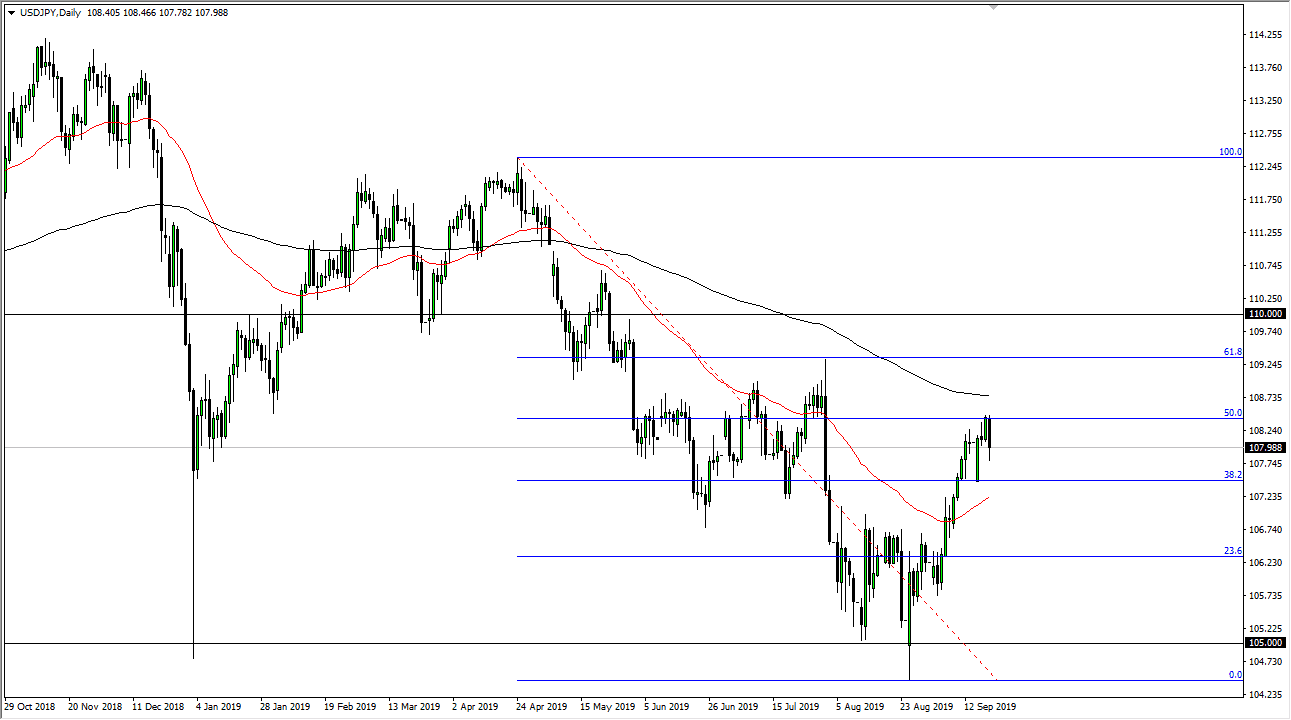

The US dollar fell during the trading session against the Japanese yen on Thursday as we had finally got a bit of an answer to the question of whether or not the 50% Fibonacci retracement level would cause problems. Beyond that, the 200 day is just above but we did get a little bit of a bounce later in the day that shows it’s at least going to be a bit of a fight. With that in mind it’s very likely that the 50% Fibonacci retracement level is attracting a lot of attention, and we could drop down from there.

If you look to the left you can see a massive breakdown candle stick that extends all the way to the 61.8% Fibonacci retracement level from July. That is the candle that I’m using as a proxy for the entire resistance barrier that we find ourselves in. In other words, it’s not until we break above the top of the candle that I’m impressed because I recognize how much noise there could be there and all we need is some type of headline or “risk off catalyst” to push this market back down. After all, the Japanese yen is the safety currency for most traders.

If we do break from here, the ¥107 level is the initial target, followed by the ¥105 level. Beyond that, there are some pundits out there that are looking for this pair to drop down to the ¥100 level, which might be a little bit rich for my liking, but I can see the argument for it as all it would take is some type of blowup between the Americans and the Chinese when it comes to the trade war, something that could very well be a real threat at any moment.

The alternate scenario is that we close above the 61.8% Fibonacci retracement level because it then typically means you are going to go to the 100% Fibonacci retracement level, which in this case would have USD/JPY trading at the ¥1.1250 level. That would be a rather significant move and would probably need really good economic news or a major “risk on” type of situation. At this point, the most likely scenario to cause that would be the US/China trade relations, which of course have been exhausting to try to trade around so it really would need some type of finalize deal or concrete plan.