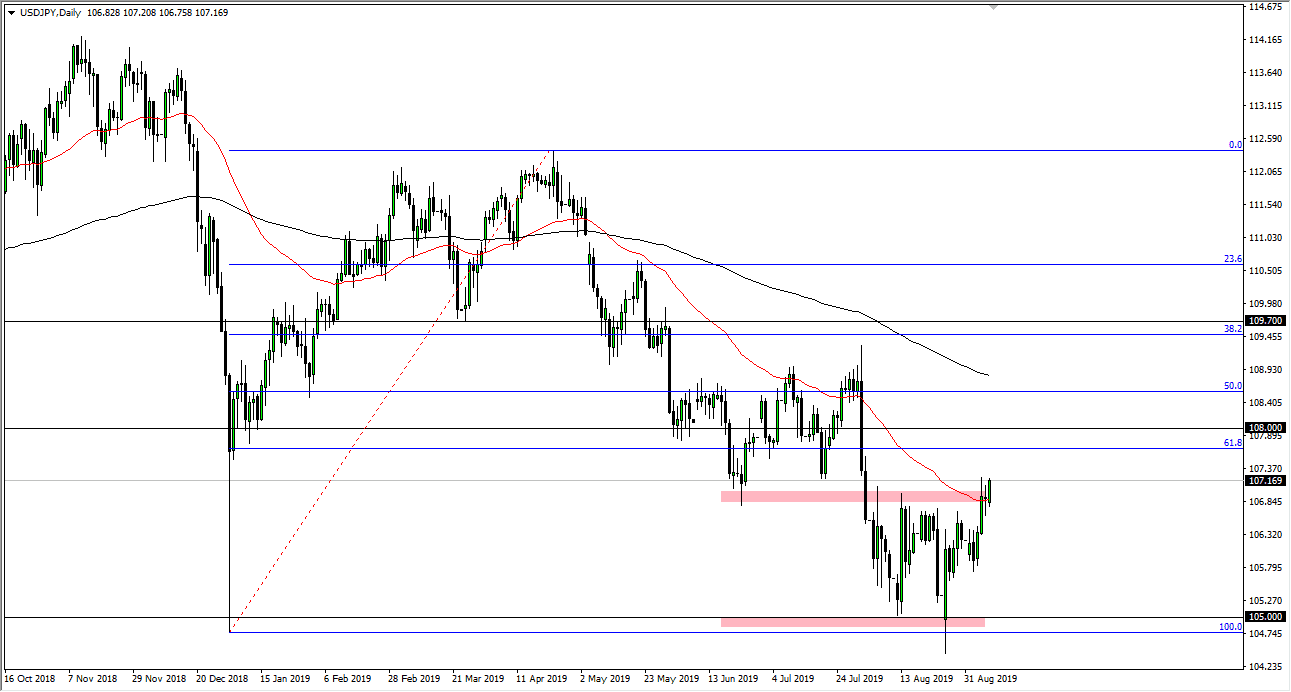

The US dollar has rallied a bit during the trading session on Monday, as we are now clearly above the ¥107 level. If we can break above the highs from a couple of days ago, it’s very likely that we could then go to the ¥108 level. That’s an area that would attract a lot of attention, but I think ultimately we could go even further to the upside, perhaps reaching towards the ¥109 level, perhaps even the 200 day EMA which is painted in black on the chart.

Looking at this chart, it will continue to move right along with the S&P 500, as it typically does. At this point, if we continue to the upside in the S&P 500, it’s very likely that the dollar will continue to strengthen against the Japanese yen, the ultimate safety currency. That being the case, as long as the stock markets do fairly well, then it’s likely that we will continue to see the Japanese yen get sold. On the other hand, if the S&P 500 does rollover a bit, I would use the bottom of the candle stick from the trading session on Monday as the key to start selling because that could send this market back into the previous consolidation area.

All things been equal though, it does look like both the S&P 500 and the USD/JPY pair are going to continue to go higher. I like the idea of searching for short-term pullbacks, as long as we can stay above that level. All things been equal though, this is probably a short-term bounce more than anything else as there are a whole plethora of potential problems out there that could come into play. That being the case it’s likely that we continue to “climbing a wall of worry” when it comes to the stock markets and anything risk related such as this market.

Looking at the chart, if we do break down then we could go to the ¥106 level, and then eventually the ¥105 level. Ultimately, that is essentially the “floor” of the market and if we were to clear that area all hell would break loose and we would probably see not only a break down in this market, but on several other charts around the world as well. With that, I like the idea of watching correlations as the market has become so emotional as of late.