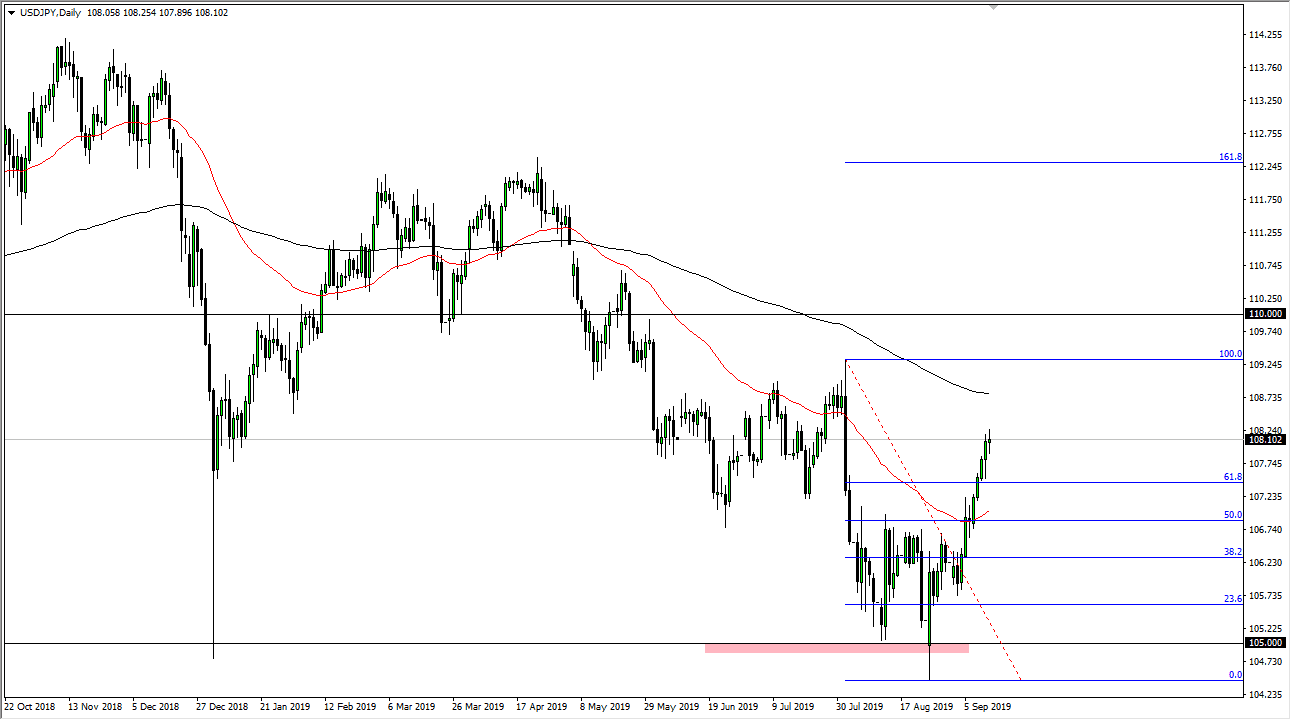

The US dollar has rallied significantly over the last couple of weeks but stalled a bit during the day on Friday as the ¥108 level seems to be a bit important at this point, and at this juncture it’s likely that we need to pullback in order to build up any momentum anyway. However, above the ¥108 level we have the 200 day EMA which also could be a target. Any signs of exhaustion in that area is a selling opportunity, just as a break down below the Thursday candle would also be a selling opportunity, at least for the short term.

The ¥107 level is a target that should continue to be attractive, as it was previous resistance. This pair is probably going to move right along with the S&P 500 which is a bit overextended at the moment and trying to break out. If the S&P 500 were to run out of steam at this point, it’s likely that the USD/JPY pair would follow right along with it. We are parabolic so it is overdue. It’s now a matter of whether or not we can break down below that candle from Thursday, or if we need to rally towards the 200 day EMA before selling off again.

If the US and China come to some type of longer-term agreement then we should send this market much higher but I don’t think that happens in the short term. It’s been a nice bounce, but I still believe that it is still just that, a bounce. All things being equal I don’t believe that this market can continue the way it’s gone, so at the very least they need to send it back lower to collect a bit of momentum, even if the buyers were to take over completely.

Expect a lot of volatility and choppiness, because nobody knows what’s going to happen next. Unfortunately, the Japanese yen is a “safety currency”, which has a lot to do with what happens next, so a Tweet involving the US/China trade relations could send this market higher or lower, depending on the attitude. In other words, you will need to be very cautious about your trading of the Japanese yen, but clearly it is pretty much driven by that reason only. Momentum is slowing down and that of course is one of the most important things to pay attention to.