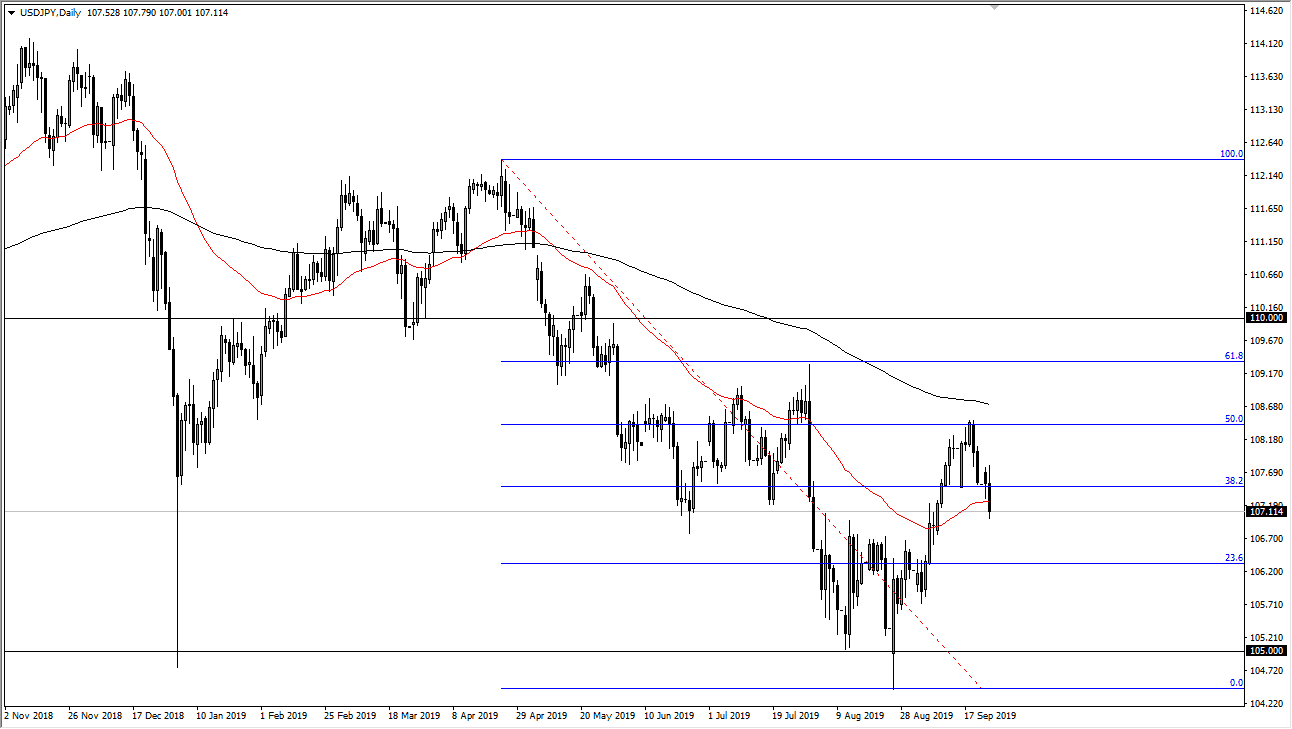

The US dollar has initially tried to rally during the trading session on Tuesday but then broke down to reach towards the ¥170 level. We have sliced through the 50 day EMA which of course is a negative turn of events, but at this point it’s very likely that we still have a bit of momentum to the downside as well. It will be interesting to see how this plays out, as this is a risk appetite based currency pair. By pulling back the way we have, and especially from the 50% Fibonacci retracement level, it makes quite a bit of sense that we continue to go lower.

To the upside, the 200 day EMA sitting just above 50% Fibonacci retracement level will of course offer plenty of resistance. That’s an area where I would expect see a lot of selling pressure even if we do rally, and at this point it looks like we are going to continue to see the type of negativity that suggests there is a significant “risk off” flavor to the markets in general. With that being the case, short-term rally should continue to be the opportunity to start selling again as the US dollar isn’t as “safe” as the Japanese yen.

The ¥105 level underneath is a major barrier, where we have bounced from, with the 0% Fibonacci retracement level just underneath the ¥105 level. At this point, if the market were to break above the 200 day EMA, it’s likely that the pair will go looking towards the ¥110 level. At this point in time it’s likely that the market has gotten a bit exhausted and it does need to return back to where it once was, just a few weeks ago. There are plenty of geopolitical issues out there to send the market lower as well and let us not forget that the US/China trade situation is a major issue as well, with the problems in Asian markets continuing to drive monetary flow as well. With that, expect a lot of choppiness but certainly a significant amount of negativity as there is without a doubt going to be major problems around the world and should continue to be. This doesn’t mean that it will be an easy move lower, but clearly the downtrend is still very strong, and likely to be building up pressure at this point.