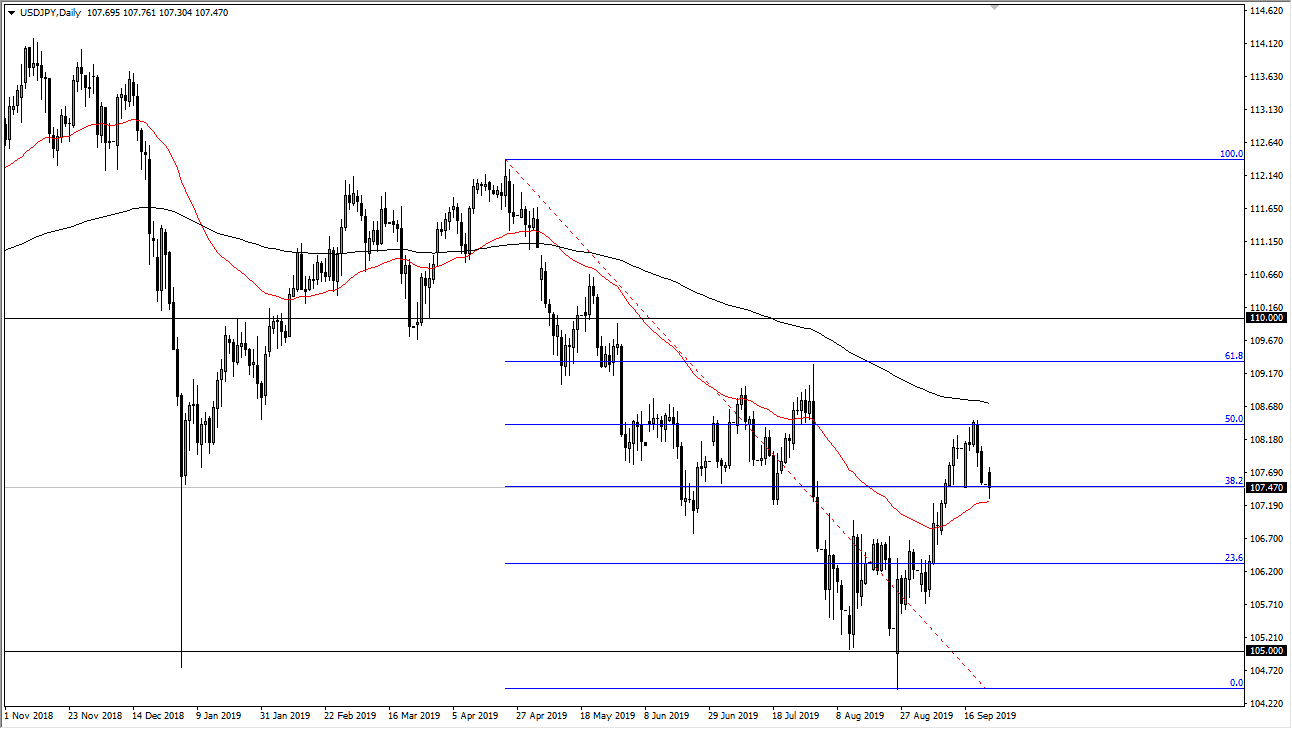

The US dollar has fallen a bit during the trading session on Monday to kick off the week but has found a bit of a bounce in the form of the 50 day EMA. It’s very likely that the market is going to continue to show signs of support at this area, but overall there has been a bit of consolidation back and forth between the 50 day EMA and the 200 day EMA. The market is a bit choppy but that makes sense considering that the stock markets are essentially doing the same thing. I normally use the S&P 500 as a secondary indicator for how this currency pair is behaving. If the S&P 500 takes off to the upside, then quite often this pair will do the same. Of course the alternate scenario is also true.

The 200 day EMA above of course is crucial resistance, so if we were to break above the 200 day EMA on a daily close, it’s very likely that the market will continue the uptrend and go much higher. Otherwise, if the market continues to show a lack of strength near that area, it will probably give you an opportunity to start selling again as the Japanese yen is considered to be a “safety currency” and traders tend to run towards it when there are signs of exhaustion.

If we break down below the red 50 day EMA, the market is likely to go down to the ¥107 level, possibly even the ¥105 level after that. It doesn’t mean that we can get there quickly, because I think there is a lot of noise between here and there, but that would be the longer-term target. I do believe that is the most likely of scenarios but anything is possible this point so you should keep that in mind. If we were to break out to the upside and above the 200 day EMA, then it’s likely that the market would probably go to the ¥110 level. All things being equal, it’s a short-term back and forth scenario just waiting to happen until we can break out of the range between these two major moving averages. Anticipate a lot of choppy and short-term trading, but if you are a range bound trader, you could find this to be an excellent trading opportunity using those types of systems.